The current dip in Bitcoin value has sparked issues amongst traders whereas triggering huge promoting stress within the broader crypto market. In addition, the current market developments additionally trace in the direction of an additional dip, with many predicting a possible slip to $80K and even under. Notably, this comes regardless of the sturdy institutional curiosity within the flagship crypto, as evidenced by the shopping for spree of MicroStrategy (MSTR) and others.

Why Is Bitcoin Price Falling Today?

Bitcoin value has recorded a pointy decline in the present day, sparking issues within the broader crypto market. A flurry of causes might have weighed on the traders’ sentiment lately, which has additionally triggered huge promoting stress within the digital property area.

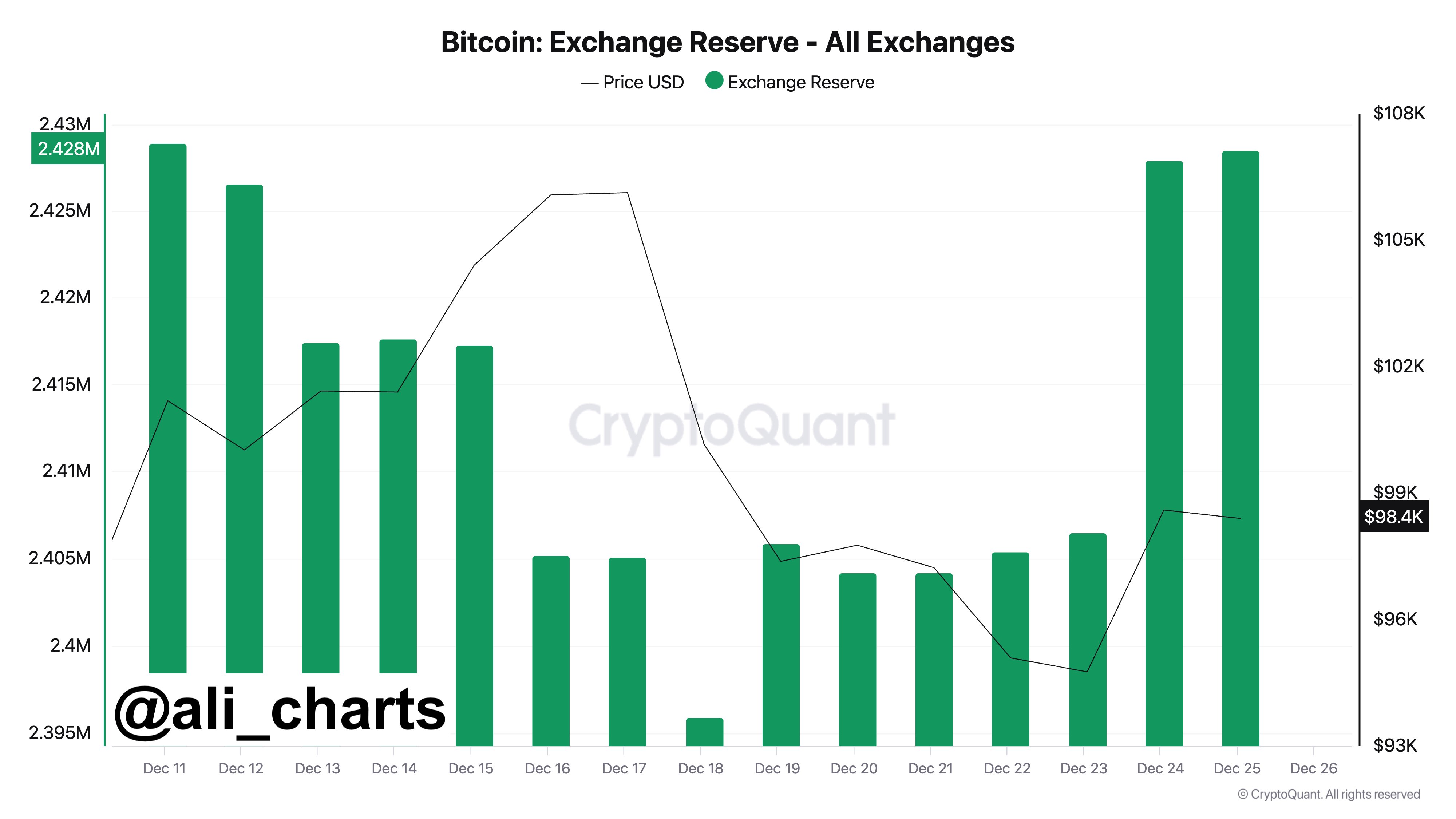

For context, BTC has recorded huge rallies since Donald Trump’s election win in November. Having mentioned that, it additionally supplied a profit-booking alternative to many traders, with current on-chain information indicating heavy promoting stress on the crypto. Top crypto market knowledgeable Ali Martinez highlighted the development, saying that 33,000 BTC, price over $3.23 billion, has moved to exchanges lately.

