Ethereum (ETH) registered some minor positive factors previously week, rising by 2.80%. Nevertheless, the distinguished altcoin stays removed from breaking out of a downtrend stretching way back to December. Amid this bearish market state, famend market analyst Ali Martinez has highlighted crucial value ranges in deciding if ETH’s correction is over and appropriate for a market entry.

Ethereum: A Buying Opportunity Or More Downside Ahead?

In a detailed analysis post on X, Martinez explains that Ethereum has crashed by 57% from its native peak of $4,100 in December. This decline has been attributed to a widespread distribution by giant Ethereum holders, particularly the whales. Over the previous 4 months, wallets holding 10,000 ETH have declined by 80. Meanwhile, ETH whales i.e. wallets holding 100,000 ETH and above, have offloaded 130,000 ETH inside this era.

During ETH’s decline, the Ethereum Spot ETFs have additionally suffered huge withdrawals as indicated by a web outflow of $760 million in simply the final month. Furthermore, buyers have transferred 100,000 ETH to buyers with intentions to promote in concern of a value loss.

Looking ahead, Martinez notes a number of technical indicators additional counsel a draw back for Ethereum amid this intense promoting stress. For instance, a breakdown from an ascending triangle on the 3-day charts suggests ETH could also be headed for a value goal of round $1,000.

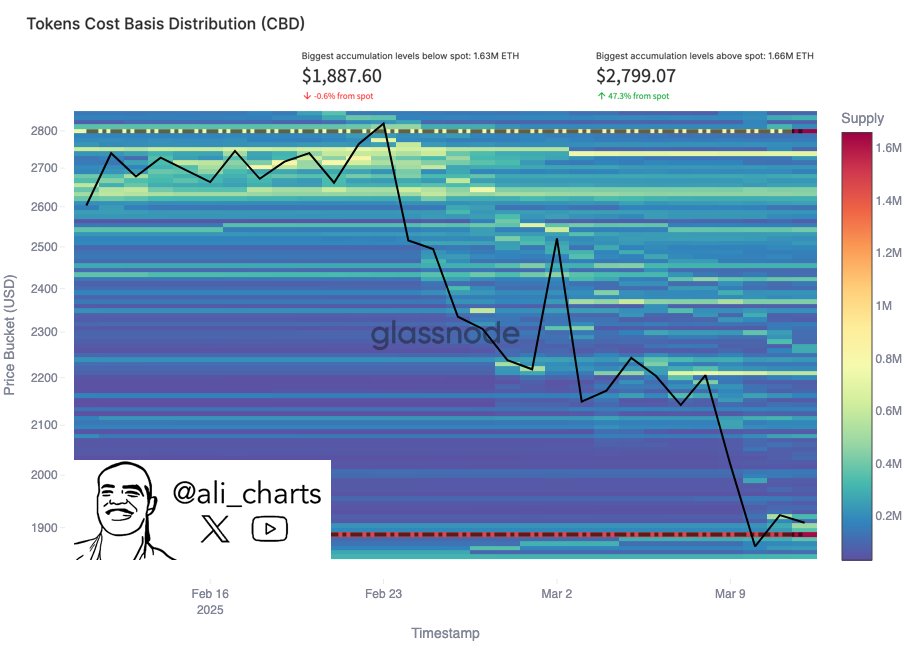

Meanwhile, the ETH pricing bands have additionally highlighted $1,440 as one other draw back goal indicating a possible 27.4% decline from present market costs. Interestingly, information from the Cost Basis Distribution correlates with each bearish projections as Ethereum is presently above key help at $1,887. However, a value fall beneath this stage will end in an extra decline to decrease targets equivalent to $1,440, $1250, and $1,000.

Albeit, Martinez notes there’s potential for an ETH market restoration. By analyzing the quantity of ETH acquired at every value stage, the analyst notes that ETH bulls are going through a critical resistance between $2,250-$2,610. If ETH bulls can push previous this resistance, it might invalidate the present bearish market outlook.

Ethereum Price Overview

At the time of writing, Ethereum was buying and selling at $1,985 reflecting positive factors of 1.10% previously day and a couple of.10% previously seven days. However, the altcoin is down by 27.32% within the final month. Being the most important altcoin out there, Ethereum boasts a market cap of $239 billion representing 8.7% of the whole crypto market.

Featured picture from Ledger Insights, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.