Altcoin/BTC spot buying and selling pairs have been as soon as thought of a key channel for traders to extend their Bitcoin holdings. However, this notion is fading. Data signifies a decline in curiosity, with many Altcoin/BTC pairs delisted in early 2025.

Meanwhile, Altcoin/USDT spot pairs stay the first avenue for merchants in search of earnings.

Binance Delists Multiple Altcoin/BTC Spot Pairs

At the start of 2025, Binance eliminated a number of Altcoin/BTC spot pairs from its platform. Today, Binance announced the delisting of MDT/BTC, MLN/BTC, VIB/BTC, VIC/BTC, and XAI/BTC because of low liquidity and buying and selling quantity. This shouldn’t be the primary such announcement this yr.

“To protect users and maintain a high-quality trading market, Binance conducts periodic reviews of all listed spot trading pairs and may delist selected spot trading pairs due to multiple factors, such as poor liquidity and trading volume,” Binance stated.

Since the beginning of the yr, Binance has issued seven delisting announcements, affecting 34 spot buying and selling pairs. Of these, 50% have been Altcoin/BTC pairs, whereas the remaining have been Altcoin/ETH or Altcoin/BNB. Notably, the delisting of an Altcoin/BTC pair doesn’t essentially imply its corresponding Altcoin/USDT pair is eliminated (e.g., ENJ, C98, REZ).

This shift displays merchants’ desire for Altcoin/Stablecoin pairs, seemingly because of higher liquidity and decrease danger publicity.

Retail Investors Reduce Bitcoin Holdings While Institutions Accumulate

CryptoQuant information reveals that retail traders have been decreasing their BTC holdings since This fall 2024, whereas massive traders proceed to build up.

“Retail is panic-selling. Whales are accumulating,” Investor Mister Crypto commented.

Since the approval of Bitcoin ETFs and the beginning of Trump’s new time period, Bitcoin has turn into a playground for institutional investors. Retail merchants appear much less , as BTC’s excessive worth is out of attain for a lot of. Instead, they maintain fewer BTC and allocate extra capital to altcoins, particularly meme coins.

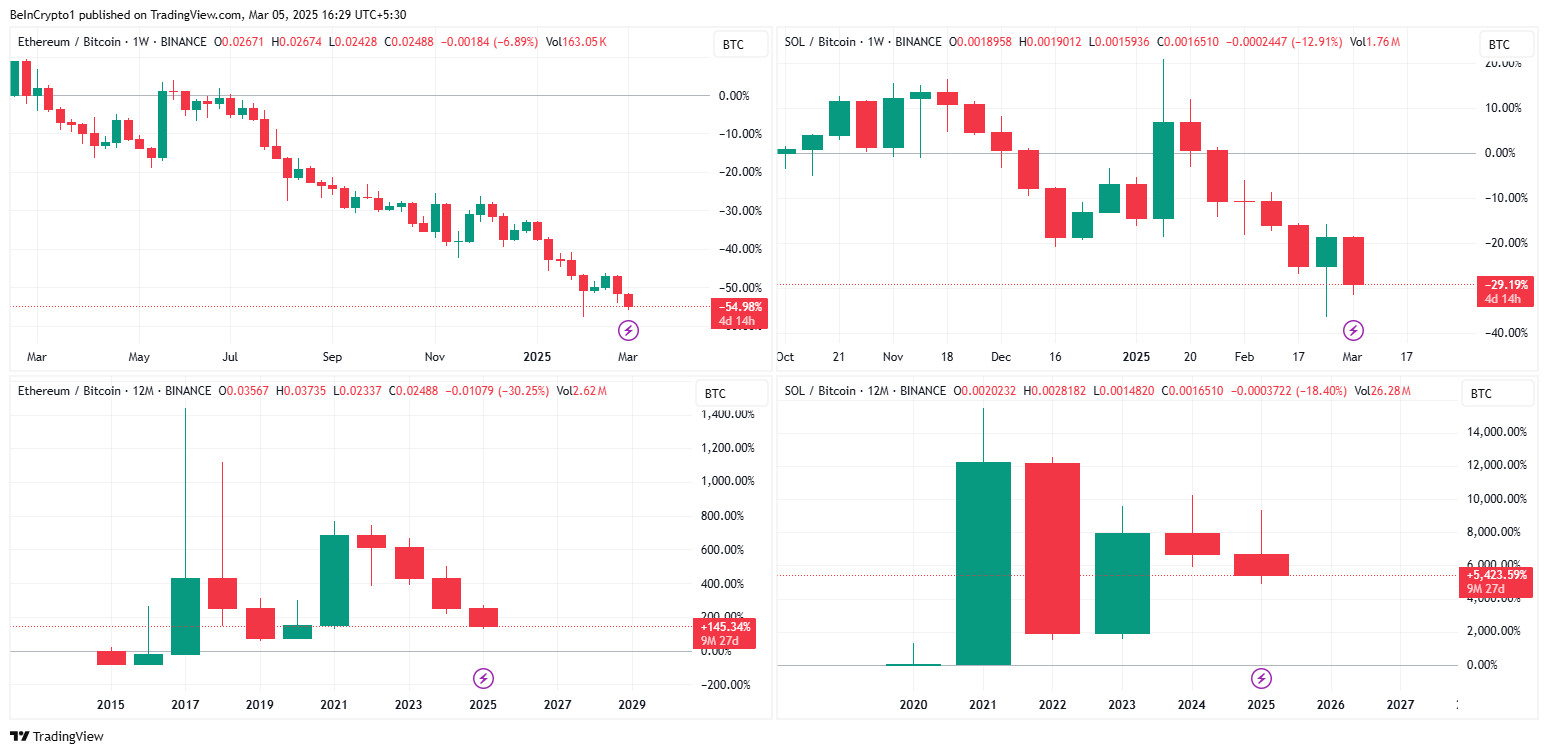

Furthermore, buying and selling Altcoin/BTC pairs exposes merchants to 2 dangers concurrently—the volatility of each altcoins and Bitcoin. Even probably the most liquid pairs, resembling ETH/BTC and SOL/BTC, have proven extended downtrends and excessive volatility, rising the danger of losses.

Market analysts additionally are likely to give attention to Altcoin/USDT spot pairs, leaving Altcoin/BTC pairs with much less consideration.

According to CoinMarketCap information, USDT’s each day buying and selling quantity exceeds $115 billion, out of a complete market buying and selling quantity of $147 billion. This confirms that USDT stays the first channel for merchants in search of alternatives.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. However, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.