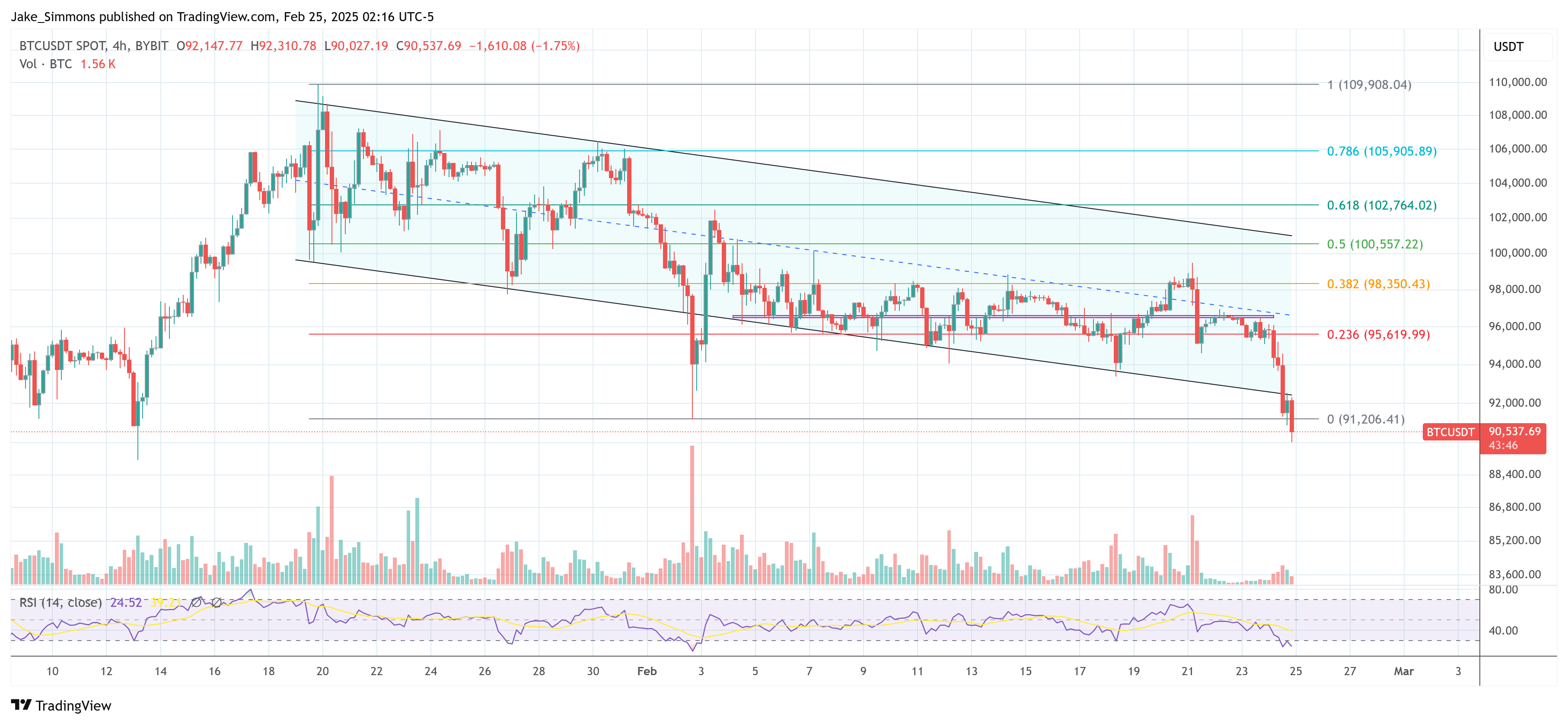

The Bitcoin worth has fallen greater than -8.8% since Friday when Bybit suffered the largest crypto hack in historical past. The flagship digital asset reached a peak of $99,493 late final week, solely to retreat to roughly $91,500 at press time, marking a -5.5% decline since Monday. This downturn not solely shatters Bitcoin’s try to carry above $95,000 but in addition locations it on the verge of dropping its crucial 97-day buying and selling vary between $91,000 and $102,000. Notably, Bitcoin’s worth has damaged beneath the descending pattern channel that has been in play since January 20.

