Crypto Market Update: The digital belongings proceed to bleed because the US President Donald Trump slapped as much as 245% tariff on Chinese items. The intensifying commerce conflict and macroeconomic considerations have continued to weigh on the buyers’ sentiment, wiping off the earlier good points from the digital belongings area. Bitcoin value right this moment slipped greater than 2% whereas ETH, XRP, SOL, DOGE, and Cardano costs fell between 4% and seven%.

Crypto Market Update: Trump’s 245% Tariff On China Sparks Concerns

The crypto market slipped right this moment after US President Donald Trump escalated the long-standing commerce conflict with China by imposing a contemporary 245% tariff on a variety of imports. According to a White House document launched within the late US hours on Tuesday, the transfer targets vital minerals and associated merchandise, citing nationwide safety and financial resilience as key causes.

Meanwhile, the actual fact sheet acknowledged that China now faces tariffs of as much as 245% following its “retaliatory actions” and lack of cooperation. However, this isn’t the primary volley within the tariff saga, because it continued to dampen the crypto market sentiment over the previous few weeks.

Trump’s Tariff On China

For context, it started with a 20% levy, adopted by a 34% hike on April 2nd. As tensions grew, Trump raised the speed once more, reaching 104%. In response, China imposed an 84% tariff on the US items.

Trump responded by growing the US tariff to 125%. However, it has excluded sure tech products from China, which has boosted market sentiment. However, simply final week, China matched that stage, lifting its tariffs to 125%. The state of affairs escalated dramatically this week with the 245% blanket tariff.

The White House cited the necessity to shield America’s protection sector, tech development, and infrastructure. As per Reuters, China exports over $400 billion price of products to the U.S. yearly — way over some other nation. The influence of this aggressive transfer is now spilling over into the monetary sector, together with the crypto market.

How Crypto Prices Are Performing?

The international crypto market cap misplaced greater than 2.3% from yesterday to $2.63 trillion whereas its one-day quantity fell 6% to $73.89 billion. Besides, the concern and greed index confirmed a studying of 29, indicating a “Fear” momentum hovering out there.

Notably, BTC price today fell practically greater than 2.5% to $83,368.76, whereas ETH value fell about 5% to $1,566. On the opposite hand, XRP value right this moment was down practically 4% to $2.04 and SOL value slipped greater than 3% to $124.89.

Simultaneously, Cardano value right this moment slipped practically 7% to $0.6032. In the meme cash phase, DOGE value was down round 5% to $0.1528 and SHIB’s worth misplaced round 3% to $0.00001160.

