Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s worth motion up to now 24 hours has seen it slowly retracing from the $104,000 zone it began the week at. This vary has turn into notably vital as Bitcoin continues to flirt with ranges final seen throughout its latest push towards new all-time highs. Bitcoin’s worth actions over the past two days have tightened, and the candlestick habits on the weekly chart has led to a doji formation on the weekly candlestick timeframe, an indicator of indecision.

Interestingly, a technical evaluation from crypto analyst Tony “The Bull” Severino has highlighted important ranges to observe that can decide whether or not the Bitcoin worth is turning bearish or still bullish.

Mixed Signals: Why the Current Resistance Zone Is Critical

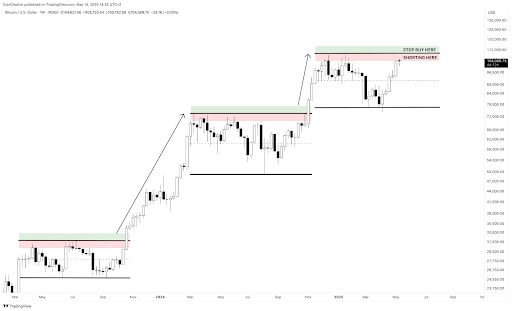

Crypto analyst Tony “The Bull” Severino shared a chart and in-depth breakdown on the social media platform X, pointing to horizontal assist and resistance ranges as a very powerful technical indicators in his view. As proven on his Bitcoin weekly chart, the main cryptocurrency is now urgent in opposition to a well-defined resistance zone just under its all-time excessive, marked clearly in purple. The proximity of this level to its all-time high means it might act as a ceiling, making it an necessary space to observe for both a breakout or a reversal.

Related Reading

Tony outlines three doable interpretations for the present market construction across the $108,000 resistance stage. The bullish case hinges on Bitcoin consolidating beneath resistance, a sample usually adopted by upward continuation. The impartial case is that Bitcoin may very well be forming a broad buying and selling vary, during which case it is sensible to quick the market at resistance whereas shopping for close to assist. On the bearish facet, the presence of a doji candlestick at this key stage could also be an indication of fading momentum and an early signal of a price reversal.

His buying and selling technique displays this uncertainty. He has positioned quick positions throughout the purple resistance zone, with a cease loss simply above the all-time excessive. At the identical time, he has set a cease purchase order within the inexperienced breakout zone above the all-time excessive, prepared to modify lengthy ought to the Bitcoin worth convincingly break by means of resistance.

Conditions For A Bullish Breakout Are Not Yet Fulfilled

Although Tony famous that the broader funding market, together with altcoins and the inventory market, appears to be like sturdy, he cautioned that this doesn’t assure a bullish breakout for Bitcoin. For affirmation, a bullish breakout should be preceded by aligning varied technical indicators. These embrace a breakout with substantial buying and selling quantity, an RSI studying above 70 on the weekly chart, and a weekly shut above the higher Bollinger Band.

Related Reading

At the second, nevertheless, the Bitcoin CME Futures chart has failed to maneuver previous 70 on the day by day RSI twice, and buying and selling quantity is in decline. According to CoinMarketCap, the buying and selling quantity of Bitcoin is $44.33 billion up to now 24 hours, a 11.40% discount from the earlier 24 hours. These are early warning indicators {that a} breakout try might lack the power wanted for sustainability.

Nonetheless, the situations are nonetheless very blended and beginning to lean more bullish than bearish. At the time of writing, Bitcoin is buying and selling at $102,352, down by 1.31% up to now 24 hours.

Featured picture from Pixabay, chart from Tradingview.com