Following such a historic run previously two years, it was solely a matter of time earlier than the projections for a Bitcoin bear market took over crypto discussions. Several pundits and consultants have shared after they assume the digital asset market will attain its cycle high and doubtless witness a reversal.(*90*)

While the gang remains to be pretty optimistic concerning the potential of assorted cryptocurrencies, the market shifting in the wrong way gained’t come as a shock. A preferred crypto dealer on the social media platform has echoed the same sentiment, offering a potential timing for the arrival of the crypto bear market.(*90*)

Why The Bear Market Could Begin In April

In a Jan. 25 publish on the X platform, outstanding crypto analyst Ali Martinez shared his “unpopular opinion” concerning the present Bitcoin bull cycle and its potential finish. According to the pundit, the bear market may start in roughly three months.(*90*)

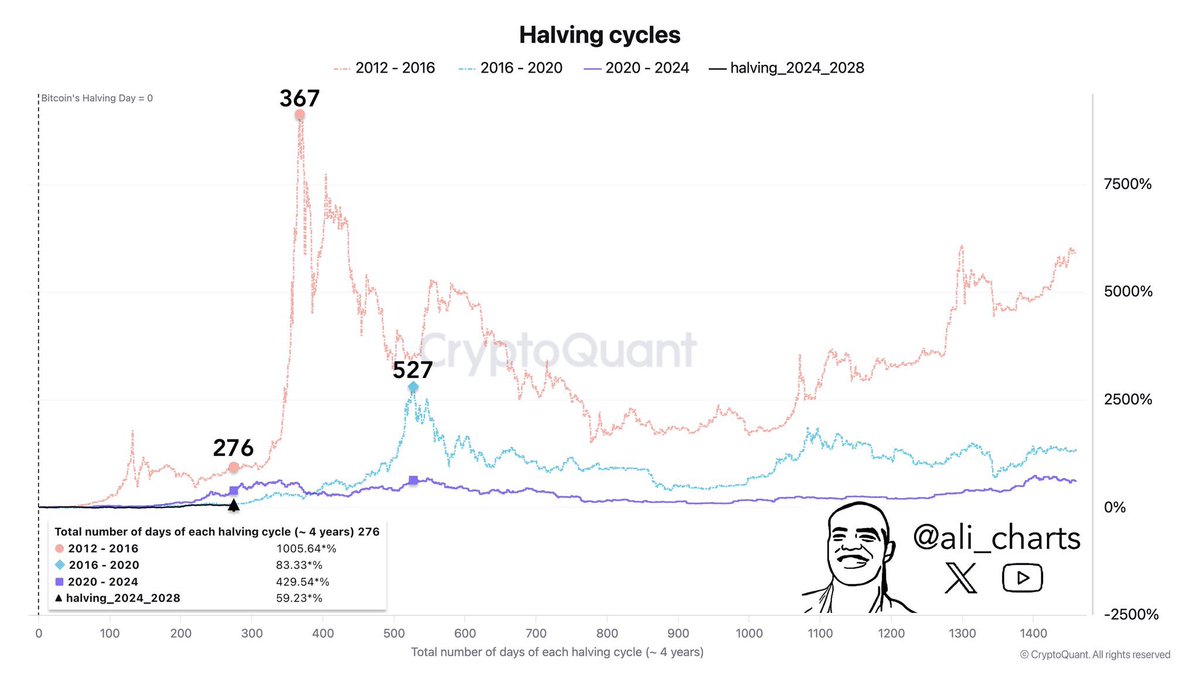

The reasoning behind this projection is the historic value efficiency of Bitcoin throughout completely different halving cycles. The Bitcoin halving, an occasion that happens roughly each 4 years, tightens Bitcoin’s provide by slashing the mining reward by half.(*90*)

As seen in 2024 — the newest halving 12 months, the halving occasion has traditionally been a precursor to substantial value progress. However, post-halving rallies are usually adopted by important profit-taking, resulting in market consolidation and a bear market.(*90*)

Source: Ali_charts/X

From a historic standpoint, roughly 276 days after the halving occasion have confirmed to be pivotal within the trajectory of the Bitcoin market. Specifically, the Bitcoin value skilled important value progress after crossing the 276-day milestone within the 2012 -2016 halving cycle.(*90*)

However, the BTC market witnessed a shift in sentiment and a extreme market downturn 367 days following halving — 91 days after the 276-day milestone. If this historic sample holds, buyers may see the bear market start someday in late April.(*90*)

As of this writing, the worth of BTC sits simply beneath the $105,000 mark, reflecting no important motion previously day.(*90*)

Retail Interest On The Rise?

While historic value knowledge is an efficient manner of analyzing a cycle’s trajectory, on-chain knowledge is one other methodology that sheds mild on cyclical value actions. One such knowledge is the retail interest in Bitcoin, which measures the demand of small-scale buyers within the premier cryptocurrency.(*90*)

Related Reading: MicroStrategy May Face Tax Issues Over $19 Billion Unrealized Bitcoin Gains: Report(*90*)

Typically, demand from retail buyers is commonly correlated with the height euphoria section. “Looking at past cycles, the last two major spikes in searches for “how to buy crypto” occurred when BTC was round $65,000 in May 2021 and $69,000 in November 2021—proper on the market high,” Martinez stated in a separate publish on X.(*90*)

Source: Ali_charts/X

As proven within the chart above, the “interest over time” indicator appears to be choosing up once more in 2025. This could possibly be a sign of an impending high for the crypto market.(*90*)

(*90*)

The value of Bitcoin on the every day timeframe | Source: BTCUSDT chart on TradingView

(*90*)

Featured picture from iStock, chart from TradingView(*90*)