Peter Brandt, a seasoned dealer, has dismissed optimistic predictions within the wake of Bitcoin’s current improve to $97,000+.

His newest technical evaluation signifies that probably the most outstanding cryptocurrency might encounter issue in surpassing the coveted $200,000 threshold previous to 2030.

Bitcoin has demonstrated a blended efficiency, with a every day achieve of 0.17% and a 2.85% decline over the course of the week, prompting the forecast.

Related Reading

The Protracted Path To Six Figures

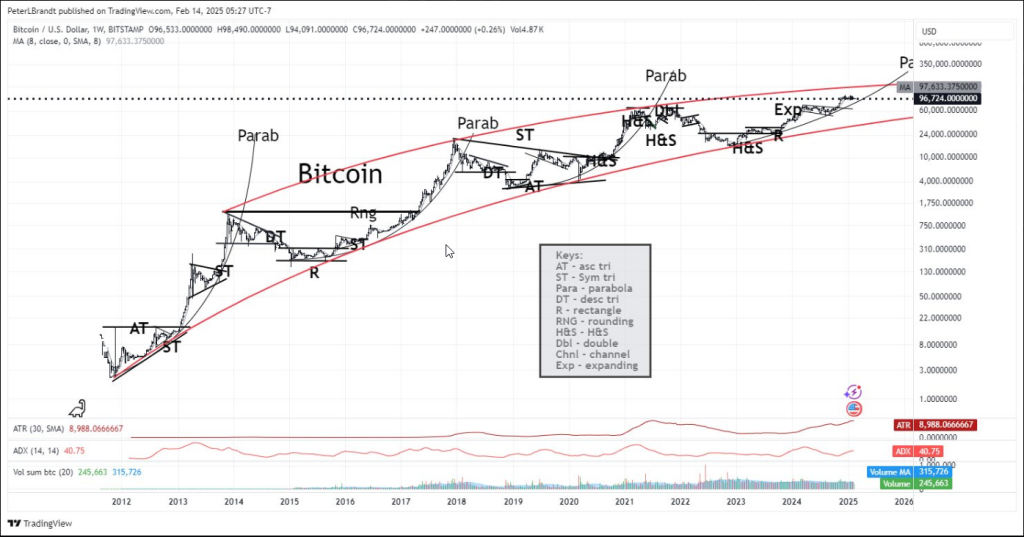

Bitcoin will face important challenges in breaching the psychological barrier of $100,000. The 8-week transferring common of $97,633, which has constantly rejected upward actions, presents the cryptocurrency with important resistance.

From the world of loopy concepts comes this thought – a thought, not a commerce

Unless Bitcoin has escape velocity by means of higher parabolic resistance line it’s impossible that BTC can be buying and selling above $200k on the finish of this decade. Only☑️can reply. No curiosity in non- ☑️replies pic.twitter.com/7a5N7Gliw8— Peter Brandt (@PeterLBrandt) February 14, 2025

The Average True Range (ATR) of 8,988 and the Average Directional Index (ADI) of 40.75, which each help a powerful pattern, present elevated volatility within the present market circumstances.

Historical Patterns Paint A Cautionary Tale

Since 2012, Bitcoin has developed a particular sample that has captured the curiosity of technical consultants. Within a crimson rising channel, the cryptocurrency has been bouncing between two essential trendlines that function worth limitations.

Particularly intriguing is Bitcoin’s tendency towards each sharp corrections and parabolic actions. Market veterans have raised their antennae as a result of placing similarities between the current rally and these earlier cycles.

Trading Volume Raises Red Flags

The numbers inform an attention-grabbing story about how folks take part available in the market. There is an opportunity that the present rally isn’t secure as a result of Bitcoin’s 20-period quantity complete of 245,600 is low in comparison with different breakout phases.

Maintaining a long-term upward pattern may very well be difficult within the absence of a notable improve in commerce quantity. For analysts watching Bitcoin’s subsequent main transfer, this weak quantity has been a rising concern.

Related Reading

Support And Resistance: The Drawing Of Battle Lines

The way forward for Bitcoin is contingent upon important worth ranges that would decide its destiny. Strong help is current within the $60,000 to $70,000 vary, whereas a stable resistance zone looms between $100,000 and $120,000.

If the scenario worsens, Bitcoin might revisit the decrease boundary of its long-term channel, which is roughly $40,000 to $50,000.

Brandt’s evaluation signifies that Bitcoin’s trajectory to $200,000 by 2030 is doubtful within the absence of a big break above the higher boundary of its parabolic trajectory.

The veteran dealer underscores the need of sustained momentum and the flexibility to surpass important resistance ranges with the intention to obtain such elevated valuations.

Featured picture from Pixabay, chart from TradingView