Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Tony “The Bull” Severino, a well-followed crypto analyst, lately took to the social media platform X to share an in depth breakdown of Bitcoin’s historic worth habits. The evaluation makes use of a cyclical lens that many within the crypto group (each bulls and bears) agree holds vital relevance.

Notably, Tony Severino focuses on the idea of Bitcoin’s four-year cycles and the way troughs and crests have persistently marked the durations of best alternative and best dangers for investing in Bitcoin. This evaluation is available in mild of Bitcoin’s recent price correction below $90,000 in March.

Cycles Define Sentiment: From Troughs Of Opportunity To Crests Of Risk

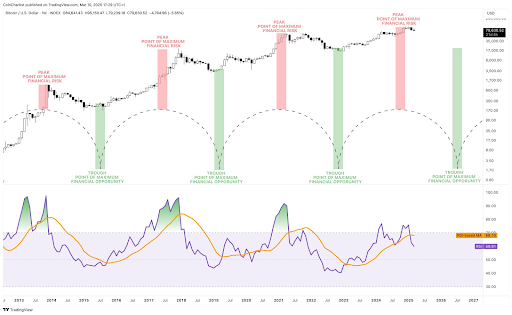

Severino’s analysis starts from a foundational perception shared throughout the crypto trade. The widely-held perception is that Bitcoin operates in clearly outlined cycles, often lasting round 4 years, largely in relation to its halving cycles. His technical outlook is predicated on Bitcoin’s cycle indicator on the month-to-month candlestick timeframe chart that goes way back to 2013.

Related Reading

As proven within the chart under, Bitcoin has gone by way of 4 definitive cycles in its historical past. These cycles, he explains, must be considered from “trough to trough.” The troughs are the darkest moments available in the market, however additionally they characterize the purpose of most monetary alternative.

As these cycles progress, Bitcoin transitions by way of durations of accelerating optimism, ultimately arriving at what the analyst calls the “cyclical crest.” These crests, highlighted in purple in his chart, are the durations the place Bitcoin has reached its level of most monetary danger. This is relayed within the ensuing worth actions, with the Bitcoin worth topping out proper after passing every cyclical crest.

Bitcoin handed by way of its crest within the present market cycle simply earlier than reaching its all-time excessive of $108,786 in January 2025. If previous cycles are any indication, the approaching months might reveal whether or not a top is already in.

Right-Translated Peaks: Is BTC Running Out Of Time In This Cycle?

Bitcoin has been on a correction path since February and is at present down by 20% from this $108,786 worth excessive. The Bitcoin worth has even gone forward to appropriate as little as $78,780 within the second week of March, triggering reactions as as to whether the crypto has already reached its peak price this cycle.

Related Reading

However, Bitcoin would possibly not be in the woods yet, as not all crests are {followed} instantly by market tops. Severino identified that previous cycles have featured “right-translated” peaks the place Bitcoin continued to rise barely even after crossing the crest. The 2017 bull run was essentially the most right-translated, with worth motion staying robust for a while after the red-zone crest. In distinction, different cycles started reversing not lengthy after reaching this level of most danger.

Bitcoin seems to have already handed the purple crest based mostly on Severino’s mannequin, however this doesn’t verify a prime is in simply but. Instead, it implies that the margin for error is quickly narrowing. The longer BTC continues to appropriate after this level, the extra elevated the risk of a bearish part turns into.

BTC is making an attempt to regain bullish momentum on the time of writing, buying and selling at $87,300 after rising 3.6% previously 24 hours. Many different analysts argue that the Bitcoin worth might still chart higher territory this year earlier than a definitive prime is confirmed.

Featured picture from iStock, chart from Tradingview.com