Bitcoin’s current worth fluctuations have left traders in a state of uncertainty, because the cryptocurrency has seen a dramatic decline from its peak of almost $107,000 to round $94,550. This volatility raises important questions in regards to the capability of Bitcoin to keep up its rally and whether or not it could actually regain its footing within the coming weeks.

Related Reading

Critical Support Levels Under Threat

CryptoQuant analyst Shayan has had one thing vital to say about present circumstances in Bitcoins. According to him, the worth is attempting to stabilize proper above the worth of $92,000 degree, which he additional says is a key assist.

He notes that Bitcoin is stabilizing close to the $92,000 mark, which he identifies as a essential assist zone. If Bitcoin breaks under this degree, it might set off a wave of lengthy liquidations and push costs down towards the 100-day transferring common of $81,000. Also, this line has been performing as a actual dynamic assist by attracting shopping for inflows and also can cushion costs throughout additional descent.

Shayan underlines the position of market sentiment and technical indicators. At current, Bitcoin is fluctuating at important assist ranges that are created within the $90K degree and Fibonacci retracement ranges at $87K and $82K. If the above-mentioned ranges don’t maintain, there may very well be additional promoting strain with corrections.

Bitcoin Bullish Outlook Despite Bearish Fears

Amidst this uncertainty, famend cryptocurrency analyst Crypto Rover has expressed a bullish outlook for Bitcoin. He just lately in contrast in the present day’s worth motion with historic patterns, suggesting that January might see constructive developments for Bitcoin.

#Bitcoin historical past is strictly repeating.

January will flip inexperienced.

You’ll remorse not shopping for extra right here. pic.twitter.com/DCssLNMGh6

— Crypto Rover (@rovercrc) January 8, 2025

In a tweet, he acknowledged, “Bitcoin history is exactly repeating. January will turn green. You’ll regret not buying more here.” His evaluation signifies that if Bitcoin can break by way of the essential resistance degree of $100,000, it might doubtlessly barrel previous $107,000.

Big Capital Inflows

Rover’s positivity is strengthened by the massive capital inflows in Bitcoin ETFs, which attracted greater than $900 million of inflows from establishments like BlackRock and Fidelity. Increasing institutional curiosity additionally alerts confidence within the long-term prospect of Bitcoin. However, he additionally cautions that failure to shut above the $100,000 mark will result in a pullback to $92,000 and even decrease.

The broader cryptocurrency market is feeling the pressure too. This decline is available in tandem with Bitcoin’s failure to remain afloat, and different cryptocurrencies akin to Ether and Solana have fallen by greater than 7%.

Related Reading

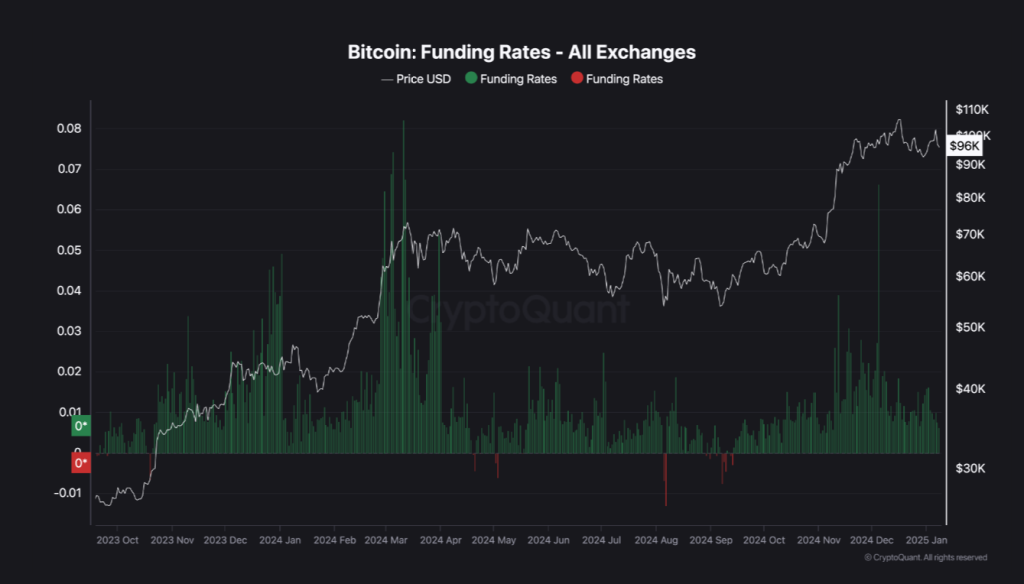

Even the normal shares of the crypto sector, akin to MicroStrategy and Coinbase, have been down sharply. Funding charges falling inside the derivatives market provides one more layer of bearish sentiment round Bitcoin. According to Shayan, the lowering funding charges had mirrored dipping demand for derivatives, which additionally performed a pivotal position in sustaining worth developments.

Featured picture from Pixabay, chart from TradingView