A big Ripple whale transaction has drawn consideration throughout the crypto market. Early reviews affirm that 200,000,000 XRP, price roughly $355.6 million, was transferred from an unknown pockets to Binance. This motion has triggered considerations about potential worth volatility within the close to time period.

The XRP worth because of the Ripple whale dropped to round $1.61, sparking fears of an additional dip.

Ripple Whale Major Transaction Sparks Worry

According to Whale Alert, a Ripple whale has moved 200 million XRP to Binance. The whole worth of this switch stands at $355,576,574 primarily based on the present XRP worth. Such giant actions typically sign upcoming buying and selling exercise that would have an effect on worth conduct. Moreover, some optimism is increase introduced by the NYSE Arca approval of listing and registration of Teucrium’s 2X Long Daily XRP ETF.

Post the Ripple whale motion, analysts on social media have shared differing views on this growth. Dark Defender commented, “There is no change in our XRP Monthly Frame. $1.8815 is holding firm.”

While the origin of the Ripple whale stays unknown, historic information reveals that related actions have preceded corrections or short-term worth drops. Meanwhile, crypto analyst Ali Charts has predicted that XRP worth is breaking out of a head-and-shoulders sample, setting the stage for a potential move to $1.30. This interpretation provides a short-term XRP bearish perspective if the sample confirms decrease ranges earlier than a possible rebound.

Will XRP Price Rally To $8 in April?

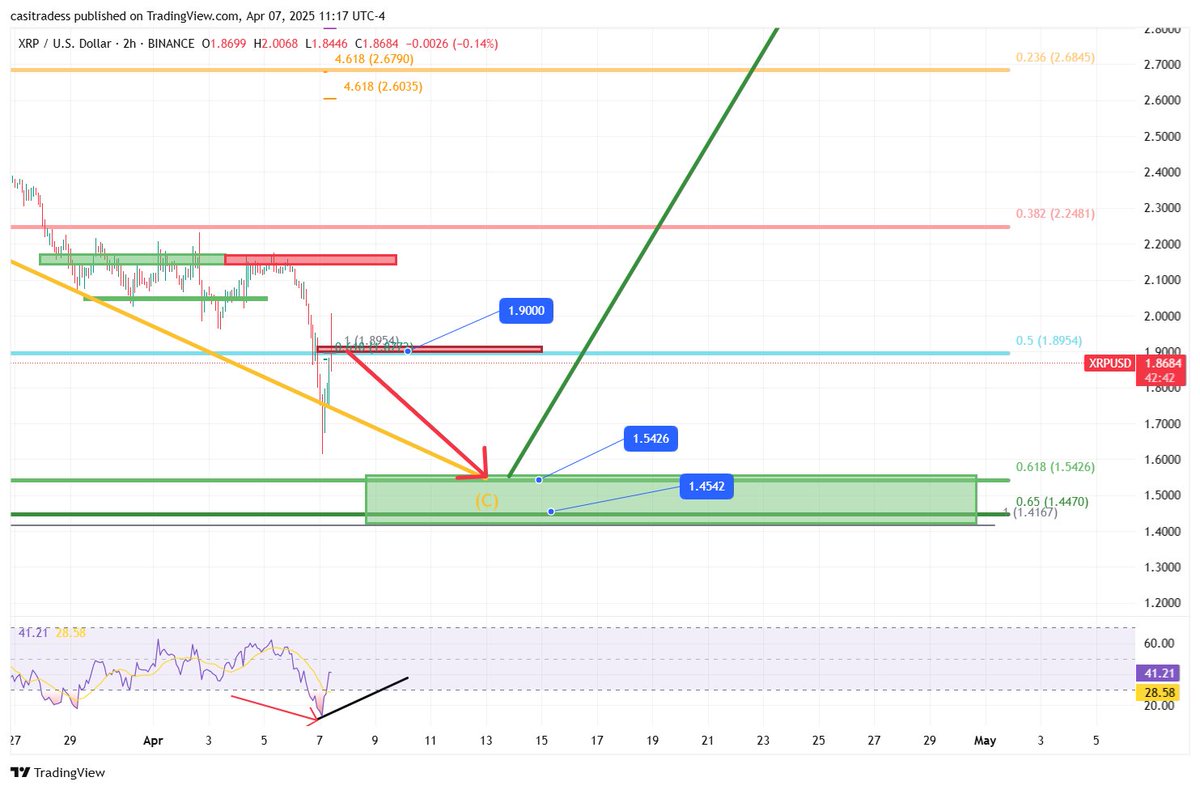

Concurrent with the Ripple whale, Casi Trades, reported that the $1.90 assist stage has damaged down, turning it right into a resistance level for XRP worth. “This low made new extremes on the RSI,” they said, referring to the market-wide worth dip that took XRP to $1.61.

Casi additionally famous the next support at $1.55, which aligns with the .618 Fibonacci retracement stage. This is an important space the place many merchants are setting alerts. According to the dealer, “If we do bottom near $1.55, it actually strengthens the bullish case for those big April targets—$8 to $13 still stands.”

CredibleCrypto echoed related ideas, noting that XRP finally moved under a variety low that had held for over a month. They pointed to a key demand zone between $1.61 and $1.79, suggesting it gives a potential setup for a rebound. However, in addition they famous that “Ideally we bracket/range here for a bit to form a base before a full-on reversal.”

As of now, regardless of the Ripple whale transfer the XRP worth is consolidating simply above this zone.

Analyst Outlines Key Resistance To Breach To Resume Bull Rally

Technical analysts have continued to watch the Elliott Wave construction, suggesting that XRP worth could also be finishing Wave 2 of a bigger development. This principle proposes {that a} robust Wave 3 may start quickly, which usually represents a robust upward motion.

The native resistance ranges to observe embody $1.97 and $2.17. A breakout above these factors may result in a transfer towards larger targets like $2.72 and presumably the earlier all-time excessive of $3.70. However, a failure to carry above $1.61 may shift the main focus to a deeper correction.

According to Egrag, a possible double-bottom or inverse head-and-shoulders sample forming, which may assist a bullish reversal if confirmed. This sample is forming inside the demand zone, which is being considered by some merchants as a really perfect lengthy setup for XRP worth.

Historical Market Cycles and Long-Term View

Egrag Crypto shared a long-term view, drawing from previous market cycles. They in contrast the present XRP worth motion with patterns from 2017 and 2021. According to Egrag, throughout each cycles, XRP worth touched or dropped under the 200 MA (shifting common) earlier than making giant good points.

“In 2017, XRP dropped 73% then pumped 2700%. In 2021, it dropped 78% then pumped 1000%,” Egrag said. He emphasised that so long as the 50 MA hasn’t crossed under the 200 MA, the bullish development stays legitimate.

Egrag identified that short-term worth declines are a part of bigger patterns. “You buy the blood, even if it’s your own,” he wrote, referring to purchasing throughout market concern.

Disclaimer: The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.