Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

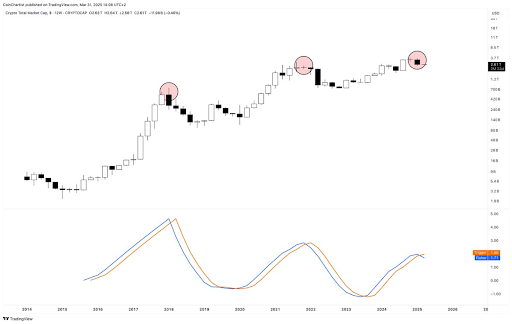

Technical skilled Tony Severino has warned that the Bitcoin and altcoins Fischer Transform indicator has flipped bearish for the primary time since 2021. The analyst additionally revealed the implications of this growth and the way precisely it may affect these crypto property.

Bitcoin And Altcoins Fischer Transform Indicator Turns Bearish

In an X post, Severino revealed that the entire crypto market cap 12-week Fisher Transform has flipped bearish for the primary time since December 2021. Before then, the indicator had flipped bearish in January 2018. In 2021 and 2018, the total crypto market cap dropped 66% and 82%, respectively. This offers a bearish outlook for Bitcoin and altcoins, suggesting they might endure an enormous crash quickly sufficient.

Related Reading

In one other X put up, the technical skilled revealed that Bitcoin’s 12-week Fischer Transform has additionally flipped bearish. Severino famous that this indicator converts costs right into a Gaussian regular distribution to easy out value information and filter out noise. In the method, it helps generate clear alerts that assist pinpoint main market turning factors.

Severino asserted that this indicator on the 12-week timeframe has by no means missed a prime or backside name, indicating that Bitcoin and altcoins might have certainly topped out. The skilled has been warning for some time now that the Bitcoin prime could be in and {that a} huge crash may very well be on the horizon for the flagship crypto.

He not too long ago alluded to the Elliott Wave Theory and market cycles to clarify why he’s not bullish on Bitcoin and altcoins. He additionally highlighted different indicators, such because the Parabolic SAR (Stop and Reverse) and Average Directional Index (ADX), to point out that BTC’s bullish momentum is fading. The skilled additionally warned {that a} promote sign may ship BTC right into a Supertrend DownTrend, with the flagship crypto dropping to as little as $22,000.

A Different Perspective For BTC

Crypto analyst Kevin Capital has supplied a distinct perspective on Bitcoin’s value motion. While noting that BTC is in a correctional section, he affirmed that it’ll quickly be over. Kevin Capital claimed that the query is just not whether or not this section will finish. Instead, it’s about how robust Bitcoin’s bounce shall be and whether or not the flagship crypto will make new highs or document a lackluster decrease excessive adopted by a bear market.

Related Reading

The analyst added that Bitcoin’s value motion when that point comes can even be trackable utilizing different strategies, akin to cash move, macro fundamentals, and general spot quantity. The main focus is on the macro fundamentals as market individuals stay up for Donald Trump’s much-anticipated reciprocal tariffs, which shall be introduced tomorrow.

At the time of writing, the Bitcoin value is buying and selling at round $83,000, up round 1% within the final 24 hours, in accordance with data from CoinMarketCap.

Featured picture from Unsplash, chart from Tradingview.com