The crypto market in 2025 is dealing with intense turbulence. The capitalization of once-hot tendencies like meme cash has plummeted. Capital has flowed out of decentralized finance (DeFi) protocols, driving DeFi’s complete worth locked (TVL) down from $120 billion to round $87 billion.

In this context, Sonic stands out. It has constantly hit new TVL highs, reaching $1 billion in April after rising practically 40 instances because the starting of the yr. So, what makes Sonic a brilliant spot amid a stormy market?

Investors Are Pouring Capital into Sonic

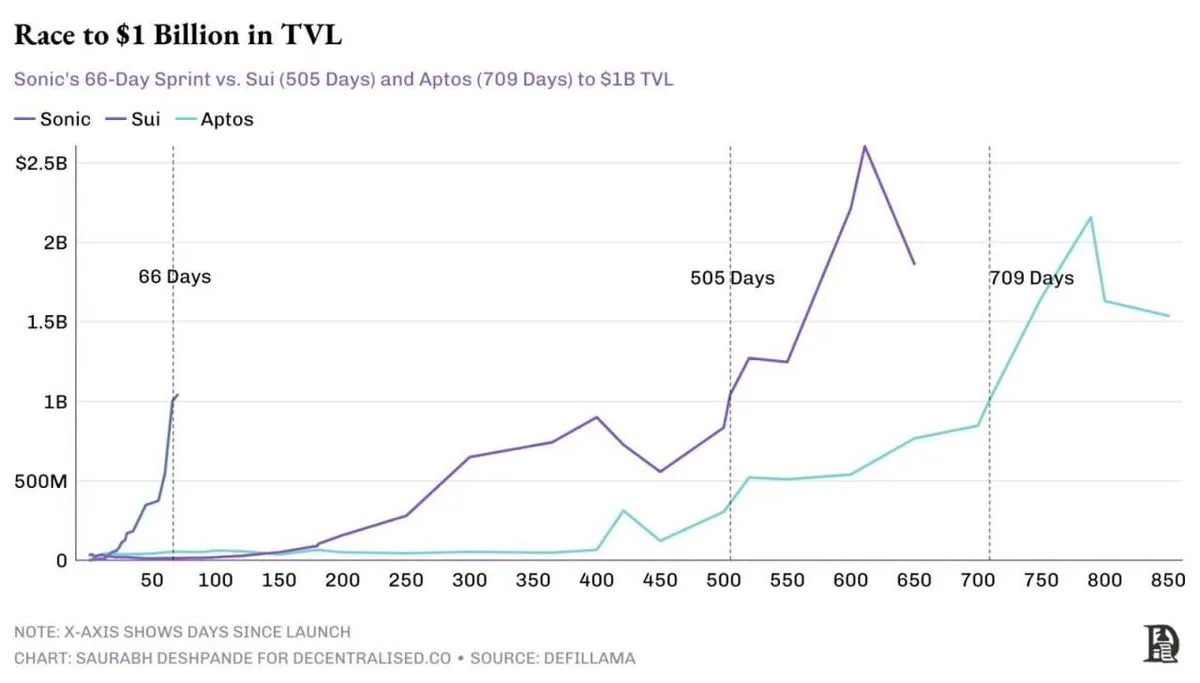

Sonic has made its mark with a fast TVL progress fee, far outpacing better-known blockchains. According to DefiLlama, Sonic reached $1 billion in TVL inside 66 days. In comparability, Sui took 505 days, and Aptos wanted 709.

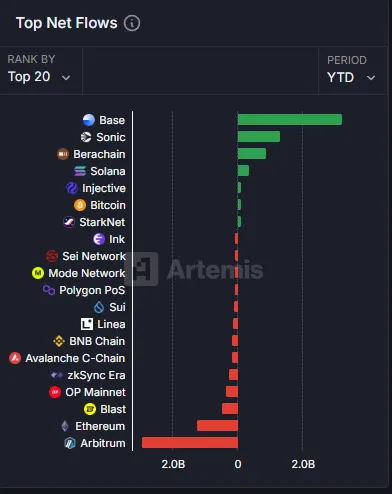

This achievement displays sturdy capital inflows into the Sonic ecosystem regardless of the broader DeFi development of capital withdrawal. Data from Artemis helps this, rating Sonic because the second-highest netflow protocol this yr—trailing solely Base, a blockchain backed by Coinbase.

The progress goes past TVL numbers. Sonic’s ecosystem is attracting varied initiatives, together with derivatives exchanges like Aark Digital and Shadow Exchange and protocols similar to Snake Finance, Equalizer0x, and Beets. These initiatives nonetheless have small TVLs, however they’ve the potential to draw new customers and capital, fueling Sonic’s momentum.

However, the query stays: Can this capital influx stay sustainable whereas the market fluctuates?

Andre Cronje on Sonic’s Potential and Strengths

Andre Cronje, the developer behind Sonic, shared his ambition in an interview to push this blockchain past its opponents.

“Sonic has sub-200 millisecond finality, faster than human responsiveness,” Andre Cronje said.

According to Cronje, Sonic isn’t nearly pace. The platform additionally focuses on bettering each consumer and developer expertise. He defined that 90% of transaction charges go to dApp, not to validators, creating incentives for builders to construct.

Unlike different blockchains, similar to Ethereum, that are restricted by lengthy block instances, Sonic leverages an enhanced digital machine that theoretically processes up to 400,000 transactions per second. Cronje acknowledges, nevertheless, that present demand has but to push the community to its full capability. Still, these technical benefits make Sonic a compelling choice for builders searching for extra user-friendly dApps.

He additionally revealed new options on Sonic which have the potential to appeal to customers.

“If your first touch point with a user is to download this wallet and then buy this token on an exchange, you’ve lost 99.9% of your users. They’ll use their Google off-email password, fingerprint, face, whatever it is, to access the dApp and interact with it, and they’ll never need to know about Sonic or token,” Andre Cronje revealed.

Risks and Challenges Ahead

Despite reaching spectacular milestones, Sonic shouldn’t be immune to threat. The worth of its token, S, has declined considerably from its peak. According to BeInCrypto, it has dropped round 20% in the previous month—from $0.60 down to $0.47—mirroring the broader market’s volatility.

Furthermore, Grayscale lately removed Sonic from its April asset consideration listing. This determination displays a shift in the fund’s expectations and raises considerations about Sonic’s skill to keep its TVL ought to investor sentiment deteriorate.

Sonic additionally faces fierce competitors from different high-performance chains like Solana and Base. Although Sonic holds a transparent benefit in pace, long-term consumer adoption will rely on whether or not its ecosystem can ship actual worth, not simply excessive TVL figures.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to present correct, well timed info. However, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.