Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has maintained its dominance on the altcoin market even amidst the ongoing price corrections. The main cryptocurrency has been within the highlight all through this market cycle, however a technical outlook means that it wants to provide approach. Particularly, a crypto analyst often called Seth on social media platform X pointed to Bitcoin’s dominance relative energy index (RSI) as an important issue that should change earlier than Bitcoin and the broader market can kick off one other leg upward.

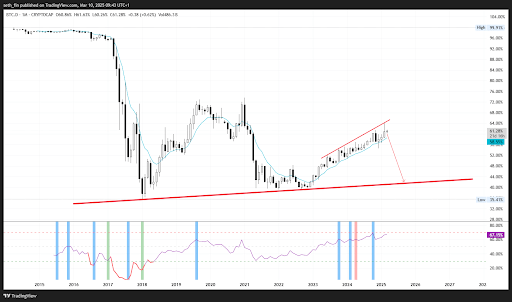

Bitcoin Dominance RSI Hits New Level

Seth’s newest evaluation, shared on social media platform X, highlights a crucial statement concerning Bitcoin’s market dominance. He famous that Bitcoin’s month-to-month dominance RSI recently surged to 70, a degree that has by no means been reached earlier than in Bitcoin’s historical past. While this may seem to be a bullish sign at first look, the analyst suggests in any other case, warning that the dominance RSI should calm down for the ultimate part of the bull run to happen. This perspective comes because the crypto market experiences a downturn, leaving investors questioning when the subsequent bullish wave will start.

Related Reading

RSI, or relative energy index, tracks the velocity and alter of worth actions and is used to establish overbought or oversold situations. With Bitcoin’s RSI dominance at such an excessive degree, even with the current worth decline, it means that BTC’s management over the market is at an unsustainable peak, which might decelerate the broader market rally.

According to Seth, these who fail to grasp this idea don’t perceive the basic mechanics of economic markets, as this precept applies past simply Bitcoin and altcoins. Given this, the healthiest path ahead can be a discount in Bitcoin’s dominance over the subsequent few weeks, with the analyst projecting a fall to 44% dominance.

Why BTC’s RSI Dominance Decline Matters

A decline in Bitcoin’s RSI dominance would imply that the market is shifting towards extra balanced situations, permitting capital to stream into altcoins and drive up their costs. Throughout past bull cycles, significantly in 2021, Bitcoin’s rise to a peak was typically adopted by a surge in altcoin investments, triggering widespread rallies throughout the market.

Related Reading

This sample has traditionally marked the ultimate part of a bull run, the place capital flows away from Bitcoin and into altcoins with a better potential for short-term good points. Until Bitcoin’s dominance cools off, the altcoin sector could battle to achieve momentum and proceed to derail the ultimate part of the BTC bull run.

At the time of writing, BTC is buying and selling at $81,500, reflecting a 2.5% decline within the final 24 hours. Market information from CoinMarketCap signifies that Bitcoin’s dominance at present stands at 61.0%, having risen by 0.65% throughout the similar interval. This rising dominance means that capital stays concentrated in BTC.

Featured picture from Unsplash, chart from Tradingview.com