The Bitcoin value has been considerably quiet since hitting its all-time high of $108,135, struggling to carry a six-figure valuation for lengthy. Case in level — the premier cryptocurrency barely lasted a day above $100,000 earlier than crashing to below $92,000 previously week.

This sluggish value motion has triggered discussions in regards to the chance of a prime being in and the Bitcoin bull market being over. However, the most recent on-chain commentary means that the flagship cryptocurrency may nonetheless have room for additional upward value motion.

What’s The Current Bitcoin Short-Term Holders Cost Basis?

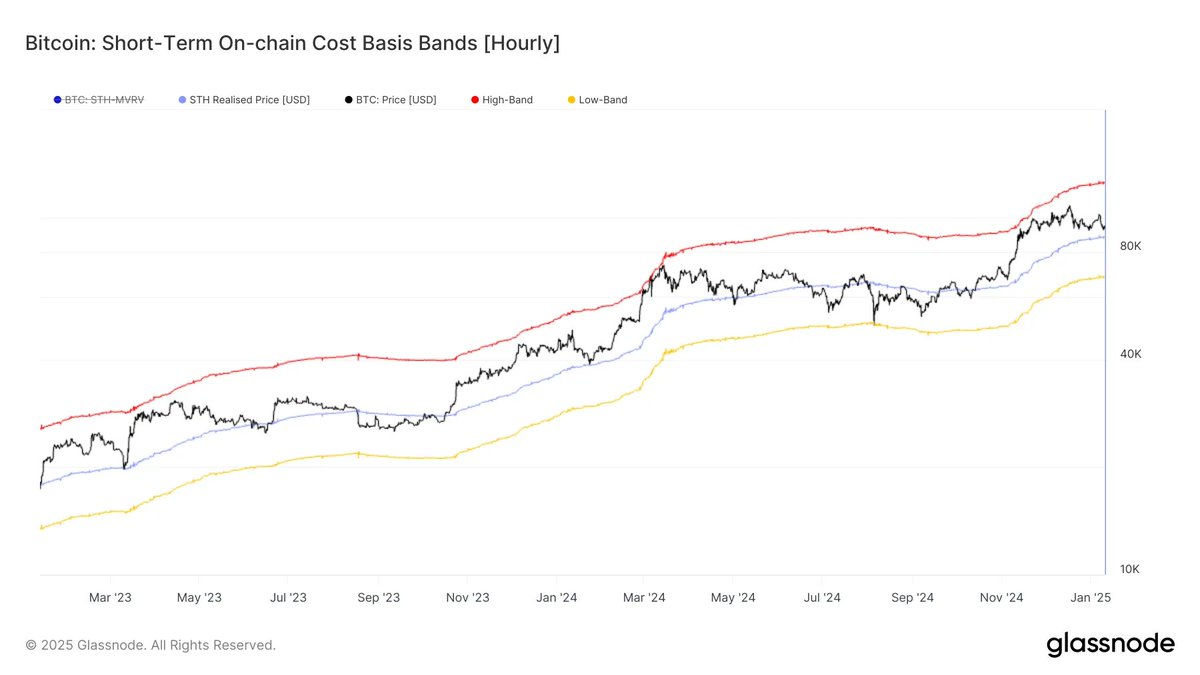

In its newest put up on the X platform, blockchain analytics agency Glassnode revealed that the Bitcoin bull market won’t be over simply but. This on-chain commentary is predicated on the motion of the BTC value in relation to the short-term holders (STH) price foundation.

Related Reading

The STH cost-basis metric tracks the typical value at which short-term holders (buyers who’ve held Bitcoin for lower than 155 days) bought their cash. It represents a psychological degree for BTC buyers and will function a technical level for analyzing costs, particularly throughout bull cycles.

Typically, the worth of Bitcoin floats above the STH price foundation throughout bull markets, indicating vital shopping for curiosity and optimistic sentiment from short-term merchants. Conversely, when the BTC value falls beneath this degree — as usually seen in bear markets, which means that newer buyers are within the crimson, resulting in substantial promoting strain.

According to knowledge from Glassnode, Bitcoin’s value is roughly 7% above the STH price foundation, which at present stands at round $88,135. While the premier cryptocurrency is just a little nearer to the price foundation, the inkling remains to be that short-term holders are much less more likely to offload their property.

If the worth of Bitcoin manages to maintain above the STH price foundation, it means the potential continuation of the present bull market. On the flip facet, a transfer beneath $88,000 may set the stage for a pattern reversal, with the market shifting from a bull to a bear section.

As of this writing, the price of BTC sits simply above $94,000, reflecting barely a 1% enhance previously 24 hours. According to knowledge from CoinGecko, the flagship cryptocurrency is down by greater than 3% within the final seven days.

Is A Market Rebound Imminent?

The crypto market has been in horrible kind over the previous week, with a number of large-cap property dipping by double digits. Unsurprisingly, many crypto merchants have indicated curiosity in offloading their property on numerous social media platforms.

Related Reading

However, this shift in investor sentiment will increase the chances of a market restoration, as costs have a tendency to maneuver within the crowd’s other way. On-chain intelligence agency Santiment famous in a post on X that this was the case within the rally witnessed in 2024 This fall, as increased costs adopted elevated bearish mentions.

Featured picture from iStock, chart from TradingView