Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin continues to be attempting to regain short-term bullish momentum, as proven by its value motion prior to now 24 hours. After briefly slipping below $104,500, the cryptocurrency bounced again to commerce above $106,000, and technical analysis now shows a technical formation that might trigger the beginning of a extra prolonged rally.

Interestingly, as seen within the each day Ichimoku chart shared by analyst Titan of Crypto, Bitcoin is presently on the verge of confirming a golden cross, which is a bullish sign, inside the coming days.

Related Reading

Ichimoku Cloud Builds Case For Bullish Breakout

Taking to the social media platform X, crypto analyst Titan of Crypto highlighted the recent daily price close above the Tenkan line as a powerful technical sign for Bitcoin. The Tenkan, often known as the conversion line, is an intriguing indicator for short-term development energy in Ichimoku evaluation. According to the analyst, the present setup on Bitcoin’s each day chart exhibits the situations aligning for a golden cross the place the shorter-term common overtakes the longer-term one, which is a possible long-term bullish shift. This crossover, if confirmed, could be some of the dependable trend-reversal patterns in technical buying and selling.

Right now, Bitcoin’s value motion is consolidating round $105,000. However, if this golden cross does play out effectively, Bitcoin may try one other run towards the important thing resistance degree round $111,600. However, present geopolitical instability, particularly the rising tensions in the Middle East, may disrupt this technical image at any second and trigger a reassessment of the bullish outlook.

Support And Whale Activity Clash With Bullish Setup

Despite the bullish technical backdrop, different market indicators are flashing warnings for Bitcoin. Notably, analyst Ali Martinez identified $104,124 as an essential help degree for Bitcoin. This value level is not only arbitrary, because it represents a heavy focus of UTXO realized costs.

Many buyers purchased in at that degree, and if Bitcoin falls under it, the subsequent seemingly vacation spot may very well be $97,405. The URPD chart confirms that the security web between $104,000 and $97,000 is considerably skinny. This signifies that as soon as $104,000 is breached to the draw back, a swift and steep correction could follow because of the lack of sturdy shopping for curiosity in that hole.

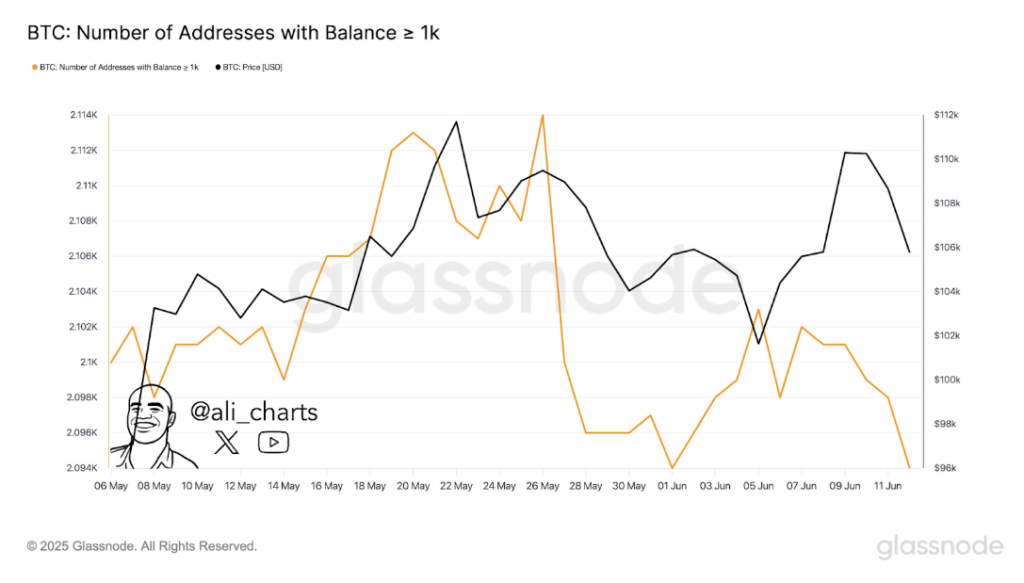

Further complicating the image is the habits of enormous Bitcoin holders. On-chain knowledge exhibits that a number of the largest whales, addresses holding over 1,000 BTC, have began decreasing their holdings in current days. This decline in whale pockets depend initially started shortly after Bitcoin reached its new all-time excessive of $111,800 on May 22. The discount in whale depend resumed once more after Bitcoin was rejected at the $110,000 region early final week.

Related Reading

As such, whale addresses holding over 1,000 BTC have fallen from a current peak of two,114 to a current studying of two,094 addresses. At the time of writing, Bitcoin is trading at $105,505.

Featured picture from Unsplash, chart from TradingView