XRP’s latest restoration has sparked recent optimism amongst merchants, however what’s occurring behind the scenes tells an much more compelling story. This isn’t simply a typical bounce; the charts reveal a calculated shift in momentum. Technical indicators just like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are starting to align, suggesting that XRP is approaching a essential determination zone.

Following the latest downturn available in the market, the worth is now on a bullish recovery after testing the $1.7 key help stage with growing conviction. If the present momentum continues and resistance zones give approach, XRP might be on the verge of a important breakout. However, failure to construct on this momentum might entice the token in one other consolidation section or a deeper retracement.

MACD Signals Brewing Bullish Pressure For XRP

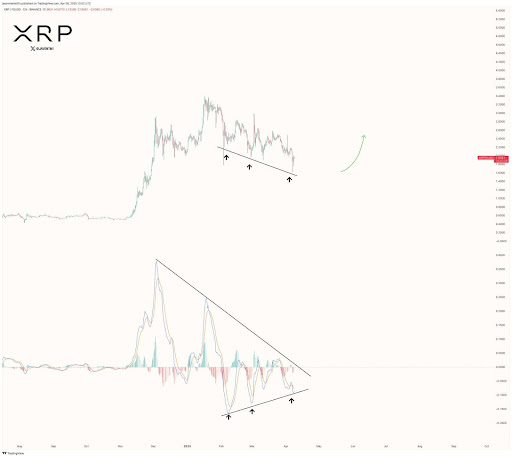

In a latest post on X, crypto analyst Javon Marks identified that XRP’s MACD is approaching a essential breaking level, doubtlessly signaling a shift in market momentum. He emphasised that this MACD indicator is exhibiting indicators of a bullish crossover, which might mark the beginning of a sturdy upward motion.

Coupled with this, Marks highlighted that XRP is presently holding a key Regular Bullish Divergence, the place the worth has been making decrease lows whereas the MACD is exhibiting increased lows. This signifies a weakening of bearish strain, setting the stage for a potential reversal.

Marks instructed that this technical setup might be the catalyst for the bulls to take management, doubtlessly resulting in a highly effective transfer that breaks by present resistance ranges. With this convergence of bullish alerts, XRP could also be primed for a rally again towards the $3.30+ vary, persevering with its earlier uptrend.

Key Levels to Watch: The Exact Breakout And Rejection Zones That Matter

In order to completely perceive the long run actions of XRP, it’s essential to pinpoint the important thing ranges that can both drive the worth increased or trigger a reversal. Firstly, the breakout zone for the altcoin lies across the $1.97 resistance stage.

If the worth manages to surpass this threshold with sturdy quantity, it might set off a surge in direction of increased ranges, together with $2.64 and $2.92. This breakout would doubtless verify the upward momentum instructed by the MACD and the common bullish divergence.

On the opposite hand, a rejection at the $1.97 resistance stage would possibly sign a lack of shopping for curiosity. Should the asst fail to interrupt above this stage, the worth might pull again towards decrease help ranges like $1.7 and even $1.34. A failure to carry these help ranges would set off the potential for a extra substantial downturn, with bears regaining control.