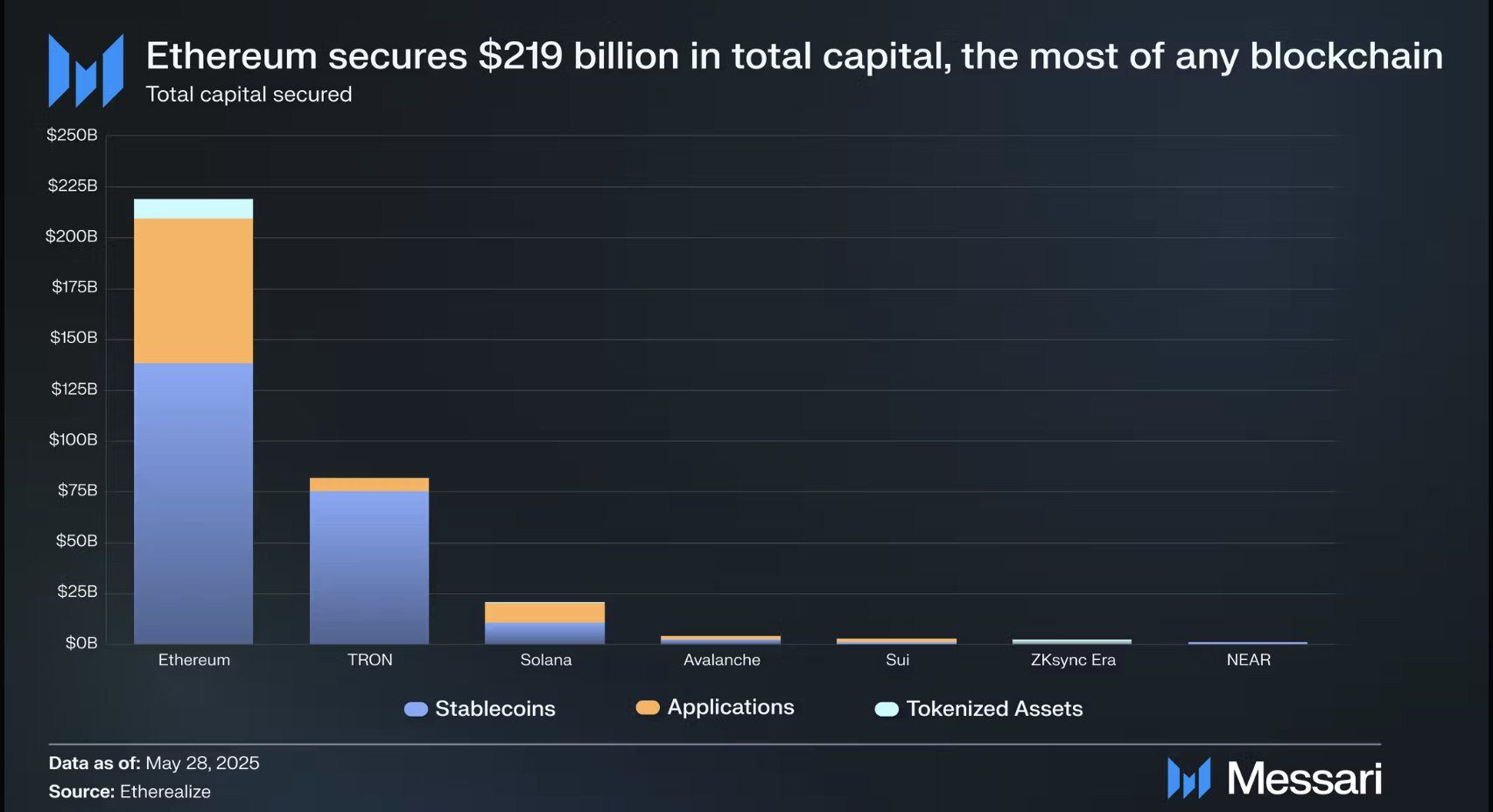

Ethereum has amassed $219 billion in whole capital, bolstered by stablecoins, decentralized purposes, and tokenized belongings. Despite a surge in on-chain transactions, Tron, Solana, and Avalanche proceed to path Ethereum in phrases of whole capital secured.

Ethereum Rakes In $219B in Assets, Dwarfing Other Blockchains

According to a post on X by analytics platform Messari, Ethereum at present holds $219 billion in worth. Messari’s information reveals that Ethereum’s figures outperform these of Solana, Avalanche, and Tron.

The information accounts for whole on-chain worth hosted on the blockchain, together with stablecoins, tokenized belongings, and different purposes. A better take a look at Messari’s chart signifies that stablecoins signify essentially the most good portion of Ethereum’s $219 billion in secured capital.

Specifically, stablecoins account for over $135 billion of Ethereum’s whole capital, in comparison with simply round $75 billion for Tron.

Notably, Tether (USDT), Circle’s USDC, and WLFI’s USD1 are issuing substantial quantities of their stablecoins on the Ethereum blockchain.

While Tron ranks a distant second in whole capital secured, its progress is primarily pushed by the USDT stablecoin.

Other chains, resembling Solana, reported a lot decrease stablecoin volumes, totaling simply round $12 billion.

Meanwhile, the Ethereum community maintains a transparent lead over its friends in the applying phase, pushed by non-fungible tokens (NFTs), decentralized finance (DeFi), and staking. Data from DeFiLlama locations Ethereum’s whole worth locked (TVL) at $61.10 billion, underscoring its dominance throughout all classes.

Additionally, information from Artemis Analytics reveals that Ethereum leads all different blockchains in internet flows throughout DeFi bridges.

However, Solana is gaining floor in the applying phase, having secured roughly $25 billion in capital, outperforming Avalanche, SUI, and NEAR.

Despite Ethereum’s dominance, calls to scale the community have reached a deafening pitch in current months. Recently, Vitalik Buterin unveiled a plan to scale Ethereum L1 by 10X in a little bit over a 12 months to enhance community capabilities.

Institutional Buyers Flock To ETH

Investors are bracing for an Ethereum supply shock as new information reveals that ETH balances on exchanges are at their lowest ranges in seven years. According to the information, ETH holders are withdrawing their balances from exchanges, signaling long-term bullish sentiment.

🚨ETH SUPPLY SHOCK Incoming!🚨

Exchange balances of Ethereum are collapsing—now at their lowest ranges in 7 years. pic.twitter.com/5hx61lEiJ1

— Coin Bureau (@coinbureau) June 2, 2025

At the second, ETH is buying and selling at $2,545, rising by practically 1% over the past day. Several establishments are scooping up ETH en masse in current days, with BTCS acquiring 1,000 ETH to extend its holding.

Additionally, Sharplink Gaming is transferring ahead with plans to determine an Ethereum Reserve Treasury, elevating $425 million via a non-public placement deal.

The mixture of institutional ETH accumulation and the upcoming community improve fuels optimism for a rally to $3,000. Analysts counsel {that a} decline in Solana may set off capital rotation into Ethereum, driving ETH again towards earlier highs.

Disclaimer: The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.