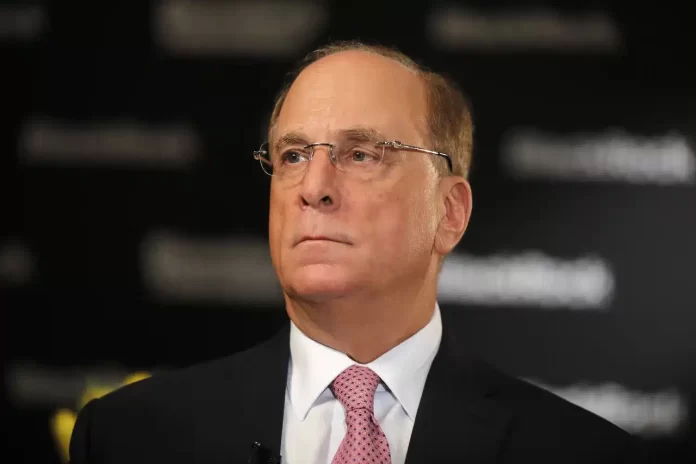

Blackrock CEO Larry Fink, has issued a stark warning relating to the U.S. greenback’s standing because the world’s reserve forex. In his newest annual letter, Fink emphasised that the U.S. faces vital financial challenges, notably regarding its rising nationwide debt.

He said that if the U.S. fails to manage its fiscal trajectory, Bitcoin may emerge as a viable various to the greenback.

U.S. Debt Crisis Could Undermine Dollar’s Global Dominance

BlackRock CEO Larry Fink’s concerns heart across the rising U.S. nationwide debt, which has surpassed 100% of the nation’s GDP. He warned that if this pattern continues, it may result in a state of affairs the place the U.S. struggles to keep up its world monetary place. Considering that the curiosity on the nationwide debt is projected to be greater than $952 billion this 12 months, the fiscal strain might intensify and trigger potential vital impacts. Fink famous that if present tendencies proceed, the federal authorities of the United States may have a everlasting deficit by 2030, whereby all federal income could be directed to debt servicing.

According to BlackRock CEO Larry Fink, if these points persist, then confidence within the U.S. greenback is more likely to lower. He mentioned that, since this 12 months, presumably Bitcoin or different digital property might be thought-about much less dangerous and provide a possibility to eliminate the danger related to property in U.S. {dollars}. This assertion comes amid criticism of Bitcoin’s status as digital gold by Peter Schiff attributable to latest value decline and volatility.

Fink additionally identified that the truth that Bitcoin is free from the management of the traditional establishments and accepts it in change for items and providers make it very enticing to buyers particularly throughout inflationary occasions.

Tokenization and Digital Assets as Solutions for Market Modernization

While writing the letter, the Blackrock CEO careworn digital finance as one of many key components of an financial system and the tokenization of property. Tokenization is the method by which conventional monetary devices resembling equities, bonds, or properties are reworked into blockchain-embedded tokens.

According to Fink, tokenized property might be extra clear, cost-effective, and liquid as in comparison with typical monetary buildings. He spoke of the present construction of economic transactions as primitive, evaluating it to sending mail by the put up workplace.

BlackRock’s embrace of digital property additional helps this angle. The agency has made strides in growing tokenized monetary merchandise, such because the BUIDL fund, a tokenized cash market fund.

This fund has rapidly expanded, and it has the potential for turning into one of many largest tokenized funds out there. According to Fink, the tokenization course of can be a gradual disintegration that can democratize the monetary markets by enabling faster and fractionalized possession.

Role of Bitcoin within the Future of Finance

Under BlackRock CEO Larry Fink, the corporate has made appreciable investments in Bitcoin, launching the iShares Bitcoin Trust (IBIT), which has rapidly develop into one of many largest Bitcoin exchange-traded merchandise on the earth.

Fink reiterated his perception within the innovation behind decentralized finance (DeFi), declaring that it might probably make markets sooner, cheaper, and extra clear.

However, he additionally acknowledged the dangers related to the rise of Bitcoin and different digital property. While he sees their potential, Fink warned that the U.S. should act rapidly to deal with its rising fiscal challenges. Failure to take action may see Bitcoin and different digital currencies being adopted as a hedge towards the greenback’s decline.

A Call for Financial Innovation and Regulatory Reform

In his letter, Blackrock’s CEO Larry Fink advised that the present monetary system needs to be overhauled and has referred to as for improvements resembling tokenization and blockchain expertise. He underlined the necessity for addressing the present points associated to the deep fakes and id verification to unlock institutional adoption of DeFi.

Effective regulatory frameworks are essential to making sure that digital property can thrive in a safe and clear setting.

Besides market shifts, Fink referred to as to help monetary innovation. Evaluating the views, he pointed to the need to offer the correct stability of regulation and develop correct integration of digital property into the present monetary system. If so, these improvements can provide options to the issues that conventional monetary techniques current.

Disclaimer: The offered content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.