The Bitcoin (BTC) market has been extremely unstable within the final week and below a powerful bearish affect. In this era, Bitcoin has crashed by over 15% falling as low as $80,000. Interestingly, blockchain analytics agency Glassnode has offered an in-depth evaluation of buyers’ habits amidst this value decline highlighting the cohort with the biggest realized losses.

BTC 1-Day To 1-Week Holders Lead Market Liquidation Pressure

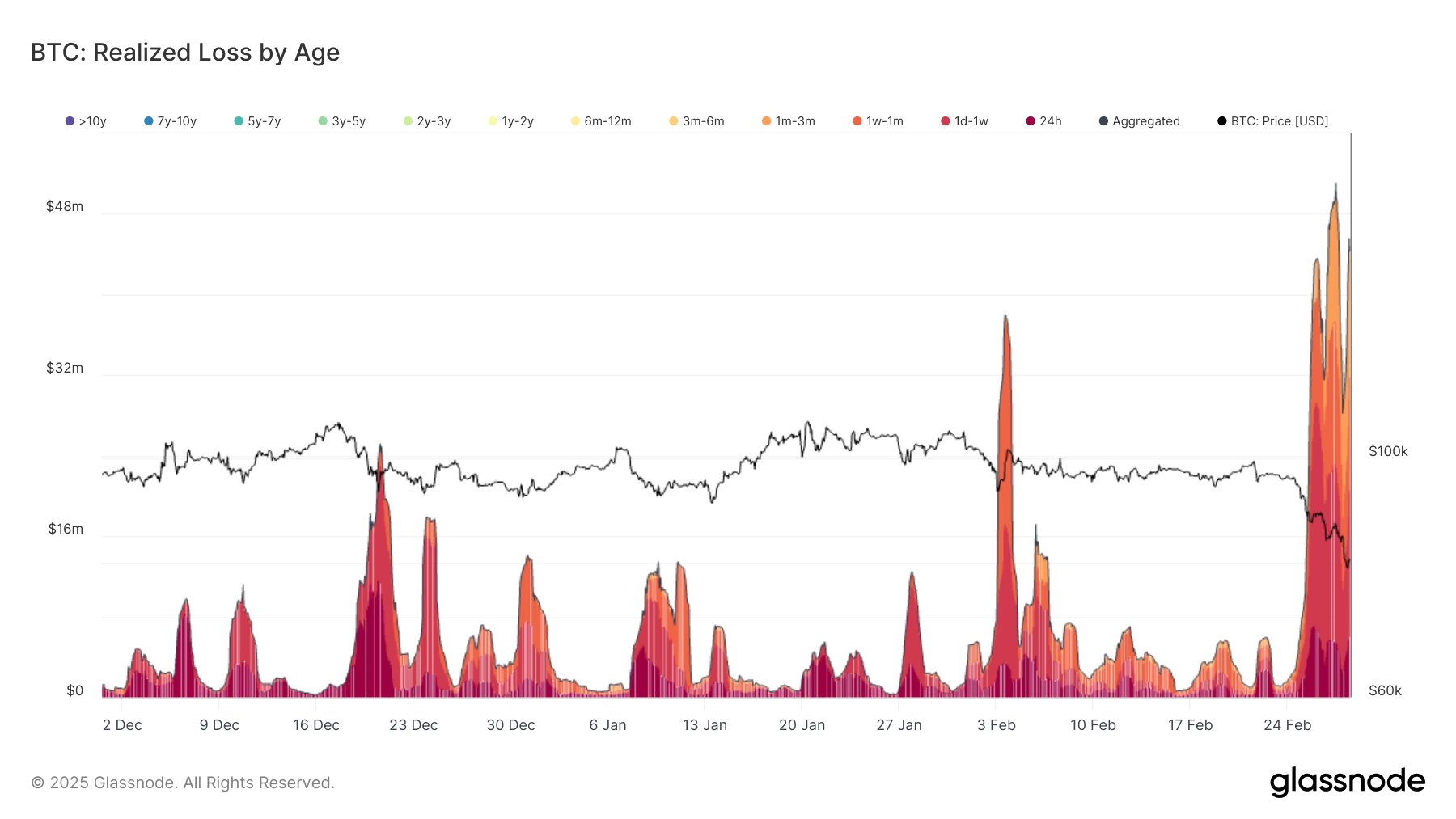

On Friday, February 28, Bitcoin dipped under $80,000 reaching a value degree final seen in November 2024. In response, the BTC market recorded $685 million in realized losses along with the preliminary $2.16 billion between February 25-27. In a recent X post, Glassnode analysts dived into the market sell-off on Friday, indicating that this latest capitulation is primarily concentrated amongst short-term holders (STH) who’re realizing losses at a a lot larger fee than long-term holders.

From Glassnode’s report, probably the most affected cohort of STH has been new market entrants over the previous week as indicated within the following knowledge: 1-day to 1-week holders with $238.8 million in losses,1-week to 1-month holders ($187.6 million), 1-month to 3-month holders ($132.4 million) and 24-hour consumers ($104.9 million). However, it’s price noting that holders from the previous 3-6 months additionally skilled a big spike in realized losses. This group recorded $ 12.7 million in realized losses on Friday, representing a 95.4% achieve from yesterday.

Looking additional, Glassnode’s report additionally realized the worth dip on Friday additionally pushed the Bitcoin loss realization common fee to $57.1 million per hour. The realization pace per cohort of the STH – who account for almost all of the market losses is as follows: 1-day to 1-week holders with $19.9 million/hour, 1-week to 1-month holders ($13.9 million/hour), 1-month to 3-month holders ($14.2 million/hour) and 24-hour consumers ($8.04 million/hour).

As anticipated, the 1-day to 1-week cohort is the dominant drive in driving liquidity strain with a loss realization fee virtually double the subsequent largest group.

Bitcoin Long-Term Holders Stay Resolute

According to extra knowledge from Glassnode’s report, Bitcoin long-term holders from the final 6-12 months have proven minimal, negligible loss realization regardless of a widespread market capitulation.

This growth signifies that the longer-term buyers are largely unbothered by the latest sell-off and value correction with sturdy confidence for a market rebound. At press time, Bitcoin trades at $85,200 following some value restoration on Friday. However, its weekly losses stay at 11.34% indicating the present bearish transfer out there.

Featured picture from Getty Images, chart from Tradingview