Bitcoin Whale Continues To Dump Amid Crypto Market Woes

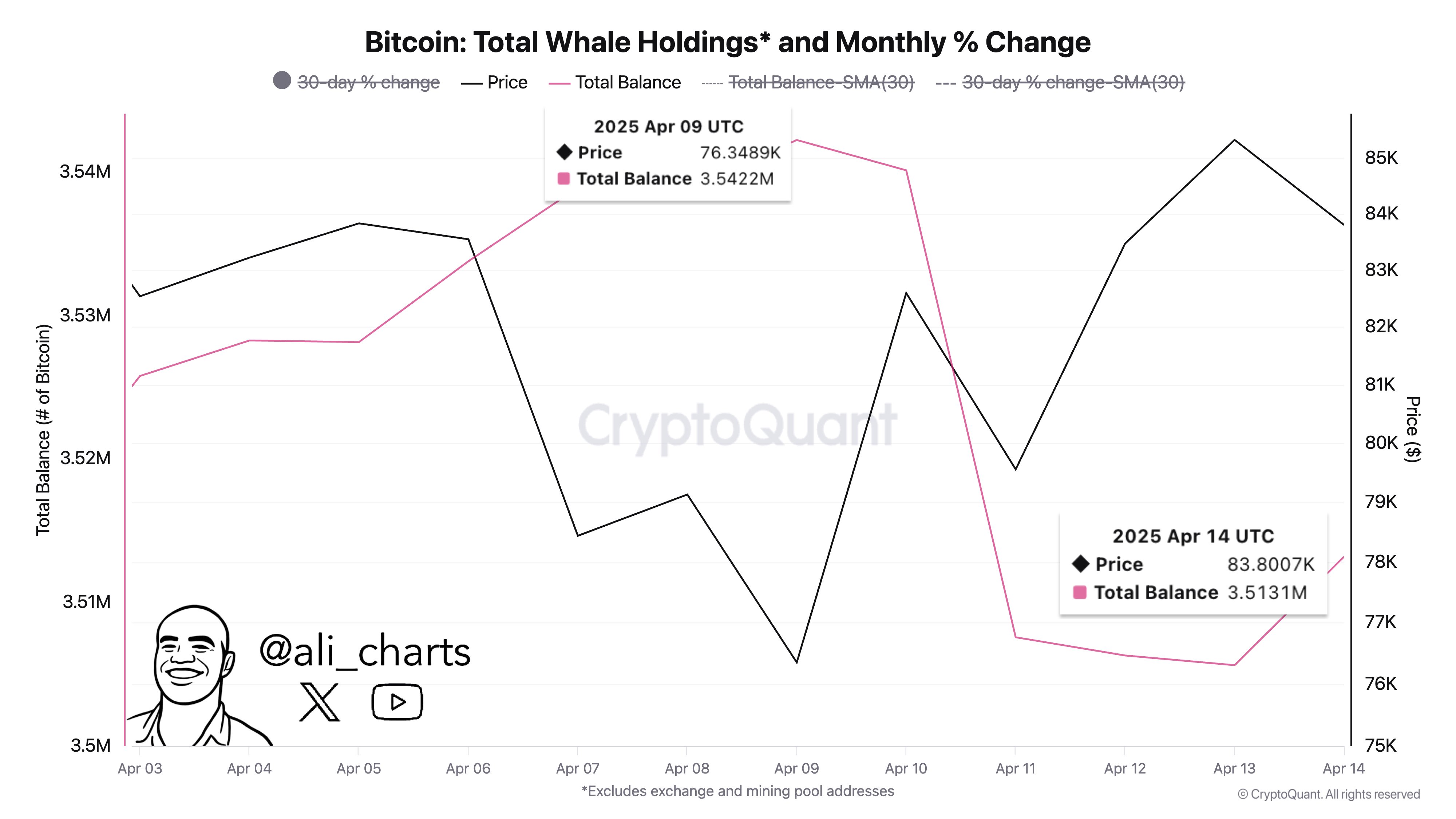

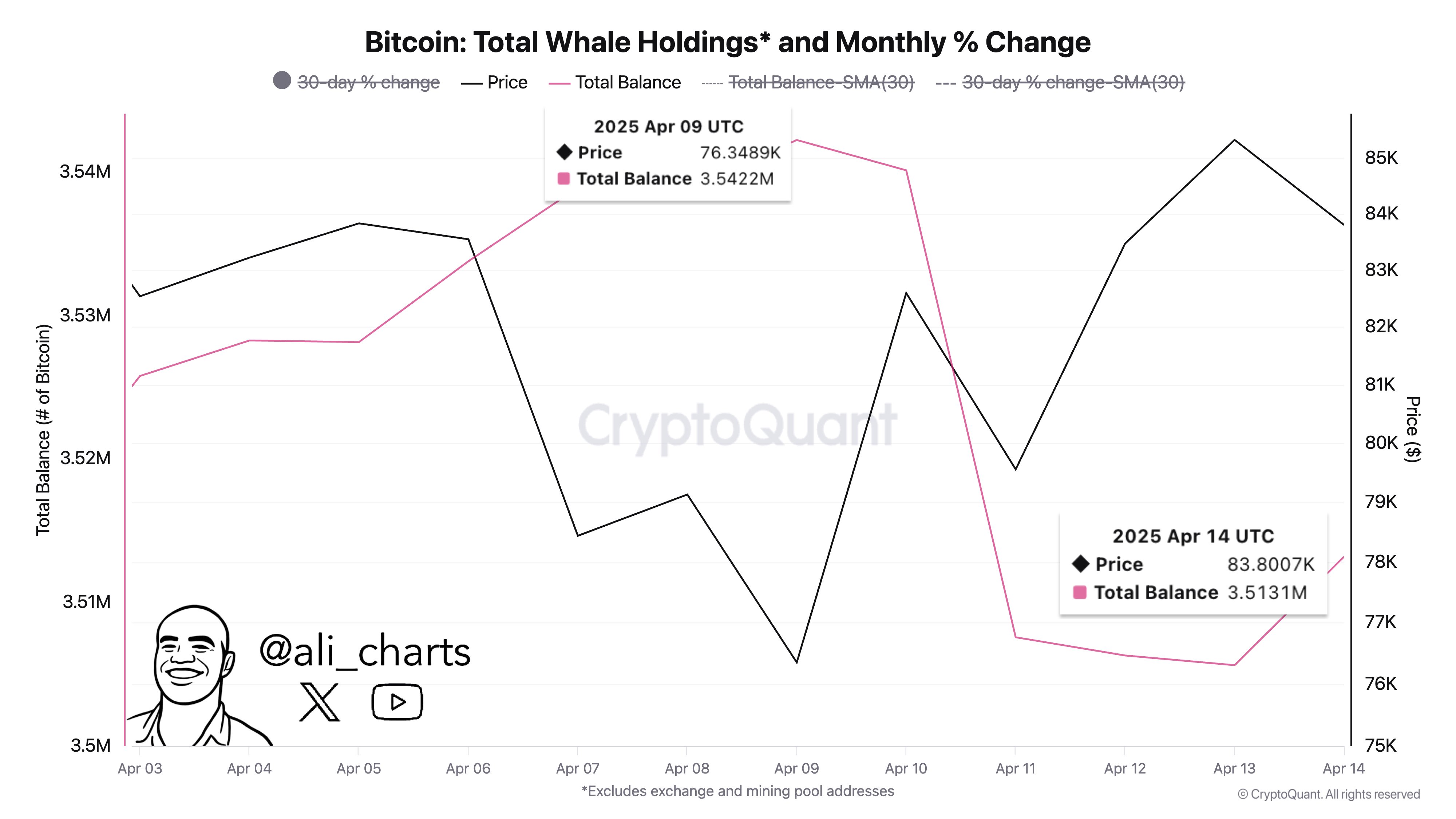

The current stoop in BTC value additionally comes as Bitcoin whales look like shedding confidence within the asset’s potential amid an intensifying commerce conflict. Besides, speculations are additionally excessive that the whales are reserving revenue, reflecting a waning threat wager urge for food of the buyers. The US vs China tensions amid Trump’s tariff insurance policies have weighed on the buyers’ sentiment, inflicting an enormous selloff out there.

For context, famend analyst Ali Martinez not too long ago highlighted the promoting pattern. In a current X put up, Martinez stated “Whales have been taking profits during the recent rally.” According to him, the whales have offloaded greater than 29,000 BTC from April 9.

Disclaimer: The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.