The crypto market is in turmoil, with its complete market cap plunging by $325 billion since final Friday. Bitcoin’s value took a pointy 8% hit, dropping to the $87,000 mark. Leading altcoins like Ethereum, XRP, and Solana noticed losses exceeding 12%.

So, right here we take a fast have a look at the potential causes which will have dampened the traders’ sentiment.

Why Is Crypto Market Falling?

A flurry of things might need contributed to the latest crypto market collapse. A mix of liquidity points, macroeconomic tendencies, and technical sell-offs seems to be behind the most recent downturn.

According to The Kobeissi Letter, a number one international capital markets commentary platform, crypto markets erased $100 billion in only one hour right now with none main headlines. The platform identified that round $150 billion in liquidations occurred in 24 hours, dragging nearly all cryptocurrencies down.

Even the meme coin sector, which had been booming, noticed a steep decline. Notably, CoinGlass information confirmed that $1.49 billion has been liquidated within the final 24 hours amid the broader digital assets market crash. As of writing, the worldwide crypto market cap stood at $2.9 trillion.

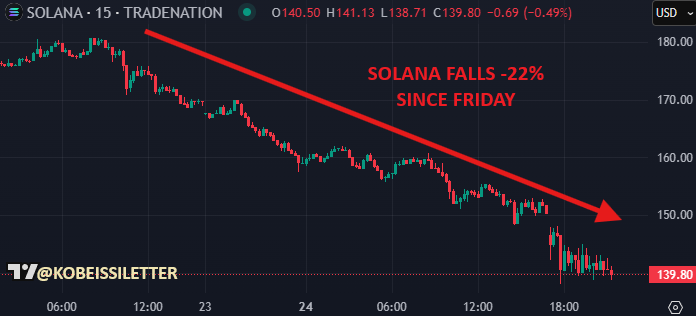

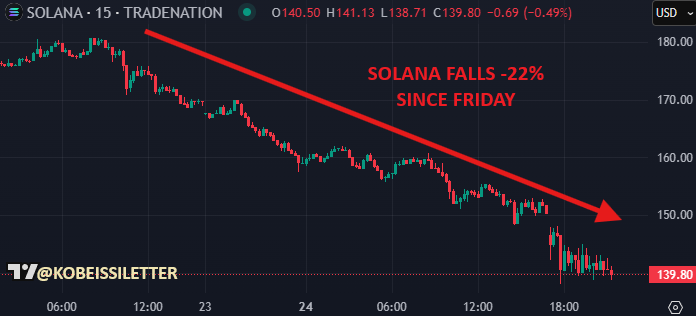

Solana’s Downfall Triggered Selling Pressure

Solana was one of many key gamers within the latest crypto frenzy, particularly with meme cash driving its fast surge. However, as memecoin hype began fading, Solana value suffered a drop of round 20% in every week. Initially, this decline remained remoted from Bitcoin, but it surely later unfold throughout the market.

Adding to the market-wide sell-off, the S&P 500 additionally started shedding floor on Friday. Bitcoin, typically correlated with broader monetary markets, adopted go well with. Once Bitcoin broke beneath the $98,000 help stage, panic promoting intensified. As of writing, BTC value was down about 8% and hovered close to the $87K mark.

Citadel’s Crypto Pivot and the Bybit Hack Impact

Interestingly, the sharp decline got here simply hours after a report that the $65 billion monetary large Citadel Securities is exploring the crypto space as a liquidity supplier. However, as a substitute of boosting market sentiment, the information triggered a “sell-the-news” response.

Another main blow got here from the Bybit hack, which cybersecurity agency Arkham Intelligence described because the “largest financial heist in history.” The hack exceeded $1 billion in stolen belongings, greater than doubling the notorious $611 million PolyNetwork breach in 2021. Such safety incidents erode investor confidence, resulting in extra panic-driven exits from the market.

Crypto Market Pullback: Normal Correction or Bull Run End?

Ethereum’s weak point has added extra pressure to the broader crypto market. The latest wave of promoting seems to be a mixture of technical pullbacks and declining liquidity. However, analysts counsel that such corrections are a part of a wholesome market cycle.

For context, in a latest X submit, standard market skilled “il Capo Of Crypto” hints at a “strong bounce” available in the market. These feedback point out that regardless of the short-term selloff, the crypto market is more likely to witness a powerful comeback within the coming days.

Disclaimer: The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.