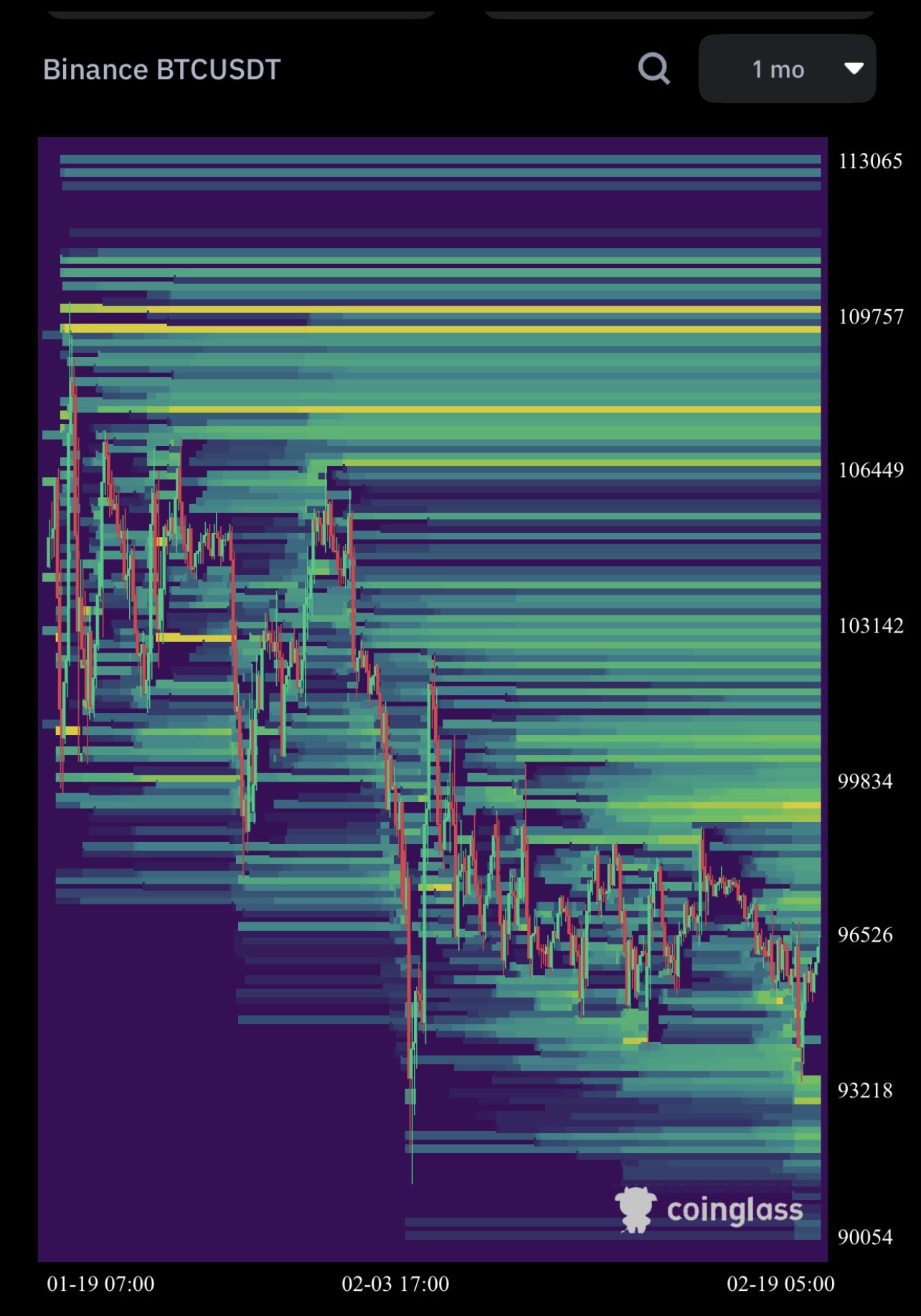

While the Bitcoin worth is hovering beneath the essential resistance at $96,500, the liquidation heatmap on Binance’s BTC/USDT pair is sending highly effective alerts of a possible quick squeeze to the upside. Analyst Kevin (@Kev_Capital_TA) shared his insights alongside the hooked up liquidation heatmap, noting indicators of serious liquidity swimming pools forming each above and beneath Bitcoin’s present buying and selling vary.

“What we’re seeing over the last couple of days is lining up perfectly with what I have been saying,” Kevin defined, referencing his earlier market calls. “Sweep liquidity towards 91K which we did yesterday. Maybe we take more maybe we don’t but overall I have never seen this much liquidity to the upside on the monthly time frame on #BTC.”

According to Kevin, the info strongly suggests that enormous liquidity—the place merchants’ positions can be pressured to liquidate—is now stacked across the 91K area and, extra crucially, close to the 111K mark. While the decrease zone may nonetheless see occasional sweeps, it’s the huge cluster of liquidity round 111K that has prompted him to forecast a possible transfer to that degree.

Related Reading

“There is more emotions in this market right then I have ever seen,”he continued. “Gurus are quitting X, Youtubers aren’t streaming or making content anymore, The comments are hateful and insulting every single day […] Meanwhile over here we are staying measured and calculated.”

Kevin emphasizes that many market members are fixated on altcoins somewhat than monitoring Bitcoin’s liquidity construction, general market capitalization, and USDT dominance. He argues that merchants’ slender deal with particular person altcoins, somewhat than these broader metrics, is inflicting them to overlook vital alerts.

