In 2025, predictions of an impending altcoin season have circulated quite a few instances. Yet, none have come to fruition. While some market watchers proceed to carry out hope for a resurgence, others are rising more and more skeptical.

BeInCrypto consulted a number of consultants to debate the potential for an altcoin season in this cycle. They agree that whereas the altseason has been delayed, it’s removed from useless.

What’s Holding Back the Altcoin Season in 2025?

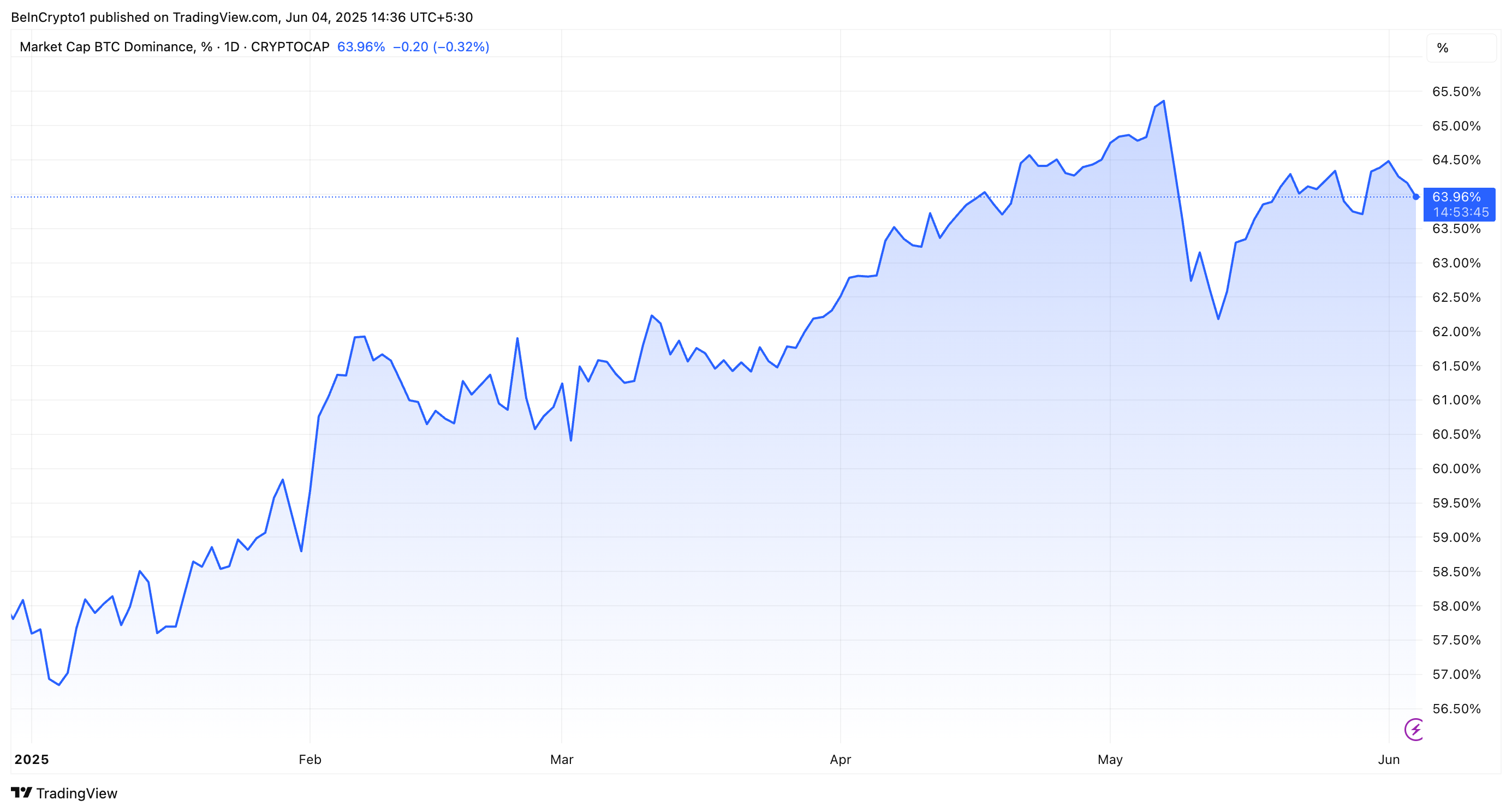

Bitcoin (BTC) has been main the cost in the present crypto cycle, with its market dominance steadily rising. In May, it reached 65.3%, the highest level since 2021. While BTC.D briefly dipped mid-month, it bounced again and stood at 63.9% at press time.

At the identical time, BTC’s value has additionally appreciated considerably, hitting an all-time excessive of over $111,800 final month. Historically, altcoin seasons follow Bitcoin’s rallies as capital rotates into smaller cash.

While some cash have seen robust positive factors not too long ago, they’ve been remoted. Furthermore, Coinglass information confirmed that the Altcoin Season Index stood at simply 16 at press time.

