Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Speculation over a purported White House plan to pause tariffs for ninety days on all nations besides China despatched markets right into a frenzy earlier in the present day, triggering abrupt worth reversals throughout equities, Bitcoin and cryptocurrencies. In a quick-fire sequence of conflicting updates, the rumor initially floated at round 10:10 AM ET, sparked momentum in danger belongings, and was finally deemed “fake news” by the White House.

The Kobeissi Letter (@KobeissiLetter) described the chronology on X, noting: “What just happened? At 10:10 AM ET, rumors emerged that the White House was considering a ‘90-day tariff pause.’ At 10:15 AM ET, CNBC reported that Trump is considering a 90-day pause on tariffs for ALL countries except for China. By 10:18 AM ET, the S&P 500 had added over +$3 TRILLION in market cap from its low.”

Related Reading

However, solely seven minutes later, at 10:25 AM ET, studies emerged that the White House was ‘unaware’ of Trump contemplating a 90-day pause. “At 10:26 AM ET, CNBC reports that the 90-day tariff pause headlines were incorrect. At 10:34 AM ET, the White House officially called the tariff pause headlines ‘fake news.’ By 10:40 AM ET, the S&P 500 erased -$2.5 TRILLION of market cap from its high, 22 minutes prior. Never in history have we seen something like this,” The Kobeissi Letter writes.

The mere suggestion of a short lived reprieve from tariffs managed to shift sentiment quickly in each fairness and crypto markets. BTC, which was buying and selling round $75,805 on the time, soared by roughly 7.2% to surpass $81,200 inside half an hour. Once affirmation arrived that no such pause was deliberate, the beneficial properties evaporated nearly as quick as they’d arrived, pulling Bitcoin again to roughly $77,560.

The abrupt flip of occasions unleashed a wave of commentary amongst crypto observers. Pentoshi (@Pentosh1) remarked that “The fake news tweet showed there’s a lot of sidelined capital at least for relief rally and the risk is to the upside on any positive news at least temporarily.”

Will Clemente III cautioned: “Bear take: Liquidity is bad and this volatility might break something. Bull take: This headline was the cointelegraph intern BTC ETF headline but for equities.”

Related Reading

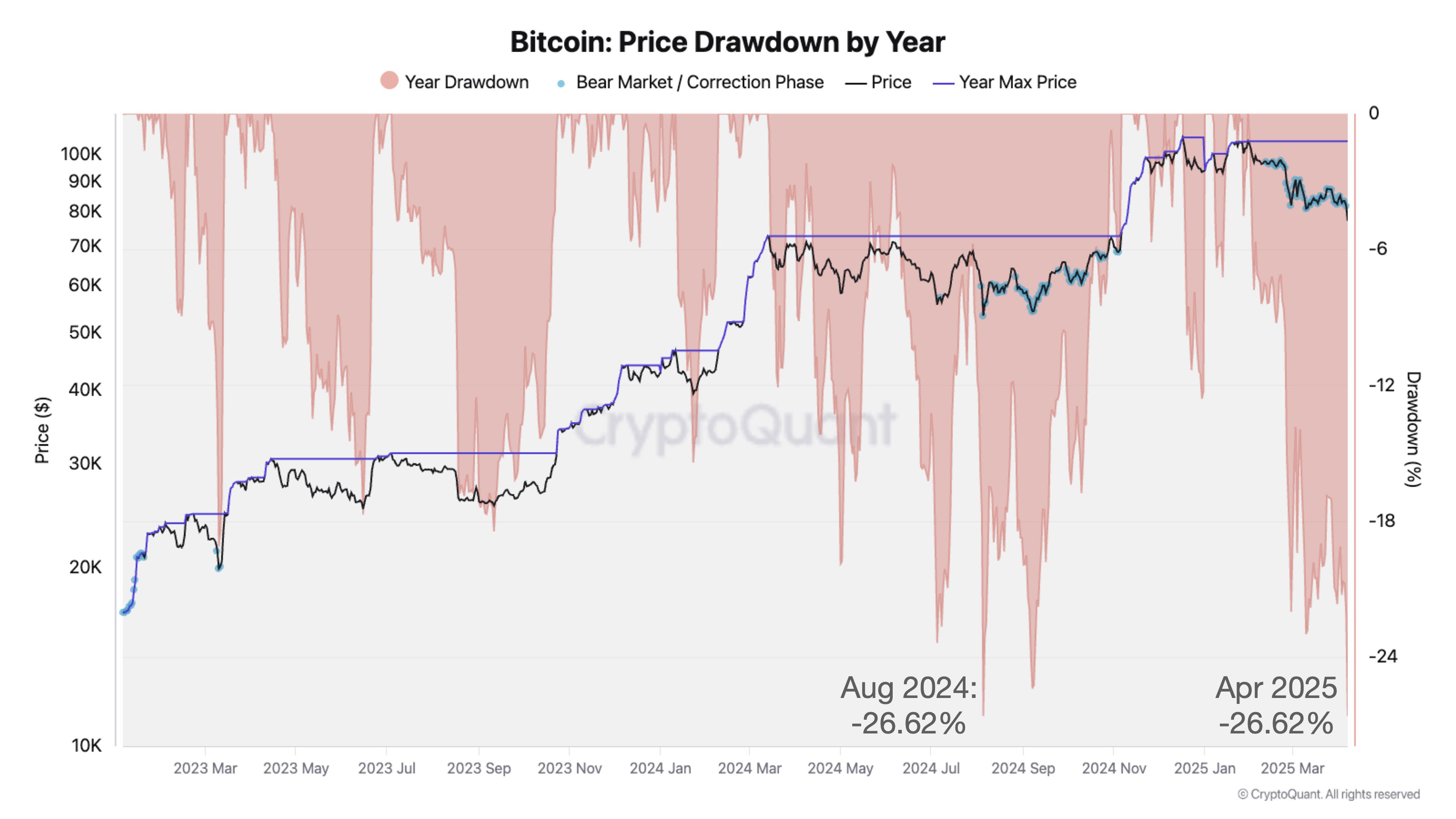

Julio Moreno, Head of Research at CryptoQuant, remarked that “Bitcoin’s current price drawdown is about to become the largest of the current cycle,” illustrating his level with a chart that confirmed BTC’s correction reaching -26.62%, matching the size of August 2024’s correction.

Macro analyst Alex Krüger (@krugermacro) invoked BlackRock CEO Larry Fink’s statement that one other 20% market drop shouldn’t be out of the query, saying: “That’s the thing. Under normal circumstances, probability of such scenarios or things such as stagflation are so low you can just brush them off. Trump opened up the left tail => anything is possible. We are one headline away from a 7% candle in either direction.”

Podcast host Felix Jauvin (@fejau_inc) agrees: “What’s so crazy about this crash vs other is its entirely self-willed and could be reversed in an instant on one tweet. Has there ever been anything like that?”

In the midst of the turmoil, European Union Commissioner Ursula von der Leyen reaffirmed a willingness to hunt options, stating, “Europe is ready to negotiate with the US,” together with the potential of zero-for-zero tariffs on industrial items.

At press time, BTC traded at $78,824.

Featured picture created with DALL.E, chart from TradingView.com