“The problem is everyone is hyper focused on the wrong thing and that is #Altcoins charts,”he stated. “I’m literally giving you the playbook. Follow it.”

What The Bitcoin Liquidation Heatmap Tells Us

A liquidation heatmap illustrates the place massive batches of leveraged positions—equivalent to futures or margin trades—are most certainly to be force-closed if the worth reaches sure ranges. When many merchants place stop-losses or preserve closely margined trades round comparable worth factors, these zones typically accumulate as “hot spots” on the heatmap. If worth motion nears these clusters, it might set off a series response: pressured liquidations drive additional worth motion, which might then cascade right into a quicker squeeze or sell-off.

Related Reading

In Kevin’s view, Bitcoin’s heatmap presently reveals billions of {dollars} in potential liquidations concentrated at greater ranges (111K) and a major liquidity block beneath (round 91K). The presence of this deep liquidity on the upside has led Kevin to anticipate a “bigger relief rally” which may power out quick positions en masse.

“Now as we can see […] we have billions in liquidity to the upside at 111K. More than I have ever seen on the 1M time frame,” he remarked, emphasizing how uncommon he finds this month-long focus. “It would be totally fine and preferable if we swiped [the 91K area] first to build up even more liquidity to then start the real relief rally.”

Alongside liquidity knowledge, Kevin additionally cites sentiment indicators such because the Fear & Greed Index, presently reflecting a “fear” studying. From his standpoint, this setting means that the market’s emotional extremes—coupled with heavy positioning—may very well be setting the stage for a swift momentum shift greater, as unfavourable sentiment typically accompanies native bottoms.

“You can tell this relief rally wants to get going but it’s just not totally there yet […] I see no reason to be overly bearish on this market. You guys need to calm down and stop being so angry. Stop being so soft.”

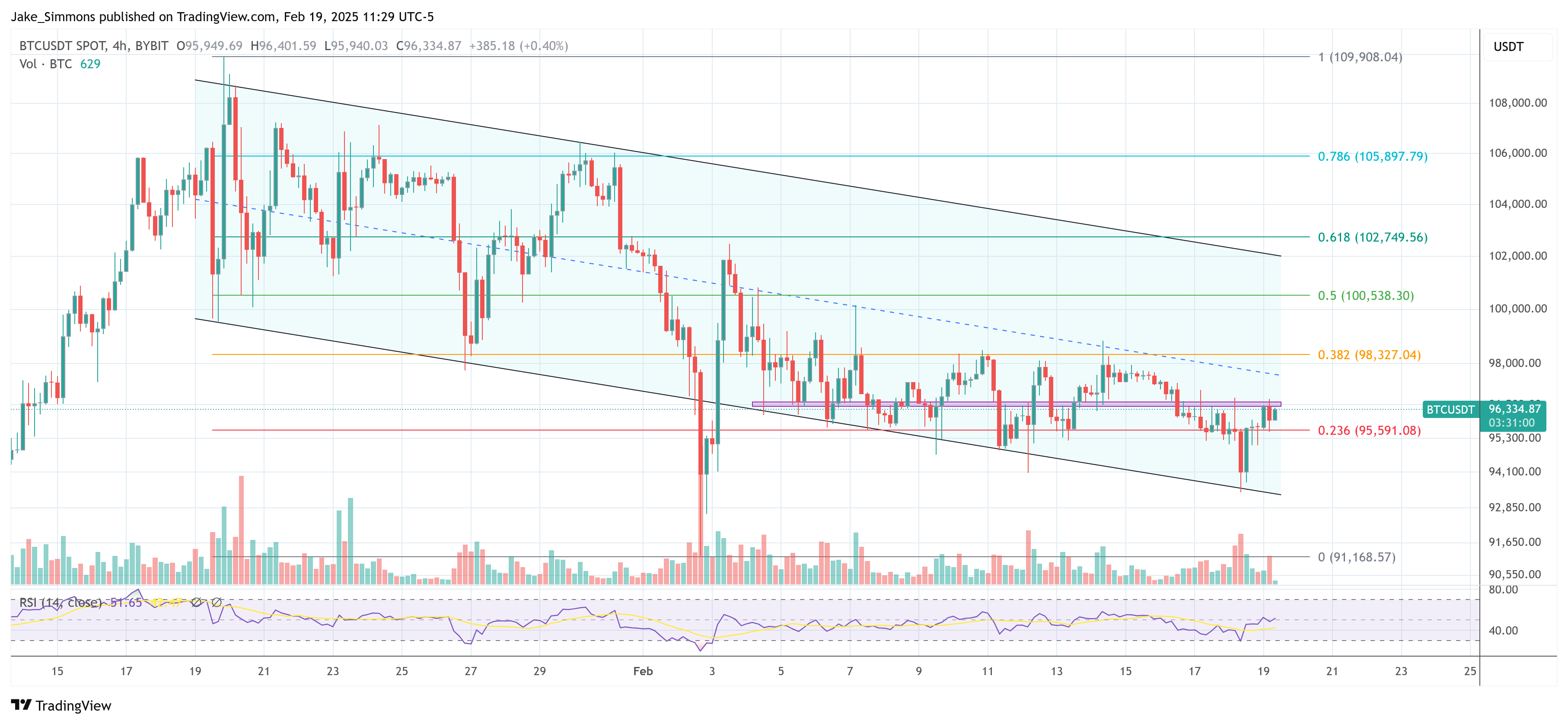

At press time, BTC traded at $96,334.

Featured picture created with DALL.E, chart from TradingView.com