In a weekend trade on X, Elon Musk was nudged to increase his cost-cutting Department of Government Efficiency (DOGE) to some of the closely guarded websites within the United States: Fort Knox, the US Army set up famously mentioned to carry 4,580 tons of gold. The dialogue, which drew in voices starting from the Bitcoin neighborhood to sitting lawmakers, has reignited decades-old questions concerning the transparency and precise contents of America’s gold vault.

Musk Sparks The Conversation

It all started when monetary information aggregator Zerohedge (@zerohedge) tagged Musk, suggesting, “It would be great if @elonmusk could take a look inside Fort Knox just to make sure the 4,580 tons of US gold is there. Last time anyone looked was 50 years ago in 1974.”

The tweet, considered by 1.9 million customers and preferred over 59,000 instances, prompted Musk to ask: “Surely it’s reviewed at least every year?” Zerohedge promptly replied: “It should be. It isn’t.”

From there, the net neighborhood swelled with reactions, hypothesis, and solutions. Questions concerning the final complete audit of the Fort Knox depository have resurfaced, together with persistent rumors that the stash has been bought off or in any other case depleted.

Not lengthy after, Sen. Rand Paul (R-Ky.), 62, joined the dialog with a succinct endorsement of a proper inspection, remarking: “Nope. Let’s do it,” in response to Musk’s musings. Paul’s father, former Rep. Ron Paul (R-Texas), has an extended historical past of calling for higher transparency across the United States’ gold reserves. Back within the Seventies, Ron Paul famously raised considerations that the gold won’t be as safe—or as plentiful—as lengthy believed.

The most up-to-date recognized visits to Fort Knox look like in 1974, when journalists and members of Congress have been permitted to step inside, and 2017, when the power briefly opened its doorways to former Treasury Secretary Steve Mnuchin. Even so, there isn’t any publicly accessible document of a full, complete audit in latest a long time, fueling conspiracy theories that the gold will not be in Fort Knox in any respect.

Estimates counsel that if the vault does certainly maintain 4,580 tons of gold, it will be price roughly $425 billion at present market charges.

Implications For Bitcoin

The spark of skepticism round Fort Knox’s holdings shortly fed into a bigger dialog about Bitcoin’s verifiability. Nate Geraci, President of the ETF Store and Co-Founder of the ETF Institute, remarked how BTC may get rid of doubts over possession. “If only there were a technological solution that would allow anyone to independently verify ownership of an asset,” Geraci mentioned, including, “Btw, if for whatever reason Ft Knox doesn’t actually have the gold… It’s absolutely game on for btc. IMO, the gold is there. But at least now everyone might fully appreciate real-time & foolproof verification of asset ownership.”

Others echoed that sentiment. Dennis Porter, CEO and founding father of Satoshi Act Fund, emphasized Bitcoin’s around-the-clock transparency: “Another reason why states (and the federal government) should prefer Bitcoin instead of gold. The public can audit government-bitcoin-holdings 24/7/365. The last extensive audit of our gold reserves happened… over 70 years ago.”

Meanwhile, US Senator Cynthia Lummis, a longtime Bitcoin advocate who serves because the Senate Banking Subcommittee Chair on Digital Assets below US President Donald Trump, underscored the need for a modernized strategy: “Bitcoin fixes this. A bitcoin reserve could be audited any time 24/7 with a basic computer. It’s time to upgrade our reserves.”

Some took the situation to imaginative extremes, predicting potential outcomes if a Fort Knox audit revealed considerably much less gold than is formally reported. Walker, host of THE Bitcoin Podcast, posted an in depth hypothetical chain of occasions, starting with an Elon Musk-inspired audit, adopted by a discovery that Fort Knox holds “less than 500 tons of gold.”

From there, he speculated an govt order could be issued by Trump to kind a Strategic Bitcoin Reserve, triggering worldwide competitors for Bitcoin whereas undermining gold’s market standing. By the top of Walker’s sweeping situation, “China and Russia realize Trump got the jump on them and start trying to acquire Bitcoin,” resulting in a collapse in gold’s worth relative to Bitcoin—whereas vocal gold proponent Peter Schiff turns into, as Walker put it, “admitted to a mental hospital.”

Here’s what’s going to occur:

1. Elon pushes Trump to audit Fort Knox.

2. Audit reveals there’s lower than 500 tons of gold.

3. Trump realizes China and Russia have far more gold than the U.S., however little or no Bitcoin.

4. Trump points EO for Strategic Bitcoin Reserve, citing… pic.twitter.com/hQrAk7vMj1— Walker⚡️ (@WalkerAmerica) February 16, 2025

Eric Balchunas, a Bloomberg ETF analyst, responded to Walker’s daring prophecy with measured skepticism, asking: “What a prediction. What % chance would you give of this actually happening?”

Whether these audits come to fruition stays unclear. As of this writing, there was no official affirmation from the US Treasury or the Department of Defense to open Fort Knox for a complete public overview. Still, a Fort Knox audit may have large implications for the gold value and in addition probably for the digital gold, Bitcoin.

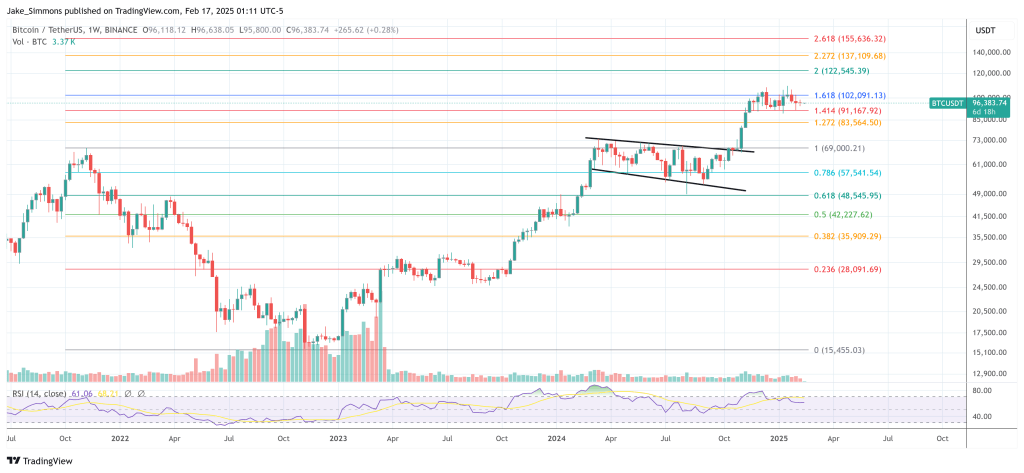

At press time, BTC traded at $96,383.

Featured picture created with DALL.E, chart from TradingView.com