The second-largest crypto Ethereum noticed a pointy selloff of greater than 9% in the final 24 hours. ETH value tumbled to mid-November ranges of $3,300 as merchants took cues from strong US macroeconomic knowledge, which shot down the Fed charge minimize hopes.

Ethereum Price Led $700 Million in Net Crypto Liquidation

The broader crypto market and Bitcoin price saw major selloff, however ETH led the liquidation in the final 24 hours. Coinglass knowledge reveals greater than $152 million in ETH had been liquidated, with $132 million in lengthy positions. Whereas, BTC noticed $128 million in liquidation.

The total crypto liquidation reaches $710 million in the final 24 hours. Notably, 237,476 merchants had been liquidated and the most important liquidation occurred on leading crypto exchange Binance as somebody bought ETH valued at $17.74 million. This is one of the most important in Ethereum historical past.

Whales and Institutions Offload ETH Holdings

Multiple ETH promote transactions had been recorded over the past 24 hours as whales and institutional buyers pared their holdings. Ethereum value fell after buyers misplaced confidence about additional rally as JOLTS job openings and ISM Services PMI knowledge confirmed a powerful US financial system. This will trigger the U.S. Federal Reserve to delay its charge cuts this yr.

Whale Alert highlighted a 40,000 ETH switch price $140.44 million from Arbitrum to Binance. In addition, 18,172 ETH valued at $66 million transferred from Cumberland to Coinbase Institutional.

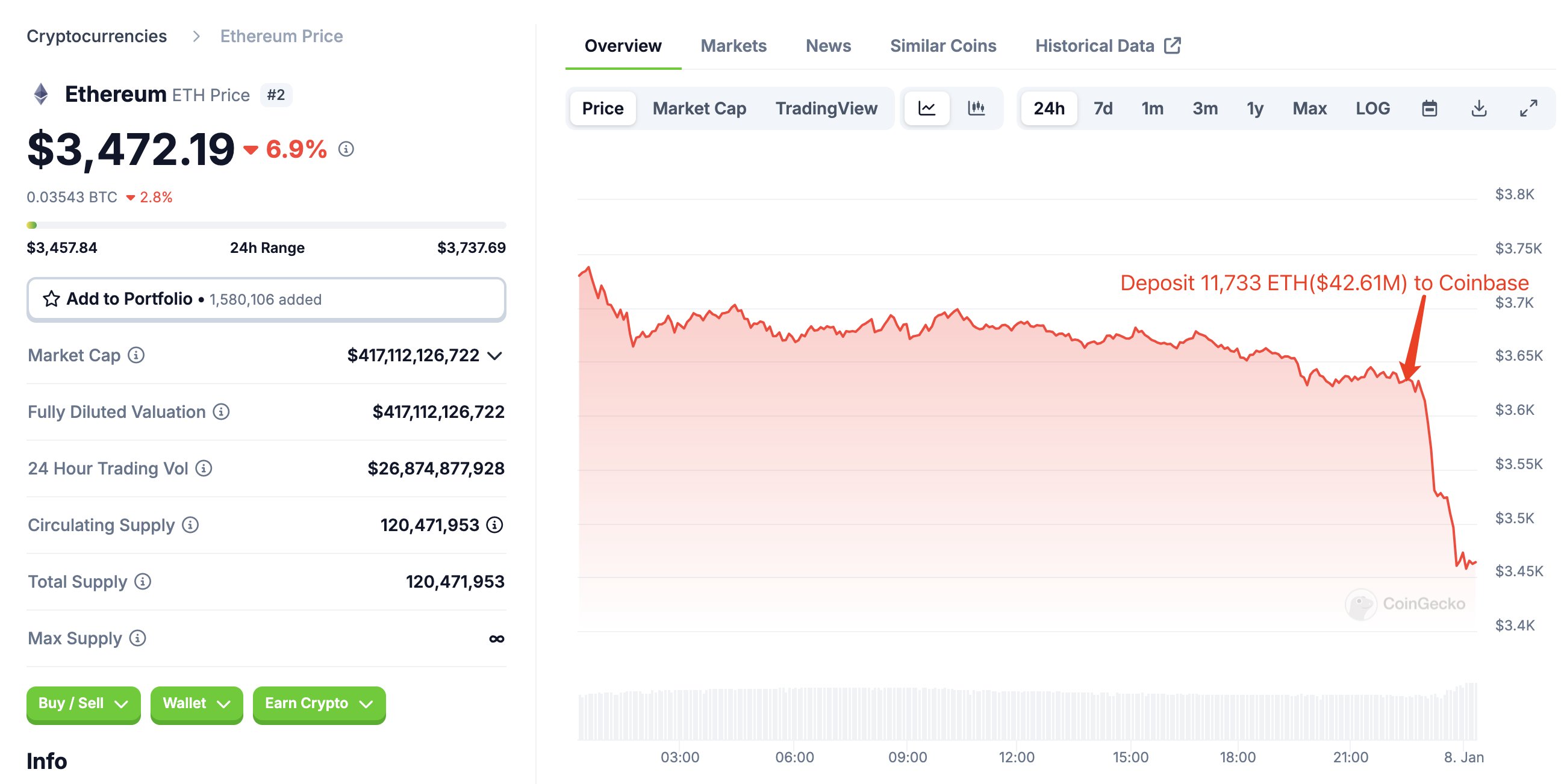

WisdomTree additionally deposited 11,733 ETH to Coinbase simply earlier than the crypto market crashed, reported Lookonchain.

Ethereum Foundation Makes First ETH Sale of 2025

The Ethereum Foundation simply made its first ETH sale of the yr. The basis has transferred 100 ETH, valued at $336K, for 329,463 DAI. The basis has bought practically $12.96 million in ETH in 2024, which has restricted the upside trajectory for Ethereum value.

Spot Ethereum ETFs Record Outflow

As institutional buyers misplaced confidence, spot Ethereum ETFs noticed a internet outflow of $86.8 million on Tuesday. Farside Investors data exhibits outflows primarily got here from Fidelity’s FETH, Grayscale’s ETHE and ETH mini exchange-traded fund. The ETF move is taken into account an indicator of power in an asset and buyers regulate it to know the present sentiment.

What’s Next for Ethereum Price

Ethereum value at the moment trades at $3,329 and there are not any indicators of restoration but. Experts have given $5000 and $10000 value targets for this yr.

ETH derivatives knowledge exhibits that open curiosity has dropped 7%. ETH Futures OI 9.04 million at the moment are valued at $30.33 billion. Whereas, Options OI has elevated as merchants rearrange calls and places.

Analyst IncomeSharks revealed fast scalp commerce on the decrease timeframe. He suggests on the lookout for a bounce after which closing lengthy. Meanwhile, one other analyst Crypto Tony stated “As long as we hold $3200 on the daily closure I remain in my long.”

Disclaimer: The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.