Crypto and monetary markets are experiencing a way of déjà vu as analysts examine the present macroeconomic outlook to previous cycles, notably the earlier Trump-era commerce wars.

As merchants and buyers wait with bated breath for a crypto market restoration, all eyes stay pegged to the US greenback index (DXY) and the M2 Money Supply for potential hints.

Bitcoin, Altcoins & Tariffs: Is a 2017-Style Rally Ahead?

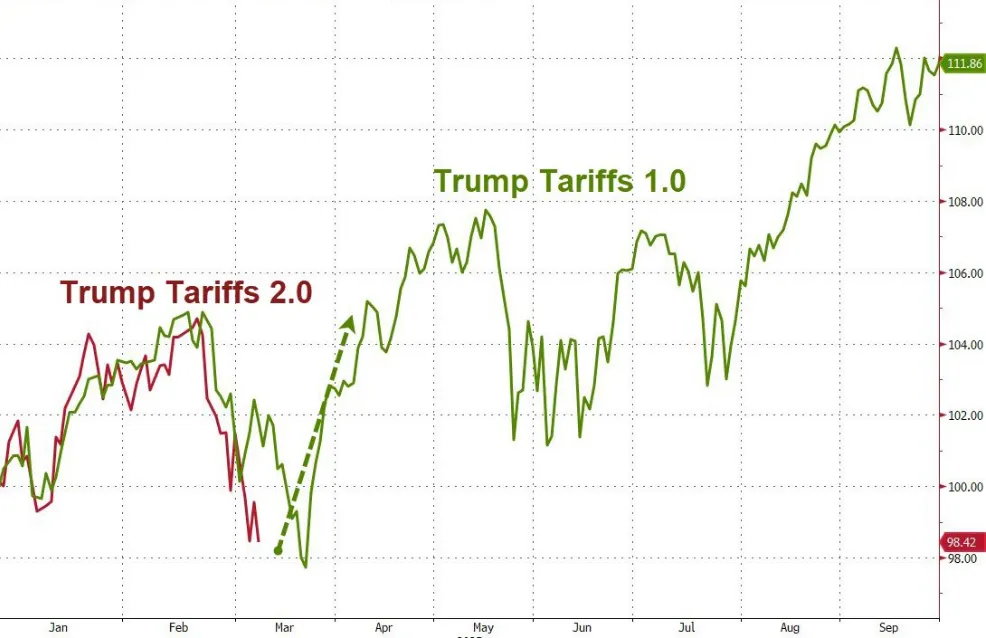

A current chart from ZeroHedge highlights how the US Dollar Index (DXY) in 2025 intently mirrors its 2016 actions. This provides credence to the concept market tendencies echo previous patterns.

This parallel has drawn vital consideration from buyers, notably within the crypto sector. Analysts assess whether or not Bitcoin (BTC) and altcoins will observe an identical trajectory to their 2017 bull cycle.

Financial market commentary, The Kobeissi Letter, weighed in on this dialogue, emphasizing the similarities between Trump Tariff War 1.0 and a pair of.0.

The commentary acknowledges that immediately’s macroeconomic situations differ from these of the earlier Trump administration. However, it additionally notes that a number of technical movements across asset classes, together with shares, gold, oil, and Bitcoin, have been strikingly comparable.

So far this 12 months, gold costs have surged over 10%, reflecting a shift towards safer property. Meanwhile, Bitcoin has declined practically 10%. This divergence highlights the significance of risk appetite in shaping market sentiment.

Bitcoin’s current value motion additional validates these observations. On March 4, Bitcoin skilled an abrupt $2,000 drop in simply 25 minutes, approaching the resistance degree at $90,000. Market members have famous that cryptocurrency valuations incessantly shift by over $100 billion, even with out materials information.

This means that liquidity-driven movements and technical resistance ranges play a dominant function in value fluctuations. In this regard, The Kobeissi Letter famous that long-term buyers who took benefit of volatility throughout Trump Trade War 1.0 discovered glorious cut price alternatives. This means that comparable situations might come up once more.

Altcoin Season To Align with Trump Season

Meanwhile, a rising narrative inside the crypto house is that “Altcoin Season” might align with “Trump Season.” Crypto investor and analyst bitcoindata21 highlighted how Bitcoin’s value motion in 2025 resembles the 2017 cycle. This statement reinforces the assumption {that a} main altcoin rally may very well be on the horizon.

Historical tendencies counsel {that a} strengthening Bitcoin market typically precedes explosive development in altcoins as capital rotates. This raises the chance that an upcoming bullish cycle might mirror the altcoin increase seen throughout Trump’s first time period.

Elsewhere, broader financial tendencies additionally level to potential upside for Bitcoin. As BeInCrypto reported, the DXY recently fell below a key support level, which has traditionally been a bullish sign for Bitcoin. A weakening greenback tends to push buyers towards different property similar to cryptocurrencies and gold.

Additionally, analysts have highlighted the expanding M2 money supply as one other issue that would gas a Bitcoin rally. Historically, expansions in M2 have coincided with main Bitcoin bull runs, with consultants predicting a surge in late March as liquidity situations enhance.

For now, uncertainty stays excessive attributable to macroeconomic elements and policy shifts. However, historical past means that buyers strategically place themselves throughout risky intervals and infrequently reap vital rewards.

If the sample from 2017-2020 repeats, Bitcoin and altcoins might enter a renewed bull cycle within the coming months. Nevertheless, merchants ought to stay vigilant, as short-term volatility stays a key attribute of the present market atmosphere.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. However, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.