BlackRock’s iShares Bitcoin ETF (IBIT) recorded over $597 million in influx on Tuesday. The BlackRock Bitcoin ETF saves the day for the bleeding crypto market after buyers turned cautious with sturdy US JOLTS job openings and ISM Services PMI knowledge.

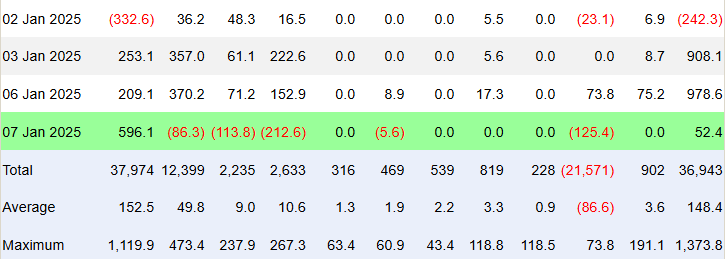

The spot Bitcoin ETF in the United States noticed a internet influx of $53.46. Bitcoin ETFs by Fidelity, Bitwise, Ark 21Shares, Franklin Templeton, and Grayscale recorded outflows.

BlackRock Bitcoin ETF Saw Inflow Despite Crypto Market Crash

BlackRock’s iShares Bitcoin ETF (IBIT) bought 6,078 BTC price $208.7 on January 7, whereas miners solely mined 450 new BTCs. IBIT recorded an influx of $597.18 million, as per Trader T knowledge.

This makes the third consecutive influx into IBIT regardless of a serious selloff in the crypto market. Notably, US Bitcoin ETF noticed an influx of $978.6 million on Monday, sparking optimism as the flagship crypto soared previous the $102K mark.

Meanwhile, Fidelity’s FBTC, Bitwise’s BITB, and Ark Invest’s ARKB noticed outflow of $86.29 million, $113.85 million, and $212.55 million, respectively. Also, Franklin EZBC noticed a $5.58 million in outflow.

Grayscale’s GBTC additionally witnessed an outflow of $125.45 million. Flows have been zero for Invesco, Valkyrie, VanEck, and Grayscale Mini.

According to Farside Investors, the complete internet influx for Bitcoin spot ETFs reached $52.4 million. The iShares Bitcoin Trust by BlackRock noticed a internet influx of $596.1 million. Whereas, different ETFs skilled various levels of outflow.

Bitcoin and Crypto Market Crash On Macro Concerns

According to the U.S. Bureau of Labor Statistics, the JOLTS jobs openings elevated by 259,000 to eight,098 million in November 2024, Also, ISM Services PMI got here in increased than anticipated, which reveals the resilience of the U.S. financial system at present. This prompted Bitcoin price to crash by greater than 5%.

In truth, the US greenback index (DXY) holds its advance above 108.50 at the moment, after a two-day low transfer that prompted a restoration in Bitcoin worth. Also, the 10-year US Treasury yield elevated to a 35-week excessive of 4.68%. The sturdy US financial knowledge diminished expectations for additional charge cuts by the Federal Reserve.

Whereas, BTC price continues to fall regardless of higher efficiency by BlackRock Bitcoin ETF. The worth at present trades at $96,259. The 24-hour high and low are $96,132 and $102,022, respectively. Furthermore, the buying and selling quantity has decreased by 23% in the final 24 hours.

Disclaimer: The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.