After months of downward stress, Ethereum (ETH) might lastly be poised for its subsequent main transfer upward. The second-largest cryptocurrency by market capitalization seems set to learn from a number of bullish developments – starting from technical setups to bettering institutional demand – that might propel it towards the psychologically vital $2,000 mark.

Ethereum Heading To $2,000?

ETH has proven notable momentum over the previous week, rallying from round $1,575 on April 22 to roughly $1,830 on the time of writing. This practically 20% improve has rekindled bullish sentiment throughout the market.

Technical analysts consider this current surge could possibly be the start of a bigger transfer. In an X submit, analyst Kiran Gadakh shared a 12-hour ETH chart, noting that if ETH confirms a 4-hour candle shut above resistance – marked by the pink line – it might quickly target the $2,000 degree.

At the identical time, Ethereum spot exchange-traded fund (ETF) inflows are gaining momentum. Data from SoSoValue exhibits that ETH spot ETFs noticed over $64 million in inflows on April 28 alone. More notably, the week ending April 25 marked the primary time since February 2025 that ETH ETFs skilled a constructive weekly web influx.

Currently, the overall web belongings held in US ETH spot ETFs stand at $6.20 billion, representing roughly 2.87% of Ethereum’s complete market cap. Meanwhile, cumulative web inflows into these ETFs have reached $2.47 billion – a transparent signal of rising institutional curiosity.

Further supporting Ethereum’s bullish case is a surge in institutional demand. CoinShares data revealed that ETH funding merchandise attracted web inflows of $183 million final week. This breaks an eight-week streak of consecutive outflows, suggesting a possible shift in investor sentiment.

Ethereum’s decentralized finance (DeFi) ecosystem can also be seeing a resurgence. According to DefiLlama, the overall worth locked (TVL) in Ethereum-based DeFi platforms has jumped greater than 10% since April 22, now sitting at $51.67 billion.

ETH Not Completely Out Of The Woods

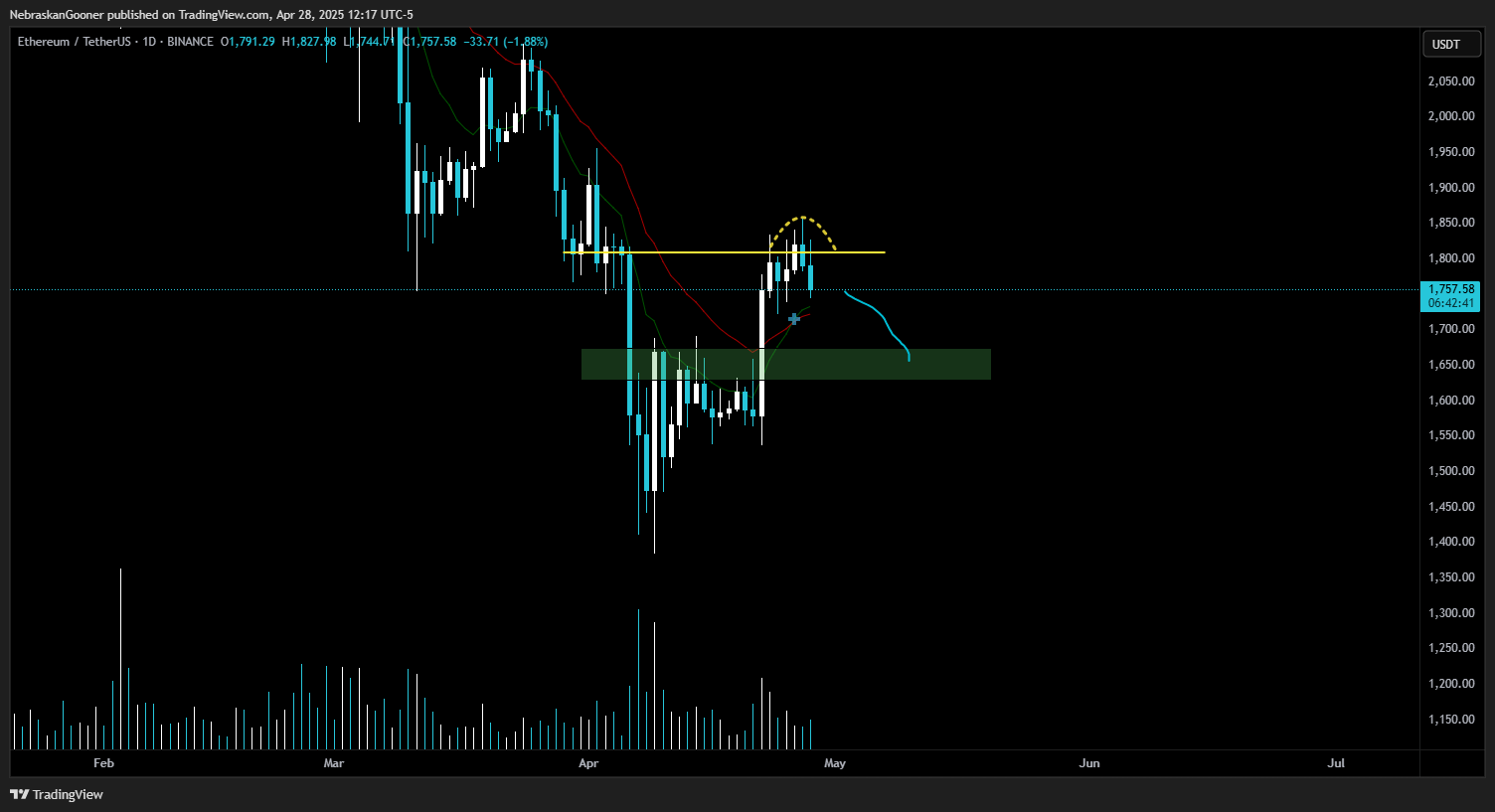

Despite this promising knowledge, not everyone seems to be satisfied that Ethereum is out of the woods. Crypto analyst Nebraskangooner described ETH’s current value motion as “sloppy.” He famous:

Sloppy value motion. The indisputable fact that this deviated above resistance and is rejecting on growing quantity makes me assume it should drop again to this help zone beneath.

Still, dwindling ETH reserves on exchanges are fueling hypothesis a couple of potential provide squeeze. If this development continues, it might present the mandatory momentum for ETH to breach $2,000 and maintain increased ranges. At press time, ETH trades at $1,819, up 3.5% prior to now 24 hours.

Featured Image from Unsplash.com, Charts from X and TradingView.com

Editorial Process for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.