What’s Next For Bitcoin?

Ari Paul, co-founder and Chief Investment Officer of BlockTower Capital, supplied a wide-ranging view on Bitcoin’s trajectory and the broader macroeconomic surroundings. In a post on X, Paul touched on the potential for continued equity-market weak spot and its knock-on impact on digital belongings: “My market take: equities in for 4-15 months of pain (I’ll guess 9 months) tied to deflationary government policies (tariffs and mass layoffs mostly). Then it’s a political question – does Trump admin ‘capitulate’ and turn severely inflationary? In vast majority of similar cases in history the answer was yes, but just a low confidence guess to me currently.”

Related Reading

Shifting focus to crypto, Paul emphasised that whereas cryptocurrencies should show short-term correlations with equities, they’re inherently on completely different cyclical rhythms: “What does that mean for crypto? I continue to think crypto and equities are on different cycles rhythms, but that doesn’t negate shorter term correlation. Alts probably follow equities down at least at first (but they’re already down so much, even versus 2021 prices, they may bottom well before equities.)”

Speaking on Bitcoin, Paul predicts that the main cryptocurrency will “act like a blend of gold and S&P 500,” including, “if gold remains strong, than that would suggest Bitcoin would outperform losing equities, but maybe not by much. A retrace to ~$73k-$77k seems plausible, I’d probably add there.”

Despite the near-term volatility, Paul stays optimistic: “I remain confident crypto bull market not over, but this is looking increasingly different from prior cycles, maybe substantially slower and longer. My base case is that crypto will lead the general macro inflation turn, so maybe crypto bull run resumes in 6 months and equities turn up in 9. The dates given are just indications of my guesstimates. I place no weight on the exact timeframes.”

BitMEX founder Arthur Hayes additionally took to X to warn of an imminent downward push. He pointed to the mechanics of Bitcoin Exchange-Traded Funds (ETFs) and futures market arbitrage as potential drivers of elevated promoting strain.

“Bitcoin goblin town incoming: Lots of IBIT holders are hedge funds that went long ETF short CME future to earn a yield greater than where they fund, short term US treasuries. If that basis drops as BTC falls, then these funds will sell IBIT and buy back CME futures. These funds are in profit, and given basis is close to UST yields they will unwind during US hours and realise their profit. $70,000 I see you mofo,” he writes.

Related Reading

Notably, analysis agency 10x Research published an evaluation on Monday indicating that whereas Bitcoin ETFs—led by BlackRock’s IBIT product—have garnered $38.6 billion in internet inflows since their January 2024 launch, a lot of this capital could not signify easy bets on rising BTC costs, aligning with Hayes’ assertion.

“Although Bitcoin ETFs have attracted $38.6 billion in net inflows since their January 2024 launch, our analysis suggests that only $17.5 billion (44%) represents genuine long-only buying. The majority—56%—is likely tied to arbitrage strategies, where short Bitcoin futures positions offset inflows,” the agency famous.

