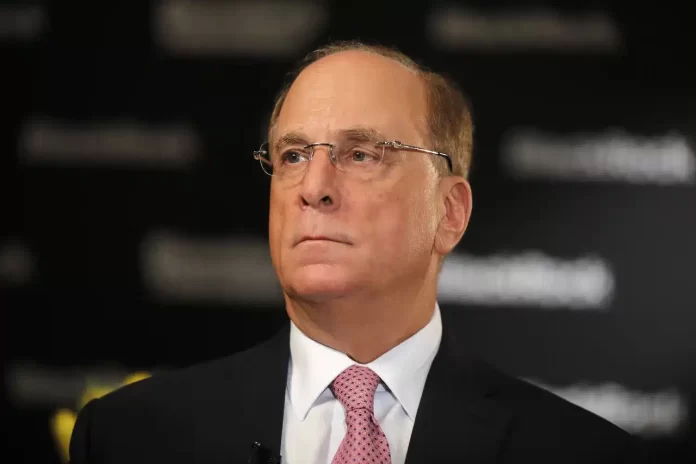

BlackRock’s CEO Larry Fink predicts Bitcoin value might hit $700,000 if sovereign wealth funds assign 2-5% of their portfolios to digital forex. During his World Economic Forum dialogue in Davos Fink revealed talks with sovereign wealth fund managers about inserting 2% to five% of their cash into Bitcoin. He thinks investments from these funds will enormously enhance Bitcoin’s market worth.

BlackRock CEO Larry Fink Predicts BTC Price To $700K With Sovereign Fund Support

BlackRock CEO Larry Fink recounted discussions he’d had with a sovereign wealth fund managers throughout a panel at World Economic Forum. The conversations surrounded 2% to five% of their investments in Bitcoin and its potential influence. According to Fink, such strikes might set off Bitcoin value to $500,000, $600,000 and even $700,000.

Fink emphasised Bitcoin’s utility as a hedge in opposition to financial and political instability. He identified that Bitcoin presents an internationally acknowledged instrument for traders looking for options to guard in opposition to native forex geopolitical uncertainties.

Larry Fink added,

“If you’re frightened about debasement or local political instability, you have an international instrument called Bitcoin to overcome those fears. I was with a sovereign-wealth fund during this week, and there was a conversation: Should we have a 2% allocation? Should we have a 5% allocation? If everybody adopted that conversation, it would be $500,000, $600,000, $700,000 for Bitcoin.”

Larry Fink’s predictions align with Bitcoin’s ongoing bullish momentum, because the cryptocurrency eyes recent all-time highs. As Bitcoin consolidates close to $106K, a breakout above this resistance might pave the best way for additional positive aspects.

Transition From Skepticism to Cryptocurrency Advocacy

The BlackRock CEO’s latest remarks mirror a shift in his stance on cryptocurrencies. In 2018, Fink dismissed the concept BlackRock’s shoppers had been enthusiastic about digital property. However, in recent times, BlackRock has embraced cryptocurrency, launching iShares Bitcoin and Ethereum Trusts to supply institutional traders entry to the digital asset market.

The iShares Bitcoin Trust lets traders take part in Bitcoin’s market worth since its starting in 2024. After its launch BlackRock’s iShares Bitcoin Trust (IBIT) exceeded all expectations by rising to $50 billion in property in simply 11 months of operation. IBIT broke several records together with turning into probably the most quickly increasing ETF ever.

This progress highlights sturdy investor curiosity, pushed by IBIT’s dominance in day by day buying and selling quantity, accounting for over 50% of U.S. Bitcoin ETF exercise.

Bitcoin Price Trends and Volatility

At press time, Bitcoin was buying and selling at $104,898, barely under its latest excessive of $109,225. Despite Fink’s optimism, he cautioned that he was not selling Bitcoin however merely discussing its potential. Cryptocurrencies are recognized for his or her volatility, with Bitcoin experiencing sharp pullbacks even throughout market uptrends.

Market analysts have famous BTC increasing dominance within the crypto market, an element that always indicators value motion. If sovereign wealth funds and different institutional gamers undertake Fink’s steered allocation, Bitcoin worth might surge.

Disclaimer: The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.