Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

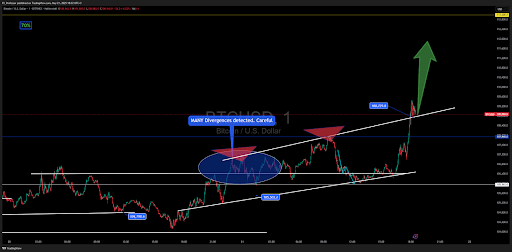

Bitcoin’s worth motion prior to now 24 hours has been nothing wanting exceptional. After consolidating for a number of days in a tightening vary, the market broke previous the $105,503 support-turned-resistance zone earlier within the week and kicked off a steep climb prior to now buying and selling day. This has allowed Bitcoin to push into new all-time high levels, and is displaying no indicators of slowing down.

Interestingly, technical evaluation exhibits the rally comes off an approach of a golden cross between the 50 and 200-day shifting averages, however FX_Professor supplied a special tackle the much-celebrated golden cross.

Analyst Disputes Golden Cross Hype As Late Signal

In a latest analysis published on TradingView, FX_Professor mentioned a special tackle Bitcoin’s golden cross. While most market commentators interpret this crossover of the 50-day easy shifting common above the 200-day as a powerful bullish affirmation, the analyst dismissed it as a delayed indicator. The analyst described it because the afterparty the place retail buyers arrive late to the scene.

Related Reading

Instead of ready for the golden cross to flash green, FX_Professor famous pre-indicator strain zones as the actual sign of worth. In the case of Bitcoin’s worth motion in latest months, the analyst identified the $74,394 and $79,000 area because the zone of accumulation and early positioning, nicely earlier than the golden cross grew to become seen. As such, by the point the cross appeared just lately, Bitcoin’s worth motion had already been up considerably.

The golden cross is commonly utilized by merchants as a sign to enter a protracted place, because it means that the asset’s worth is more likely to proceed rising. However, this evaluation follows a development amongst skilled merchants who view the golden cross as extra of a lagging affirmation than a set off of a rally.

Early Entry Zones And Structure Matter More, Analyst Says

According to FX_Professor, indicators reminiscent of EMAs or SMAs could be helpful however ought to by no means come earlier than understanding the value construction, trendlines, and real-time strain zones. He shared a snapshot of his personal Bitcoin worth chart that mixes customized EMAs with a signature parallelogram technique to detect the place worth pressure begins to construct. Visible on the chart are entries forming as early as April when Bitcoin bounced off support around $74,000, lengthy earlier than the crossover affirmation.

Related Reading

Now, with Bitcoin pushing toward the next target zone close to $113,000, the analyst’s technique continues to validate itself in actual time. Nonetheless, the affirmation of a golden cross remains to be bullish for Bitcoin’s worth motion shifting ahead, even when the value rally is already midway to its peak stage.

At the time of writing, Bitcoin is buying and selling at $110,734. This marks a slight pullback from the brand new all-time excessive of $111,544, which was registered simply three hours in the past. The Bitcoin worth remains to be up by 3.1% prior to now 24 hours, and new all-time highs are doable earlier than the weekly shut.

Featured picture from Getty Images, chart from Tradingview.com