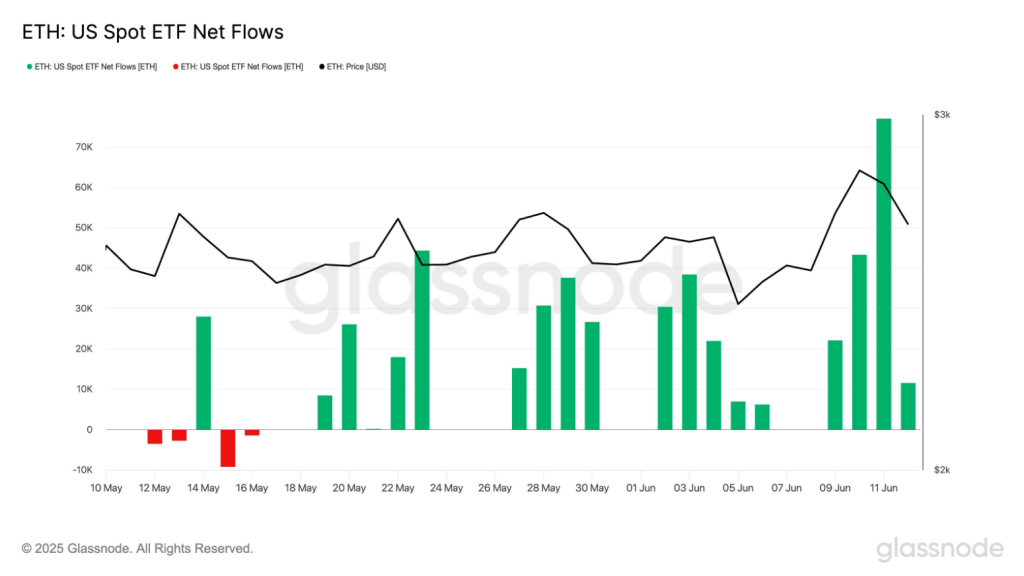

US spot Ethereum ETFs have attracted a surge of recent capital this week, drawing in 154,000 ETH over the past seven days—about 5 occasions their current weekly common. By distinction, Bitcoin funds managed simply 7,800 BTC in the identical interval.

That hole factors to rising curiosity in Ethereum’s broader makes use of, from DeFi to staking rewards, as huge buyers rethink their crypto allocations.

Rising ETF Inflows Point To Shifting Bets

Based on studies, June 11 was a standout day for Ethereum. Spot ETFs pulled in a document 77,000 ETH in a single session, marking the best every day complete for the token to date this month.

Investors are watching as the worth edges nearer to the $3,000 mark. A push previous that stage might spur extra shopping for, particularly if inflows keep sturdy.

$ETH spot ETFs are heating up. This week alone, they’ve seen 154K #ETH in inflows – 5x greater than their current weekly common. For context: the most important single-day $ETH influx this month was 77K #ETH on June eleventh. pic.twitter.com/8Xlerbc6GX

— glassnode (@glassnode) June 13, 2025

Ethereum Staking Adds Appeal

Another issue at play is staking. Holders can lock up ETH to assist safe the community and earn rewards. Word is spreading that some ETFs might quickly provide staking‑enabled shares.

That setup might make Ethereum merchandise extra enticing than Bitcoin funds, the place staking isn’t an choice. Yield‑hungry patrons might discover that additional increase laborious to withstand.

Ethereum’s second‑layer options are additionally drawing consideration. Protocols like Optimism and Arbitrum are chopping charges and rushing up transactions. That enchancment is pulling extra builders and customers into the fold.

As these rollups acquire steam, the community’s actual‑world usability retains climbing. For portfolio managers, that rising ecosystem can seem like a powerful cause to again ETH.

Bitcoin Flows Lag Behind

Bitcoin nonetheless dominates in complete ETF belongings, however inflows have been flat these days. The 7,800 BTC added this week barely tops the week’s ordinary determine and falls wanting May 23’s one‑day excessive of seven,900 BTC.

In early June, some funds even noticed redemptions, making flows bounce round from everyday. That volatility could also be pushing some establishments to discover alternate options.

Image: SKapl/iStockphoto/Getty Images

Analysts level out that buyers are looking for tokens with actual‑world makes use of and upside potential. Ethereum’s position in decentralized finance, non‑fungible tokens and sensible contracts offers it a multi‑objective edge.

Featured picture from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.