This has raised issues over why the pattern of capital rotation has not been repeated. Willy Chuang, co-founder of TrueNorth, outlined the elements behind the delay. He famous that institutional traders are largely driving the present Bitcoin rally, and so they have minimal curiosity in altcoins.

“BTC remains the consensus trade. As long as sentiment favors Bitcoin as the “safe bet,” capital rotation into altcoins will be muted. Moreover, structural risks, such as smart contract vulnerabilities, regulatory uncertainty, and operational failures—make altcoins less attractive for sidelined capital,” Chuang instructed BeInCrypto.

The govt additionally acknowledged the remoted outperformance of meme coins throughout their short-lived pumps. Nonetheless, he claimed that broader market rotation is being hindered by macroeconomic uncertainty, lowered liquidity, and a rising desire for short-term flipping over long-term altcoin holding.

According to him, many now view the conventional altcoin mannequin, with its excessive centralization and team-driven execution dangers, as structurally flawed.

Gustavo H., Senior Business Development at Kairon Labs, shared the same perspective. He emphasised that Bitcoin’s development is primarily pushed by an inflow of institutional investments and clearer regulatory readability round spot ETFs.

Gustavo defined that ETF trading volumes funnel liquidity toward Bitcoin, rising its share of the total market depth and lowering liquidity for altcoins. This has the impact of widening bid-ask spreads, making it much less enticing for big investments in smaller property and additional reinforcing Bitcoin’s dominance.

“Spot ETFs give investors direct BTC exposure; in prior cycles, alts were the proxy. With institutions still building BTC positions, the rotation clock has effectively been reset. Retail, meanwhile, remains cautious after the 2022–23 deleveraging,” Gustavo mentioned.

Both consultants additionally pointed to the surge in new tokens as a major issue. Chuang highlighted that this dilutes capital and investor consideration.

“Liquidity is now spread thin, yet 98% of total market capitalization is still locked in the top 100 coins, underscoring how little capital reaches new projects. Low switching costs push traders to chase short‑lived narratives, while many founders optimize for rapid token‑price spikes over durable utility conditions that suppress a broad, sustained rotation,” Gustavo added.

Why Altcoin Season 2025 May Still Become a Reality

Despite these elements, consultants imagine there’s nonetheless potential for an upcoming altcoin season.

“The conditions point to a delayed, not defunct, altcoin season,” Chuang remarked.

He believes that Bitcoin’s current outperformance is likely to continue in the near term. However, Chuang anticipates that an altcoin resurgence might emerge following the potential finish of quantitative tightening (QT) and the begin of a brand new quantitative easing (QE) cycle.

“A postponement is more plausible. Once BTC establishes a range, risk appetite historically shifts outward,” Gustavo famous.

He acknowledged that an altcoin season is extra prone to be delayed than utterly dominated out till the development in new token provide slows or new liquidity will increase to match it. Gustavo believes that, over time, this market shake-out will reward groups that obtain real product-market match.

Additionally, the govt affirmed that once ETF demand stabilizes and Bitcoin’s volatility compresses, capital usually shifts to higher-beta property.

“Consequently, an alt‑season in late‑2025 or early‑2026 remains plausible rather than pre‑ordained,” he predicted.

Notably, Tracy Jin, COO of MEXC, revealed that the signs have already started emerging.

“The sharp contrast in ETF flows is one of the most telling signs of the beginning of capital rotation on the market. Ethereum’s ETFs have recorded 11 consecutive days of inflows totaling over $630 million against the choppy macroeconomic and geopolitical tension backdrop, whilst Bitcoin ETFs have seen three straight days of outflows bleeding over $1.2 billion,” Jin disclosed to BeInCrypto.

She also referred to the increase in altcoin ETF purposes and corporations adopting altcoin treasury strategies. Jin harassed that this alerts a rising institutional curiosity in alternate options to Bitcoin as the market cycle advances.

The MEXC COO famous that whereas current altcoin rallies have been encouraging, a real altseason normally begins when Bitcoin’s dominance declines extra considerably. Despite the present restoration in danger urge for food, Bitcoin nonetheless holds a big market share, although its dominance seems to weaken.

“Ethereum is decisively leading the charge for transition and capital rotation into altcoins in this current market cycle, and other coins like XMR, ENA, HYPE, AAVE, and ARB are following suit, posting more than 5% gains in contrast to BTC’s muted 0.6% gain during Tuesday’s recovery rally,” she acknowledged.

In addition, Jin claimed that Bitcoin’s consolidation at excessive ranges usually creates area for altcoins to carry out, particularly when risk-on sentiment grows and traders search increased beta alternatives. With Bitcoin stabilizing after 25 consecutive days above the $100,000 mark, she instructed that the begin of an actual altseason could also be nearer.

“If the current altcoin momentum persists and institutional appetite builds further, we might witness an explosive movement across high-potential altcoins in the coming weeks,” Jin forecasted.

While altseason might not be in full impact but, Jin emphasised that the circumstances are aligning. She additionally revealed that this time, institutional capital is joining the journey.

The publish Is the Altcoin Season Over in 2025? Experts Believe It’s Just Delayed Not Dead appeared first on BeInCrypto.