Crypto outflows reached $508 million final week, marking the second collection of destructive flows in 2025. This brings the final two weeks of outflows to $925 million.

The outflows level to a shift in sentiment following an 18-week rally that amassed $29 billion as traders weigh the impression of the US financial occasions and uncertainty surrounding commerce tariffs, inflation, and financial coverage.

Bitcoin Takes the Biggest Hit While Altcoins Rally

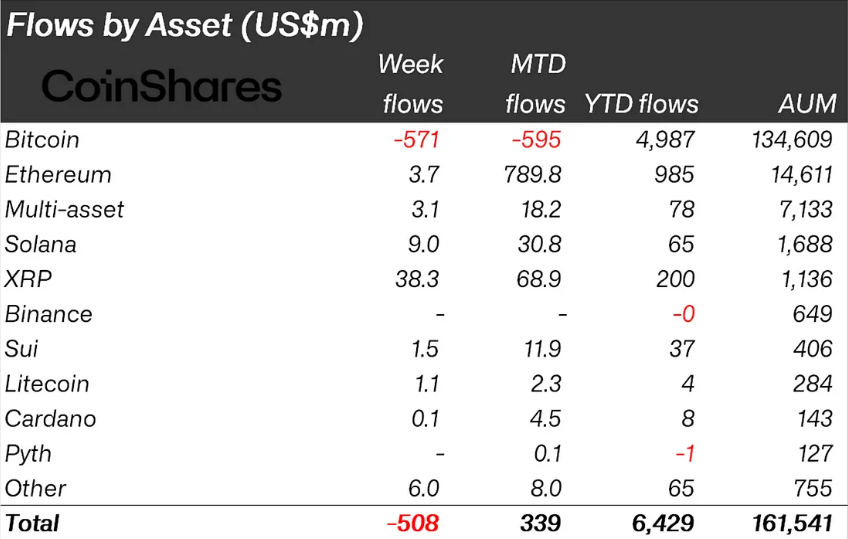

The newest CoinShares report signifies that Bitcoin (BTC) bore the brunt of investor warning, seeing outflows of $571 million. Further, some merchants opted to extend quick positions, resulting in $2.8 million in inflows for short-Bitcoin merchandise.

This follows the same development from the earlier week, when hawkish rhetoric from the Federal Reserve and CPI knowledge contributed to the first crypto outflows of 2025. According to CoinShares, the newest stream of outflows comes amid heightened warning as traders proceed to digest US financial knowledge.

“We believe investors are exercising caution following the US Presidential inauguration and the consequent uncertainty around Trump’s trade tariffs, inflation, and monetary policy. This is also evident in trading turnover, which has fallen considerably from $22 billion 2 weeks ago to $13 billion last week,” an excerpt within the report read.

Regionally, the US accounted for a lot of the outflows, dropping $560 million, accentuating issues concerning the nation’s financial insurance policies.

Interestingly, nonetheless, whereas Bitcoin struggled, altcoins continued to see constructive momentum. XRP led the way in which with $38.3 million in inflows, bringing its complete since mid-November 2025 to $819 million.

XRP’s robust efficiency comes amid rising anticipation of a US SEC (Securities and Exchange Commission) resolution on an XRP ETF. The deadline for the SEC to approve or reject sure ETF purposes has begun. Investors stay hopeful that XRP will achieve regulatory readability.

If accepted, an XRP ETF may drive additional institutional funding, reinforcing the altcoin’s resilience amid broader market uncertainty. However, XRP’s surge displays rising investor optimism that the US SEC could drop its lawsuit against Ripple.

Recent developments, together with the SEC’s acknowledgment of Bitwise’s XRP ETF application and the launch of an XRP ETF in Brazil via Hashdex, fuel speculation further.

Other altcoins additionally noticed inflows, with Solana attracting $9 million, Ethereum gaining $3.7 million, and Sui receiving $1.5 million. This suggests a possible shift in investor focus from Bitcoin’s digital gold narrative in direction of altcoins with stronger technical fundamentals and progress potential.

Meanwhile,this skittish market sentiment might be additional influenced by upcoming US financial knowledge this week. As BeInCrypto reported, Thursday’s GDP and Friday’s PCE inflation data may present key insights into Federal Reserve coverage path.

As Bitcoin’s sensitivity to macroeconomic uncertainty amplifies, undesirable studies later within the week may exacerbate promoting stress. Altcoins seem like benefiting from speculative curiosity and potential diversification plays.

The divergence in investor sentiment between Bitcoin and altcoins suggests a possible shift in market construction, with some analysts already visualizing an altcoin season.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. However, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.