Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

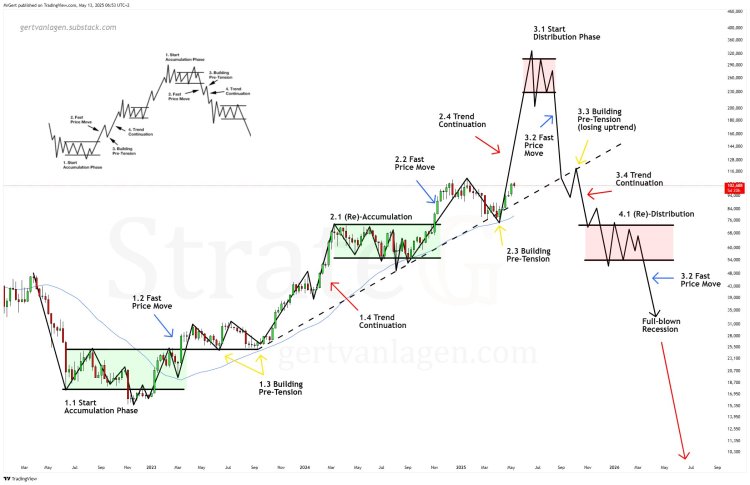

Bitcoin has continued to maintain bullish momentum regardless of seeing a small correction after initially hitting $105,000. Its lengthy keep above $100,000 has fueled the narrative that this rally is right here to remain and better costs are on the way in which. Presently, the value appears to be consolidating earlier than transferring upward, a area that crypto analyst Gert van Lagen has known as Trend Continuation.

Bitcoin Price Is In Trend Continuation

In an replace evaluation posted on X (previously Twitter), Gert van Lagen posited that the Bitcoin worth has, in actual fact, now entered the Trend Continuation section of the cycle. This comes after the Building Pre-Tension section that started on the lows at $$76,000, ending within the impulse move that ultimately pushed Bitcoin above $100,000 as soon as once more.

Related Reading

According to the shared chart, the Trend Continuation a part of the cycle is when the Bitcoin worth continues to blow up, transferring all of it the way in which to new all-time highs. Gert’s chart exhibits that the BTC worth remains to be greater than 100% away from its cycle peak, which is proven at above $320,000 right here.

However, regardless of the bull market, there’s nonetheless some hindrance for the Bitcoin price at this degree. To affirm this Trend continuation, the value must break above $109,400. Not solely should this degree be damaged, nevertheless it should maintain it and mark a weekly shut above it. The reverse of this taking place would threaten the validity of the pattern continuation.

For the entire transfer to be invalidated, the crypto analyst explains that the Bitcoin price would have to put in a structural weekly close under $79,000. This could be a 25% crash from the present ranges. Presently, Bitcoin remains to be caught in a re-accumulation stage.

Mapping Out The Road To $320,000 And Beyond

If the Trend Continuation performs out, there are a variety of different phases that the Bitcoin worth is anticipated to undergo. As talked about above, the highest for the subsequent stage is $320,000, however as soon as that is hit, the value is anticipated to go downhill from there.

Related Reading

The subsequent is the distribution section as traders start to maneuver round their holdings and promote into the liquidity. Next, the crypto analyst predicts a quick worth transfer triggering a crash back toward $100,000. Then a small restoration as rigidity builds and the Bitcoin worth loses the uptrend.

From right here, one other Trend Continuation will ship the value additional downward, after which towards extra redistribution. This is then adopted by one other quick worth transfer taking the Bitcoin worth deeper into 5-digit territory, after which a full-blown recession. At the bottom, the crypto analyst sees BTC eventually falling under $10,300 once more.

Featured picture from Dall.E, chart from TradingView.com