The world’s largest cryptocurrency could also be liable to a supply shock as demand from United States (US) Spot Bitcoin Exchange Traded Funds (ETFs) has surged far past expectations. In December 2024, the quantity of BTC acquired by way of Spot Bitcoin ETFs greater than tripled the quantity mined throughout that very same month, underscoring the extreme imbalance between provide and demand.

Spot Bitcoin ETFs Trigger Supply Shock Risks

In December 2024, US Spot Bitcoin ETFs purchased an astonishing 51,500 BTC. On the opposite hand, BTC miners produced solely 13,850 cash throughout the identical interval, in line with data from Blockchain.com. This signifies that Bitcoin ETFs alone bought almost 4 occasions the quantity BTC miners generated and equipped to the market that month.

Related Reading

According to reports, the demand for ETFs in December was nothing wanting extraordinary, exceeding the obtainable provide by roughly 272%. This large increase in demand for Spot Bitcoin ETFs has raised considerations a couple of potential BTC provide shock, with analysts suggesting that it might occur quickly.

Specifically, Lark Davis, a crypto analyst, announced earlier in December that “a massive supply shock is imminent.” The analyst primarily based this alarming forecast on the numerous accumulation of BTC from US Spot Bitcoin ETFs. Davis disclosed that in some unspecified time in the future in December, BTC ETFs had purchased 21,423 BTC; in the meantime, miners had produced solely 3,150 BTC across the identical time.

The analyst additionally noted that BTC ETFs globally held roughly 1,311,579 BTC as of December 17, 2024. This quantity, valued at $139 billion, accounts for six.24% of BTC’s whole provide of 19.8 million. Given this staggering determine, Davis initiatives that in peak bull market phases, Spot Bitcoin ETFs might maintain 10-20% of BTC’s total supply, elevating extra considerations a couple of main provide shock.

Concentration Of Spot BTC Inflows In December

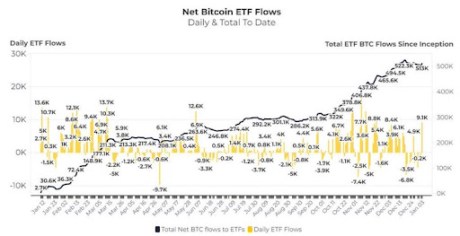

Data from Glassnode has revealed that Spot Bitcoin ETFs recorded a complete web influx of $4.63 billion in December, virtually doubling their 2024 month-to-month common of $2.77 billion. Notably, Glassnode disclosed that the surge in Spot Bitcoin ETF inflows was extra concentrated throughout the first half of the month, whereas the second half noticed outflows, with December 26 being the exception.

Related Reading

Not surprisingly, the timing for this surge and subsequent decline in Bitcoin ETF inflows aligns with BTC’s worth actions in December. At the start of the month, BTC skilled upward momentum, skyrocketing to a new ATH above $108,000 on December 17, fueled by the bull market hype and hovering demand. However, following this peak, BTC’s price saw a sharp decline, a drop that coincided with the timing of great outflows from Spot Bitcoin ETFs, as reported by Glassnode.

Despite the surge in demand for Spot Bitcoin ETFs in December, new data reveals that traders have prolonged their accumulation development into January 2025. On January 3, traders bought over $900 million value of BTC by way of Spot Bitcoin ETFs. More just lately, US Spot Bitcoin ETFs acquired an extra 9,500 BTC, value over $966 million on the present market worth.

Featured picture created with Dall.E, chart from Tradingview.com