Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

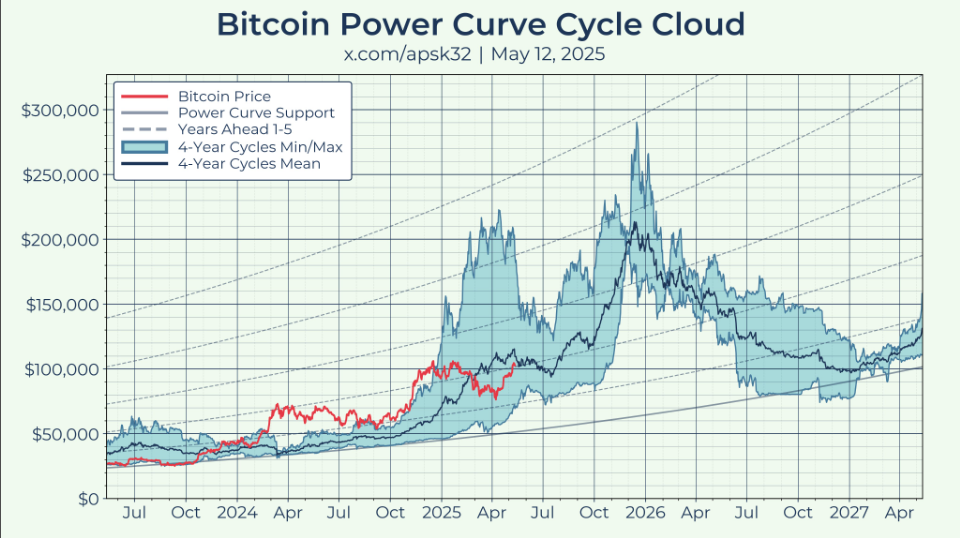

Bitcoin’s worth could surge above $200,000 subsequent yr, in keeping with latest evaluation by X account Apsk32. He warns that the acquainted 4‑yr cycle for BTC typically traces up with contemporary highs. Short swings have hit merchants onerous earlier than. This time, bulls say Bitcoin might even high $250,000 in 2025.

Related Reading

Bitcoin Gold Link

According to Apsk32, Bitcoin typically trails gold by just a few months. Gold hit a report $3,500 per ounce earlier this yr. If Bitcoin follows that path, it might surge. He measures Bitcoin’s market worth in ounces of gold as a substitute of {dollars}. That means, cash printing and inflation don’t skew the view.

Power Curve Model

Apsk32 makes use of what he calls a “power curve” instrument. It matches Bitcoin’s market cap in gold ounces to a easy curve. The instrument stretches again to the 2017 excessive close to $20,000. When plotted, it suggests a 2025 bull‑market peak above $200,000. He informed X followers that “if Bitcoin’s position relative to gold keeps improving, returns could top expectations.”

Bitcoin’s place relative to gold has improved significantly since April. This is the indicator that offers me hope for increased than anticipated returns later this yr.

BTC-USD is near excessive greed, which sounds scary, but it surely’s additionally the place we’d anticipate to be if Bitcoin… pic.twitter.com/CY1Qxy4Hdi

— apsk32 (@apsk32) May 16, 2025

Realistic Price Targets

While some fashions push for $444,000 this yr—what Apsk32 credit to “five years ahead of support”—he thinks a extra real looking objective is $220,000. He added there’s a “decent chance” BTC hits $250,000, however he doesn’t see that because the almost definitely final result. The $220,000 stage would nonetheless mark a ten× leap from Bitcoin’s low close to $22,000 in late 2022.

Gold Market Scenarios

Other market consultants ran a distinct check. They checked out how a lot Bitcoin could possibly be price if it claimed a part of gold’s complete worth. If gold reaches, say, $5,000 per ounce by 2030 and Bitcoin grabs half of gold’s market cap, BTC might hit a worth of greater than $920k. But then, these figures are situation‑based mostly, not agency predictions.

Supply And Demand Factors

Bitcoin’s provide is capped at 21 million cash. Every block halving makes new BTC rarer. These occasions come roughly each 4 years. The subsequent one is anticipated in 2024. After that, miner rewards fall from 6.25 BTC to three.125 BTC per block. Scarcity has pushed costs up in previous cycles. But demand might shift if massive buyers pull again.

Related Reading

Risks And Opportunities

Volatility in each gold and Bitcoin might upend these fashions. Gold can face sudden drops when merchants take earnings. Bitcoin has swung 20% or extra in a single day earlier than. Regulatory strikes, geo‑political occasions, and tech upgrades all play an element. Still, setting clear worth situations helps buyers plan.

Featured picture from Unsplash, chart from TradingView