Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is buying and selling firmly above the $2,600 mark after a surge in shopping for strain over the previous a number of days, marking a robust shift in momentum throughout the broader market. After months of uneven motion and bearish sentiment, bulls are clearly again in management. ETH has reclaimed a number of key ranges with conviction, signaling a possible continuation towards larger targets.

Related Reading

Price motion now appears structurally bullish, with Ethereum pushing by means of resistance zones that beforehand capped upside for weeks. This rally has reignited investor confidence and introduced renewed consideration to Ethereum’s medium-term outlook, particularly as altcoins begin to present energy alongside Bitcoin’s latest consolidation.

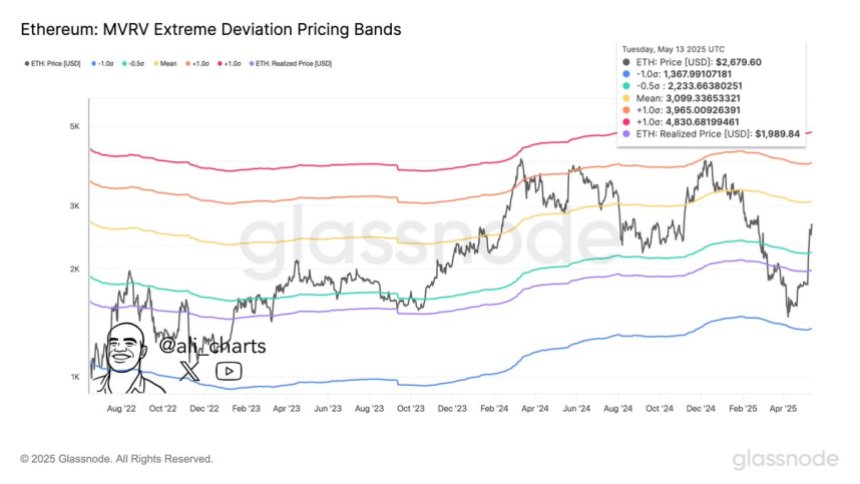

According to contemporary knowledge from Glassnode, the following main resistance space to observe is at $3,100, the place Ethereum is more likely to encounter heavier promote strain. This degree, derived from pricing bands, now defines Ethereum’s present buying and selling vary and can seemingly dictate worth course within the coming classes. With volatility returning and sentiment enhancing, Ethereum seems poised for a critical breakout or a decisive retest of assist, relying on how bulls deal with the following leg.

Ethereum Nears Key Resistance As Altseason Expectations Grow

Ethereum has rallied over 98% since its April ninth low, marking one in all its strongest recoveries in recent times. This explosive transfer has not solely flipped sentiment from bearish to bullish, but additionally reignited hypothesis round a broader altseason — a interval by which altcoins considerably outperform Bitcoin.

After months of heavy promoting strain that started in late December, Ethereum is now displaying sustained energy for the primary time. The worth has reclaimed essential ranges, and momentum continues to construct as merchants and traders rotate capital again into ETH and different large-cap altcoins. Market members are watching intently to see if Ethereum can keep this tempo and make sure a longer-term pattern reversal.

Top analyst Ali Martinez shared Ethereum’s MVRV Extreme Deviation Pricing Bands, providing a transparent technical framework for what’s subsequent. According to the information, the following key resistance degree is at $3,100 — a area that would act as a short-term ceiling if shopping for strain fades. On the draw back, the key assist zone sits at $2,233, a essential degree to carry within the occasion of a pullback.

As Ethereum continues to climb, these ranges will change into more and more necessary. A clear breakout above $3,100 may open the door to a broader rally throughout altcoins, whereas a rejection or correction would seemingly take a look at the market’s true conviction. For now, ETH stays in a bullish construction, supported by rising quantity, on-chain indicators, and renewed investor enthusiasm. The coming days can be essential in figuring out whether or not Ethereum leads the cost right into a full-fledged altseason.

Related Reading

ETH Price Action: Testing Resistance After Massive Rally

Ethereum (ETH) is at the moment buying and selling round $2,604, consolidating after a pointy surge that lifted it from below $1,400 to a excessive of $2,725 in simply two weeks. The each day chart exhibits that ETH is now approaching the 200-day easy transferring common (SMA) at $2,702.60, which is performing as a key resistance degree. This zone additionally coincides with latest native highs from early February, making it a essential space to interrupt for additional upside continuation.

The latest rally introduced sturdy quantity and bullish momentum, with ETH closing a number of each day candles above the 200-day exponential transferring common (EMA) at $2,435.66. This is a optimistic signal for pattern reversal after months of sustained bearish strain. However, immediately’s pullback indicators that bulls are dropping some steam as the worth checks this significant resistance.

Related Reading

If ETH can consolidate above the $2,500–$2,600 vary and break by means of the 200-day SMA with convincing quantity, the following upside goal lies close to the $3,100 degree, as famous in latest technical research. On the draw back, sustaining assist above $2,435–$2,450 is important to keep away from a deeper correction. The coming days will reveal whether or not Ethereum can flip this consolidation into a real breakout or if additional cooling is required earlier than the following leg up.

Featured picture from Dall-E, chart from TradingView