Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s present buying and selling vary is all a part of a consolidation transfer before a return above $110,000. Although the main cryptocurrency has largely held above the $105,000 support zones in latest days, its rally has taken a success previously two weeks.

Technical evaluation of Bitcoin’s worth motion, when overlapped with the Global M2 Money Supply metric, exhibits that it’s only a matter of time earlier than it enters into a brand new all-time excessive.

Global M2 Offset Models Says Something Interesting

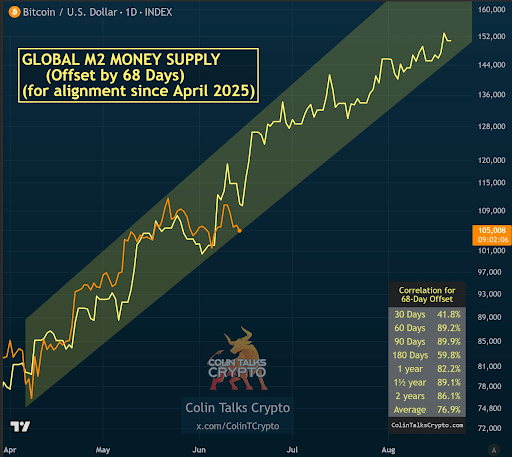

According to a detailed post by crypto analyst Colin, also called “The M2 Guy,” on the social media platform X, Bitcoin’s worth motion seems to be monitoring the worldwide M2 cash provide with a excessive diploma of correlation when the info is offset by 68 to 76 days.

Related Reading

Two separate charts offered by Colin reveal this development vividly, displaying how Bitcoin worth actions have adopted the trajectory of the Global M2 Money Supply when adjusted for time. The short-term 68-day offset chart aligns carefully with Bitcoin’s habits since April 2025, whereas the 76-day offset chart gives a longer-term view of the connection.

In each instances, the analyst highlighted that the M2 curve is pointing upward, the place Bitcoin has but to play out, implying a equally bullish trajectory for its worth motion. Colin describes this as a type of confluence, noting that when two correlated indicators present the identical directional end result, the probability of that outcome increases. Particularly, the common correlation throughout each charts is round 76.6 to 76.9%, each of that are very excessive and lend statistical weight to the prediction.

What Does This Mean For Bitcoin Price?

The 68-day offset chart exhibits Bitcoin trailing the M2 curve with excessive precision since April, with the best 89.9% diploma of accuracy on the 90-day timeframe. Similarly, the 76-day offset, whereas much less correct within the quick time period, shows a powerful correlation over longer intervals of 92.2% over one and a half years and 86.2% throughout two years. These correlation values exhibits that Bitcoin is more and more delicate to world liquidity developments, particularly now that its worth motion is tied to inflows/outflows surrounding Spot Bitcoin ETFs.

Related Reading

This relationship turns into much more notable contemplating the M2 cash provide itself has been climbing inside a rising channel. If the alignment continues, Bitcoin could quickly comply with swimsuit, lifting it again above the $110,000 degree and breaking above its all-time excessive. Bitcoin’s worth motion will likely be very fascinating to comply with within the subsequent few days. In Colin’s view, this subsequent transfer up just isn’t solely probably but could happen within days.

If Bitcoin follows this alignment, the projection exhibits that Bitcoin will proceed to maneuver inside a channel of upper highs and better lows earlier than eventually crossing above $150,000 in August. At the time of writing, Bitcoin is buying and selling at $106,549, up by 1% previously 24 hours.

Featured picture from Getty Images, chart from Tradingview.com