- Bitcoin surged previous $87,700, fueled by a weakening US dollar and potential US Treasury buybacks.

- Arthur Hayes predicts Treasury buybacks may very well be a “bazooka,” pushing BTC previous $100K (“last chance” under).

- Weak dollar (lowest since March 2022) and rising gold correlation assist Bitcoin’s attraction.

Bitcoin’s current climb, momentarily cresting $87,700, is drawing important consideration, with distinguished analysts pointing in direction of macroeconomic shifts and potential authorities actions as key drivers that would propel the cryptocurrency properly past the $100,000 threshold.

The convergence of a weakening US dollar, anticipated US Treasury debt buybacks, and sustained institutional curiosity is portray an more and more bullish image for the digital asset.

Macro tailwinds: dollar dips, treasury ‘bazooka’ eyed

A major issue supporting Bitcoin’s ascent is the declining worth of the US dollar, which just lately touched lows not seen since March 2022.

As the dollar weakens, belongings like Bitcoin usually develop into extra interesting to international buyers in search of a hedge in opposition to fiat forex devaluation.

Adding potent gas to this narrative is the prospect of the US Treasury repurchasing its personal debt.

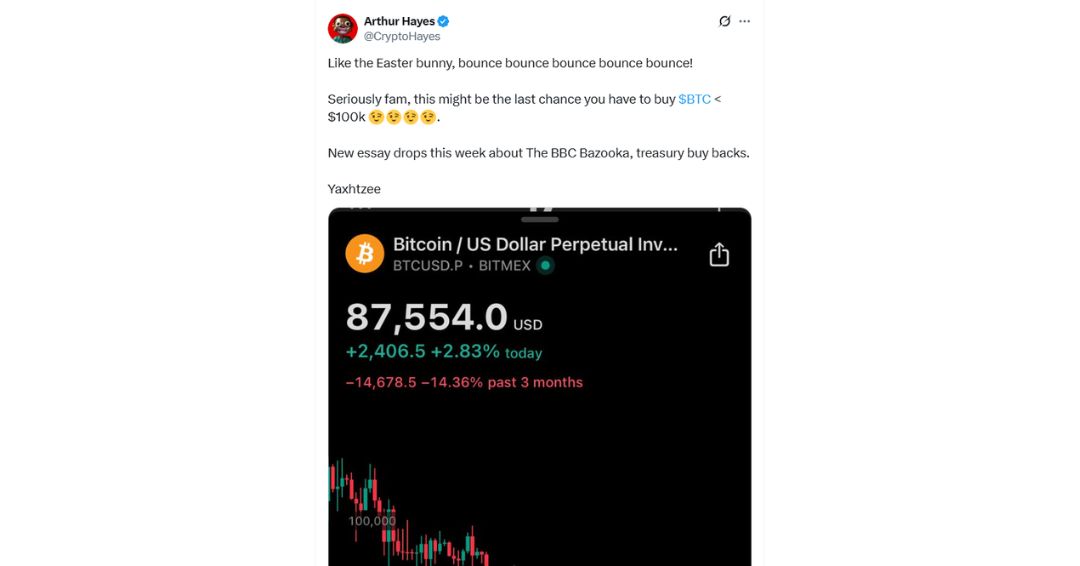

Arthur Hayes, the influential co-founder of BitMEX and present CIO of Maelstrom, has highlighted this potential transfer as a major catalyst.

He posited that upcoming Treasury buybacks might inject substantial liquidity into the monetary system, successfully performing as a “bazooka” for Bitcoin’s worth.

Hayes went to this point as to recommend this era may characterize the “last chance” for buyers to accumulate Bitcoin under the $100,000 mark, anticipating that these buybacks might simply push the worth previous that psychological barrier.

Technical indicators and institutional belief bolster case

The bullish sentiment finds resonance in technical evaluation and continued institutional adoption.

Ryan Lee, Chief Analyst at Bitget Research, famous that Bitcoin’s worth chart just lately accomplished a “descending wedge breakout,” a technical sample usually interpreted as supportive of additional upward motion.

This technical image is complemented by Bitcoin’s rising correlation with gold, one other conventional safe-haven asset, which itself has surged almost 30% this yr.

Furthermore, international institutional urge for food for Bitcoin seems unwavering regardless of current worth volatility.

Reports point out that funding companies, notably from Japan and the UK, have maintained their dedication, channeling capital into the cryptocurrency.

This sustained institutional influx indicators enduring confidence in Bitcoin’s long-term worth proposition.

Analysts eye six-figure targets amid fiat growth

As Bitcoin assessments resistance ranges nearing $90,000, some analysts are setting their sights significantly increased.

Jamie Coutts of Real Vision forecasts that increasing fiat cash provide (M2) might drive Bitcoin to as excessive as $132,000 by the tip of the yr.

This projection finds firm with evaluation from economist Timothy Peterson, who, citing historic market patterns, suggests Bitcoin might probably attain $138,000 throughout the subsequent three months.

Political pressures add gas to the fireplace

The intricate macroeconomic image is additional sophisticated by the political panorama.

President Donald Trump’s public requires the elimination of Federal Reserve Chair Jerome Powell have intensified market expectations of potential rate of interest cuts.

Such cuts, aimed toward stimulating the economic system, would probably exert additional downward strain on the US dollar, probably creating an much more favorable setting for Bitcoin’s worth appreciation.

A be aware of warning amidst the bullish refrain

Despite the confluence of optimistic indicators, some market observers urge warning concerning short-term worth motion.

Analyst Michaël van de Poppe warned that weekend rallies can typically show ephemeral and that Bitcoin may face a pullback earlier than decisively conquering key resistance zones.

The $91,000 degree is extensively seen as the following important hurdle.

Until Bitcoin firmly establishes itself above this mark, the potential of short-term corrections stays.

Nonetheless, the mixture of weakening fiat dynamics, anticipated liquidity injections by way of Treasury buybacks, sturdy institutional assist, and supportive technical patterns creates a compelling narrative for Bitcoin’s continued ascent in direction of, and probably properly past, the $100,000 milestone.