Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is buying and selling just under the $2,000 mark, holding at important ranges because the broader market reveals indicators of restoration. After weeks of uneven worth motion and fading promoting stress, bulls are step by step regaining management, pushing ETH right into a extra bullish short-term construction. Momentum is constructing as Ethereum stabilizes above the $1,800 degree, and technical indicators recommend a breakout could also be forming.

Related Reading

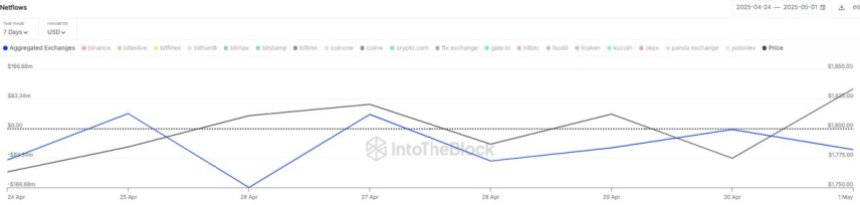

Adding to the rising optimism, on-chain information from IntoTheBlock reveals a constant move of ETH out of centralized exchanges—an indicator usually related to accumulation and diminished sell-side stress. Over the previous week alone, web outflows have exceeded $380 million value of Ethereum, reinforcing the view that traders are getting ready for a transfer greater.

Still, the important thing resistance at $2,000 stays a psychological and technical barrier. A confirmed push above this degree might set off a broader altcoin rally and sign the beginning of Ethereum’s next leg up. Until then, the market stays cautiously optimistic as bulls take a look at the higher limits of this consolidation zone, on the lookout for the momentum wanted to flee it.

Ethereum Faces Critical Test Amid Accumulation Trend

Ethereum continues to face headwinds because it trades greater than 55% beneath its December highs, hovering beneath the $2,000 resistance zone. While the broader crypto market reveals indicators of revival, ETH stays locked in a important battle between provide overhead and renewed shopping for curiosity. The current worth construction reveals some bullish improvement in decrease time frames, as patrons try to construct momentum. However, sturdy resistance ranges nonetheless loom, and failure to interrupt by might set off a recent transfer into decrease demand zones round $1,700 and even $1,500.

Despite these technical challenges, on-chain information paints a extra encouraging image. According to IntoTheBlock, centralized exchanges have seen web Ethereum outflows of roughly $380 million during the last seven days. This regular discount in exchange-held ETH suggests a rising pattern of accumulation, usually interpreted as traders shifting cash to chilly storage fairly than getting ready to promote. This habits usually reduces sell-side stress and may lay the groundwork for extra sustainable rallies.

Market sentiment stays blended. Some analysts argue that Ethereum is gearing up for a breakout, with shifting momentum hinting at an imminent surge. Others stay cautious, warning that macroeconomic uncertainty and fragile investor confidence might nonetheless pull ETH right into a deeper correction. The coming days shall be essential in defining Ethereum’s trajectory.

Related Reading

ETH Price Analysis: Testing Key Resistance

Ethereum (ETH) is presently buying and selling at $1,837 after a number of days of consolidation just under the $1,850 degree. As seen within the day by day chart, ETH has been trying to kind a short-term bullish construction after rebounding from April lows close to $1,550. The worth has steadily climbed however now faces vital resistance close to $1,850—a degree that has acted as each help and resistance in earlier months.

Volume has been comparatively steady however not convincingly excessive, indicating that bulls are gaining management however lack sturdy momentum to interrupt by. The 200-day Simple Moving Average (SMA) at $2,271 and the 200-day Exponential Moving Average (EMA) at $2,456 stay distant overhead targets. These ranges characterize key longer-term resistance, and reclaiming them could be a serious bullish sign.

Related Reading

For now, ETH should shut decisively above $1,850 to validate this short-term pattern reversal. A failure to take action could lead to one other retest of help round $1,700 and even decrease, significantly if broader market sentiment shifts. However, the worth holding above current swing lows and forming greater lows indicators that bullish stress is constructing step by step. A breakout above $1,850 would open the door to a transfer towards the $2,000–$2,200 zone.

Featured picture from Dall-E, chart from TradingView