Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has damaged out of a technical formation which will place it on monitor towards a decisive take a look at zone between $96,200 and $102,100. If confirmed within the coming days, the motion would symbolize a serious value improvement in Bitcoin’s ongoing market structure. A crypto analyst highlighted this zone as one the place Bitcoin’s trajectory may both prolong to new highs or face its subsequent rejection.

Related Reading

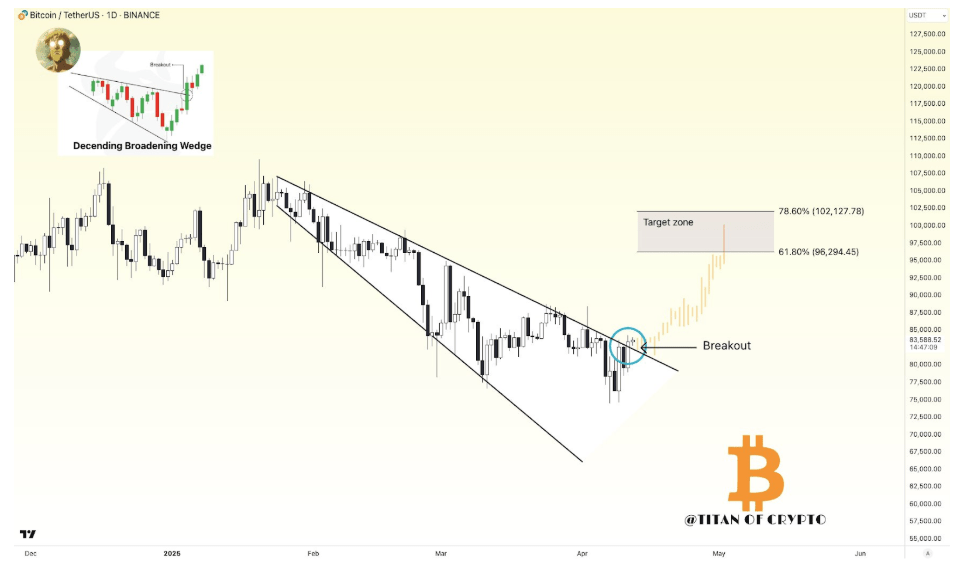

Descending Broadening Wedge Breakout Clears Path To $100,000 Again

Bitcoin’s value motion up to now 24 hours is highlighted by a return to $85,000 as shopping for strain began to creep in. Interestingly, this shopping for strain has damaged out above the higher trendline of a descending broadening wedge formation. This sample is usually thought-about a reversal sign, and its breakout implies sturdy upward continuation if validated.

The breakout of the formation was famous in an analysis posted on social media platform X by crypto analyst Titan of Crypto. Notably, the value chart shared by the analyst reveals that the wedge formation has been going down within the every day candlestick timeframe over the previous three months. The wedge started forming after Bitcoin’s peak above $108,000 in late January and regularly widened.

At the time of the evaluation, Bitcoin’s value had already made two every day candlestick closes above the higher trendline of the broadening wedge. According to the analyst, the breakout will almost certainly be confirmed this week. If confirmed, this can open up the stage for a run above the $100,000 value stage once more or at the least $96,200.

Particularly, Titan of Crypto highlighted the area between $96,200 and $102,100 as the following goal zone. The analyst emphasised that this vary might act because the precise take a look at of Bitcoin’s energy, as it would reveal whether or not the breakout results in continuation or stalls into rejection.

Image From X: Titan of Crypto

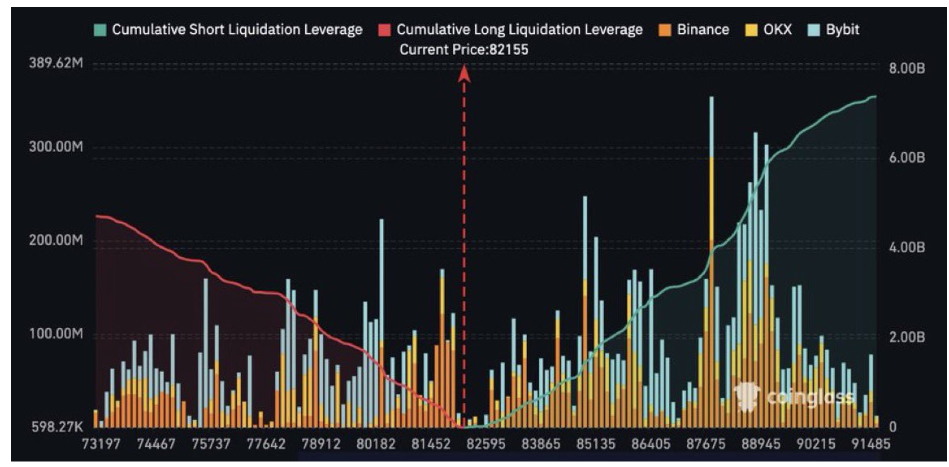

Leverage Build-Up Points To $8 Billion Short Squeeze Potential Above $90,000

Crypto analyst Sensei also commented on Bitcoin’s present value construction, noting {that a} transfer to $90,000 may set off a large liquidation occasion. Based on information from Coinglass, greater than $8 billion briefly positions could be weak if Bitcoin rose above $90,000 again.

The cumulative brief liquidation chart from Coinglass reveals a big wall of leveraged brief curiosity concentrated under that stage throughout main exchanges like Binance, OKX, and Bybit.

Image From X: Sensei

Related Reading

The information displays a major imbalance within the derivatives market, with brief positions dominating till the $90,000 mark, past which liquidation-driven shopping for may intensify. If Bitcoin does push into this zone, the ensuing cascade of liquidations amongst brief positions might present the momentum required to push the Bitcoin value towards the $96,200 to $102,100 goal zone.

At the time of writing, Bitcoin was buying and selling at $84,706.

Featured picture from Freepik, chart from TradingView