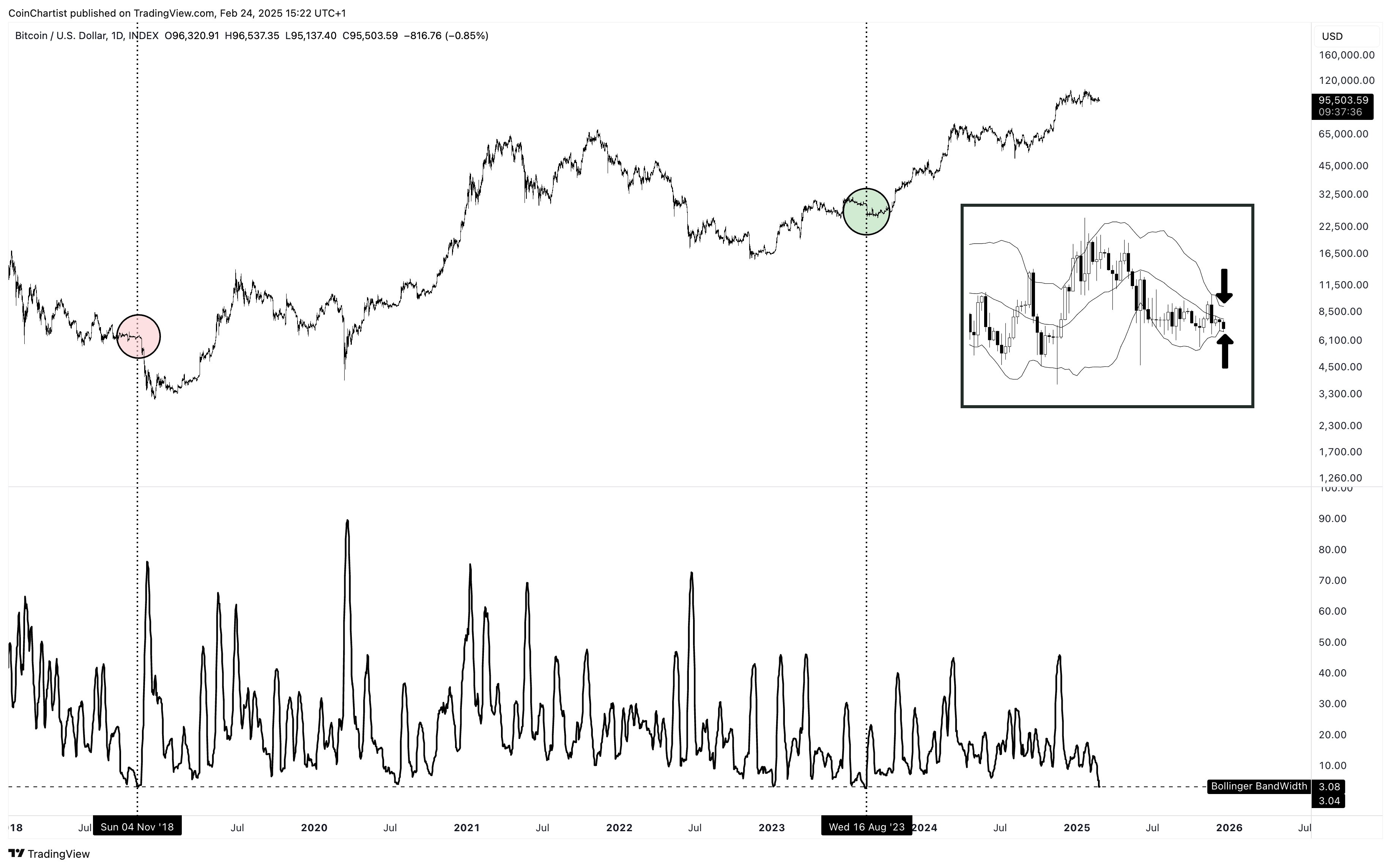

Prior to the continued worth drop, market technician Tony “The Bull” Severino, warned of looming volatility in Bitcoin, noting that the every day Bollinger Bands have been hitting excessive tightness—a sample usually adopted by a big worth swing: “A decision will be made soon in Bitcoin, as the daily Bollinger Bands reach the third-tightest reading since 2018. In late 2018, record tightness led to a 50% decline in just over a month. In mid 2023, record tightness led to a 200% climb in just over 200 days. Which direction does volatility release?”

With Bitcoin teetering simply above $91,000 and the market nonetheless reeling from Bybit’s historic hack, the market is at a pivotal juncture. Chart alerts, macroeconomic uncertainties, and the unwinding of complicated buying and selling methods collectively draw a clouded outlook with a doable extension of this stoop to the $73,000–$77,000 vary within the coming months.

Meanwhile, this doesn’t should herald the start of the bear market. Chris Burniske, companion at Placeholder VC, commented by way of X: “In the middle of 2021:BTC drew down 56%, ETH drew down 61%, SOL drew down 67%, many others 70-80%+. You can come up with all the reasons for why this cycle is different, but the mid-bull reset we’re going through isn’t unprecedented. Those calling for a full blown bear are misguided.”

At press time, BTC traded at $90,537.

Featured picture created with DALL.E, chart from TradingView.com