Bitcoin value has recovered after statements by U.S. President Donald Trump concerning commerce tariffs with China. The digital asset has climbed over 12% this week and is at the moment buying and selling above $94,000, elevating the query of whether or not it might quickly reclaim the $100,000 mark.

Donald Trump’s feedback on the decreasing of tariffs influenced the market sentiment on a number of danger belongings, together with Bitcoin, XRP, DOGE, Ethereum, and different cryptocurrencies. In a White House occasion, the president implied that Chinese tariffs can be diminished by a “big, substantial percentage” sooner or later.

However, he acknowledged that they won’t go to zero, however his change of tone appears to be pulling again on the worldwide commerce considerations.

Bitcoin Price Rises Amid Eased Trade War Tensions

Risk-on sentiment emerged again in markets after U.S. President Donald Trump floated the possibility of cutting tariffs on Chinese imports. He stated that 145% may be very excessive and it’ll not be that prime. It’ll come down considerably.”

These statements have been made after weeks of threatening phrases and gestures, and it was met with market appreciation.The transfer supported a rally in main indices and elevated demand for danger belongings like Bitcoin. Bitcoin, as an illustration, rocketed by 6.77% on Tuesday to shut the day buying and selling above $93,400. Subsequently, by Wednesday, the Bitcoin value was once more on the rise and buying and selling above $94000.

Investors noticed the assertion as a potential signal of easing tensions in U.S.–China commerce relations. The Wall Street Journal reported that Treasury Secretary Scott Bessent additionally supported a extra relaxed stance, stating that he believed a take care of China may very well be reached.

On-Chain and Derivatives Data Show Increased Market Confidence

According to K33 Research, investor exercise within the futures market has grown. CME futures publicity elevated to 140,000 BTC, with premiums rising above 9% for the primary time since January. This means that merchants count on further price appreciation.

During the Easter week, Open Interest (OI) additionally increased by about 5,000 BTC based on the K33 Research report. This despatched OI to a contemporary excessive of 140,000 BTC within the three-week vary. However, it’s nonetheless beneath the figures recorded between the interval of late This fall and early Q1, the place it crossed the 200,000 BTC mark.

An improve in futures premiums and OI is usually linked to the elevated exercise from institutional gamers. This development factors to a perception in greater costs, although total leverage remains to be not at peak ranges.

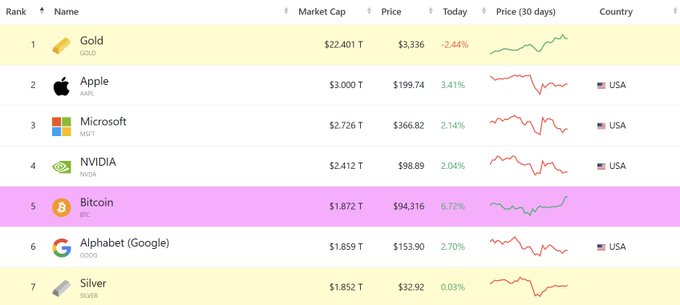

Bitcoin Flips Google’s Parent Company and Silver

Bitcoin has now surpassed the overall market worth of Alphabet, Silver, and Amazon. Data from CorporationsMarketCap reveals Bitcoin’s market capitalization at over $1.8 trillion, making it the fifth-largest world asset.

The BTC worth is now forward of Google’s father or mother firm Alphabet by $12 billion. Silver, lengthy thought-about a retailer of worth, at the moment holds a valuation of $1.856 trillion. Amazon follows with a market cap of $1.837 trillion.

This new rating locations Bitcoin among the many top-tier world belongings. The rally in value and market worth got here after investor considerations eased concerning the commerce conflict and financial coverage uncertainty.

Analysts Debate BTC Cycle and Possible Trend Reversal

Ki Young Ju, CEO of CryptoQuant, commented on the present market scenario. He acknowledged that regardless of BTC price recent gains, he sees the market shifting inside a variety. He stated,

“If it breaks above $100K, I’ll gladly admit I was wrong.”

Ju focuses on long-term provide and demand utilizing on-chain knowledge. He famous that event-driven reactions make short-term value strikes more durable to foretell. According to him, “even among on-chain analysts, interpretations of the data can differ.”

He additionally talked about that he could rethink the cycle concept if Bitcoin hits a brand new all-time excessive earlier than This fall. That would recommend the market may be coming into a distinct part than earlier bull cycles.

Disclaimer: The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.