Although merchants are on edge because of the worth conduct of Bitcoin, some analysts suppose a breakout is simply across the nook.

Related Reading

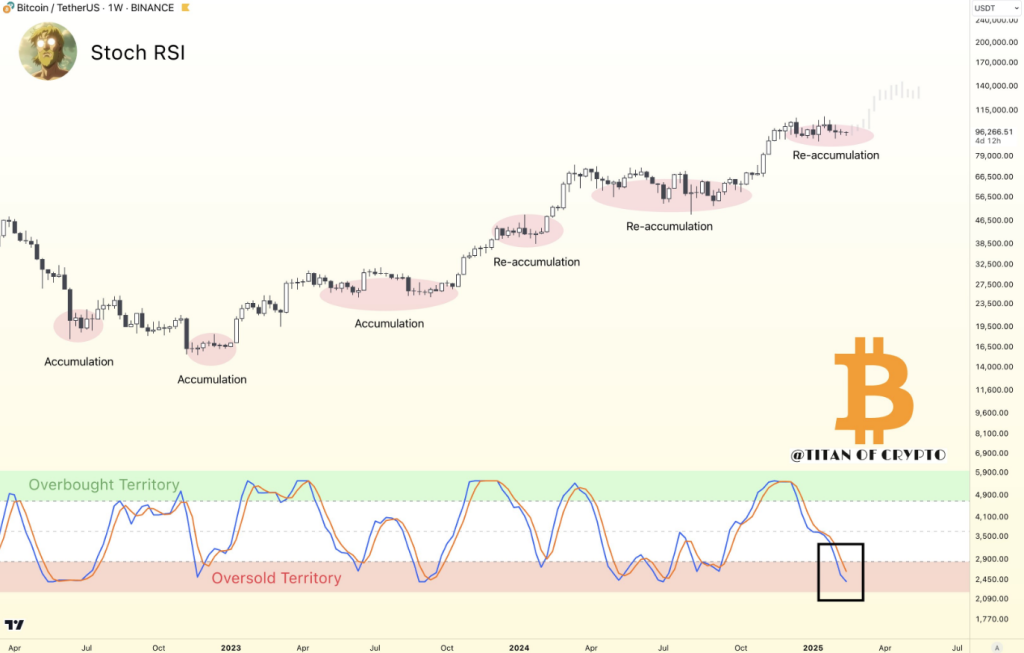

One of the vocal supporters of Bitcoin is “Titan of Crypto,” who means that Bitcoin’s stochastic relative power index (StochRSI) is about to sign a serious transfer. Could BTC be about to begin a recent climb as institutional curiosity grows and technical indicators line up?

Bitcoin: Strong Reversal From StochRSI Signals

Titan of Crypto claims that the weekly StochRSI of Bitcoin is in oversold zone, a state of affairs that has all the time preceded notable constructive reversals. Measuring momentum, this indicator factors to BTC perhaps getting ready for a push larger. The analyst stated:

“Bitcoin could be ‘about to take off.’”

The prime crypto is presently buying and selling round $96,910, marking a 1.36% improve from the earlier session. Showing indications of accelerating volatility, the intraday vary has various from $95,400 to $97,300. Should the StochRSI pattern comply with, BTC may bounce again to larger ranges.

#Bitcoin About to Take Off? 🚀#BTC has entered oversold territory on the weekly Stoch RSI, a sign usually marking accumulation or re-accumulation. pic.twitter.com/DHyEKXT31E

— Titan of Crypto (@Washigorira) February 19, 2025

Institutional Demand Still Remains Strong

Institutional engagement is among the principal parts displaying nice promise for Bitcoin. Well-known for its aggressive acquisition of the crypto, Strategy (beforehand MicroStrategy) has revealed intentions to buy extra Bitcoin by way of $2 billion raised through convertible notes. This motion underscores mounting perception within the long-term worth proposition of Bitcoin.

Bitcoin ETFs, with complete belongings amounting to $120 billion, have garnered substantial inflows. Due to the recognition of those funding merchandise, which has strengthened their standing within the monetary markets, organisations now have simpler entry to essentially the most extensively utilized digital asset globally.

BTCUSD buying and selling at $96,980 on the 24-hour chart: TradingView.com

Market Contradictions Raise Questions

Despite hopeful indicators, not everybody thinks Bitcoin will increase quickly. Crypto shares underperform typical shares, say some consultants. BTC stays beneath its January peak, suggesting market uncertainty regardless of the S&P 500’s highs.

Recent Bitcoin worth swings point out investor uncertainty. Despite constructive macro indications, bitcoin has stalled, sparking some reservations concerning its subsequent trajectory.

Related Reading

Bitcoin’s Next Move: Breakout Or Consolidation?

Bitcoin’s future continues to be hotly debated given institutional buyers’ ongoing curiosity and technical indicators pointing to a possible breakout. Should earlier developments maintain, the market could be about to expertise a rare climb. Macroeconomic occasions and investor temper will finally, nevertheless, determine whether or not BTC can keep a breakout or preserve buying and selling sideways.

Right now, everybody’s centered on the subsequent technical affirmation for Bitcoin. Will the bulls take over, or will doubt assist to regulate costs? For the largest cryptocurrency on the earth, the subsequent weeks might be essential.

Featured picture from Gemini Imagen, chart from TradingView