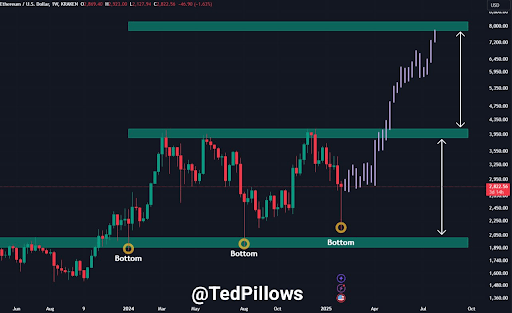

Ethereum’s price action in the previous seven days has led to the creation of a capitulation candle that may ship it on one other surge within the next eight to twelve weeks. This capitulation candle caught the eye of crypto analyst Ted Pillows, who famous an attention-grabbing repeating capitulation sample for Ethereum.

According to technical evaluation by Ted Pillows, Ethereum has printed a capitulation candle in early 2025, simply because it did within the first quarter of 2024 and the third quarter of 2023.

Capitulation Candles And Ethereum Historical Patterns

TedPillows’ analysis highlights that the Ethereum worth has undergone three main capitulation occasions previously two years, all of which led to substantial worth rebounds. Particularly, these capitulations have taken place within the weekly candlestick timeframe, the place the Ethereum worth witnessed intense promoting strain all through the week. However, historic worth playout exhibits that these capitulations have typically marked the underside earlier than a large worth rally.

Related Reading

The first of such capitulations occurred in Q1 2024 and ultimately led to a 100% rally over the subsequent three months, with the Ethereum worth reaching $3,950. The second capitulation came about in Q3 2024, resulting in the same upswing. With Ethereum now experiencing one other capitulation second in early 2025, the analyst means that the sample is about to repeat. He believes that Ethereum is as soon as once more forming a market backside, setting the stage for an aggressive upward move.

Ethereum’s 100% Price Surge And Potential Peak

If Ethereum follows its earlier trajectory, the subsequent eight to 12 weeks might convey a major worth enhance, even because the main altcoin presently struggles round $2,700. A 90%-100% pump after the latest capitulation would push the Ethereum worth past key resistance levels and above its present all-time excessive.

Related Reading

TedPillows’ evaluation means that Ethereum’s final worth goal following this capitulation might attain as excessive as $8,000. However, it’s prone to encounter vital resistance close to $3,950, a stage that has traditionally triggered rejections in previous capitulation cycles. Should Ethereum wrestle to interrupt by means of this barrier once more, a short lived pullback may very well be on the horizon earlier than any sustained transfer increased.

Meanwhile, Spot Ethereum ETFs are attracting heavy inflows despite Ethereum’s price downturn. Institutional traders look like capitalizing on the dip and growing their ETH holdings in anticipation of a broader market rebound.

Spot Ethereum ETFs have recorded $513.8 million in inflows within the final six buying and selling days, with BlackRock main the cost by buying $424.1 million value of ETH. This regular accumulation from institutional holders suggests rising confidence in Ethereum’s long-term potential and will lay the inspiration for the projected 100% surge within the subsequent eight to 12 months.

At the time of writing, Ethereum is buying and selling at $2,725, down by 4% previously 24 hours.

Featured picture from Unsplash, chart from Tradingview.com