Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin remains to be buying and selling across the $103,000 mark, though the upward momentum it began in May has exhibited a slowdown up to now seven days. Although a short-term volatility is at the moment enjoying out, the long-term outlook is undoubtedly bullish.

Related Reading

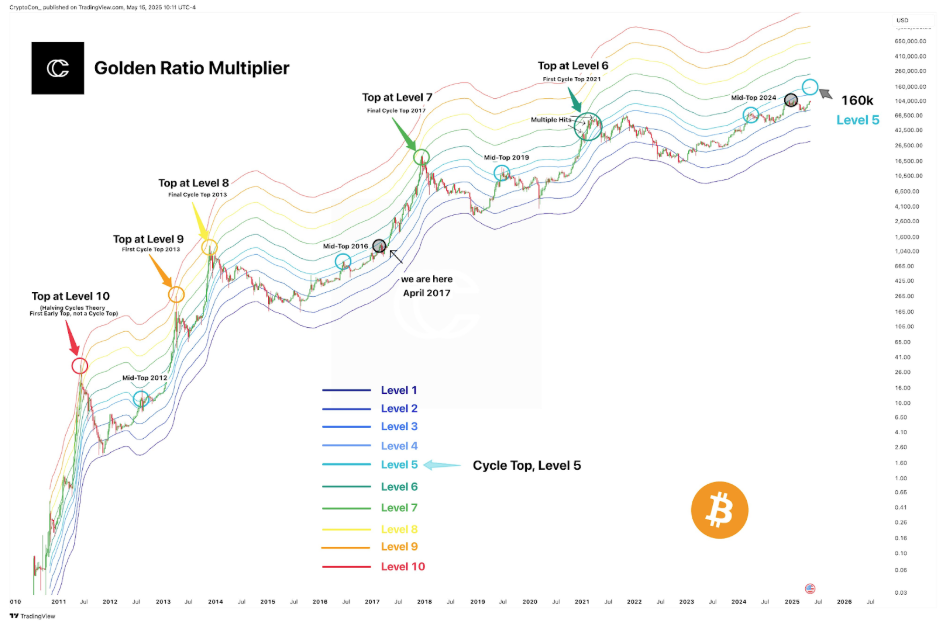

Some analysts want to long-term cycle indicators for direction. One such instrument, the Golden Ratio Multiplier, which known as the Bitcoin prime in 2021, has resurfaced with one other attention-grabbing prime for the present Bitcoin cycle.

Golden Ratio Multiplier Identified 2021 Top, Now Points To New Peak

Taking to a post on social media platform X, widespread crypto analyst CryptoCon highlighted the reliability of the Golden Ratio Multiplier in predicting Bitcoin’s worth prime in every cycle. The Golden Ratio Multiplier is a logarithmic mannequin that includes Fibonacci-derived multipliers to anticipate Bitcoin’s macro tendencies.

Notably, this metric was among the many few to precisely name the April 2021 cycle prime in actual time, the identical because the 2017 and 2013 worth tops. This cycle, the mannequin has already flagged a major peak in March 2024, though the crypto analyst interpreted this not as the ultimate excessive however as a mid-top.

CryptoCon defined that Bitcoin’s worth motion has already hit Level 4 of the multiplier chart this cycle, however this isn’t the ultimate peak. “We’ve already hit our cycle top level this cycle once, but this was for the cycle mid-top in March 2024, which means we’re bound to do it again,” he wrote.

The Level 5 band now sits round $160,000 and continues to development upward. Drawing a parallel to previous cycles, CryptoCon famous that the construction of the present cycle reveals sturdy similarities to the 2015 to 2017 interval, when Bitcoin noticed a gradual build-up adopted by an explosive breakout.

Based on this comparability, the present market part is seen as equivalent to April 2017, proper earlier than Bitcoin went on a rally within the months that adopted.

Golden Multiplier Ratio Suggests $160k Is Next Major Target

The chart accompanying CryptoCon’s submit paints a well-recognized image with the Golden Multiplier Ratio. Each band, starting from Level 1 to Level 10, is predicated on a multiplier degree derived from the 350-day shifting common. Bitcoin has topped at numerous ranges: Level 10 in 2011, Level 9 and eight in 2013, Level 7 in 2017, and Level 6 in 2021. The present cycle’s peak ought to probably be Level 5, however the Bitcoin price is yet to get there.

Related Reading

Should the market proceed to respect this construction, Bitcoin could possibly be getting ready for a rally towards the Level 5 mark of $160,000 someday later within the yr, which might mark the ultimate excessive of this cycle. The present vary round $103,000 could be the calm before the final breakout. “Slower buildup, then all at once,” the analyst stated.

At the time of writing, Bitcoin was buying and selling at $102,971.

Featured picture from Unsplash, chart from TradingView