Ki Young Ju, the founder and CEO of CryptoQuant, has challenged the normal notion of Altcoin Season.

He means that the previous capital move cycle resulting in altcoin surges has develop into out of date.

CryptoQuant CEO Discusses Changing Altcoin Season

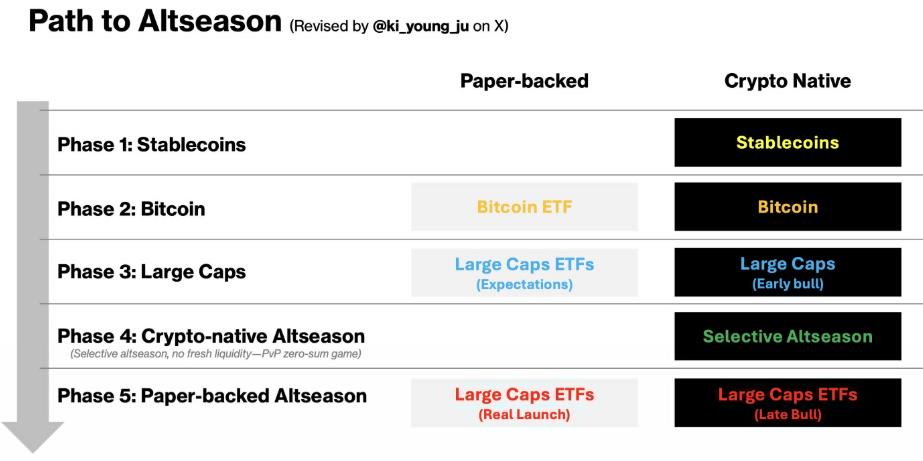

According to Ju, altering crypto regulations and institutional adoption have altered how capital strikes within the crypto market. These modifications, he says, forestall the standard explosion of smaller altcoins that traditionally outlined Altcoin Season.

In a current put up on X (previously Twitter), Ki in contrast the previous altcoin season cycle to a disappearing wet season.

“Redefining Altseason. The old altseason capital flow cycle is obsolete. What I meant was that due to climate change, the rainy season has completely disappeared, leaving only a season of occasional drizzles,” Ki explained.

He defined that Bitcoin-driven capital rotations not perform as they as soon as did as a result of institutional involvement and regulatory modifications. Instead, new capital primarily flows into stablecoins or broadly accepted altcoins fairly than speculative smaller tokens.

Despite declaring an altcoin season amid liquidity struggles, Ki rapidly clarified that the period of indiscriminate altcoin surges is over. Instead, he predicts a “selective altseason,” the place just a few altcoins will profit from new market tendencies. Based on this, he highlighted three key elements that might drive altcoin efficiency in 2025.

The CryptoQuant government cited the potential approval of exchange-traded funds (ETFs) for altcoins, sustainable consideration drivers, and revenue-generating tasks.

He emphasised that “most altcoins won’t make it,” marking a stark distinction to earlier cycles the place practically all altcoins skilled substantial worth will increase.

“The era of everything pumping is over. It’s a selective altseason—most altcoins won’t make it,” Ki added.

Meanwhile, current market tendencies help Ki’s evaluation of a selective altcoin season. As BeInCrypto reported, altcoins outperformed Bitcoin relating to crypto inflows final week. Citing a CoinShares report, BeInCrypto highlighted Bitcoin’s outflows of $571 million. Meanwhile, sure altcoins, together with XRP, led inflows with $38.3 million, largely as a result of hypothesis round potential ETF approvals.

Other altcoins, corresponding to Solana (SOL) and Ethereum (ETH), additionally registered optimistic efficiency. This development means that traders prioritize established altcoins with sturdy fundamentals fairly than smaller, extra speculative tokens.

Recently, Ki addressed the continued liquidity struggles within the crypto market. He described the state of affairs as a “PvP fight,” the place capital is redistributed amongst belongings fairly than new liquidity getting into the market.

This aligns with the notion that institutional capital progressively shapes the sector, favoring stability over speculative altcoin booms. With institutional traders exerting better affect, the times of indiscriminate altcoin surges pushed by retail merchants could finish.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. However, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.