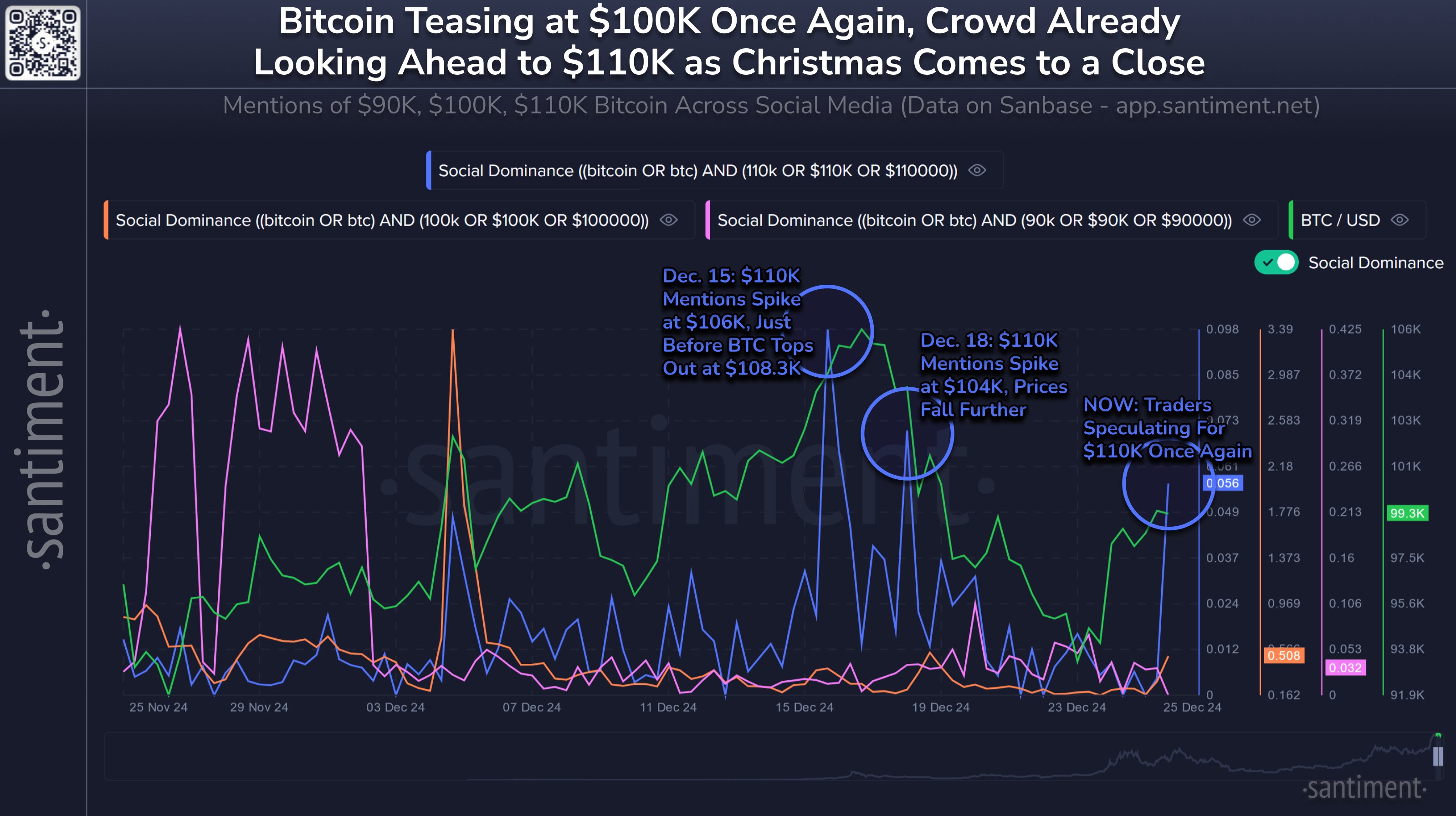

This signifies the profit-booking technique, which the merchants usually use when an asset’s value goes larger. On the opposite hand, Santiment lately highlighted the BTC drop after reaching $99.8K on Christmas, sparked by bullish dealer sentiment. The report famous that hypothesis of the cryptocurrency hitting $110K has additionally elevated as a result of current rally.

However, Santiment means that traditionally, Bitcoin solely reaches such highs when crowd expectations are low. This signifies that the present downturn could also be a market correction, as merchants’ excessive expectations for $110K could also be self-fulfilling prophecies that forestall the worth from rising additional.

Bitcoin Options Expiry Sparks Concern

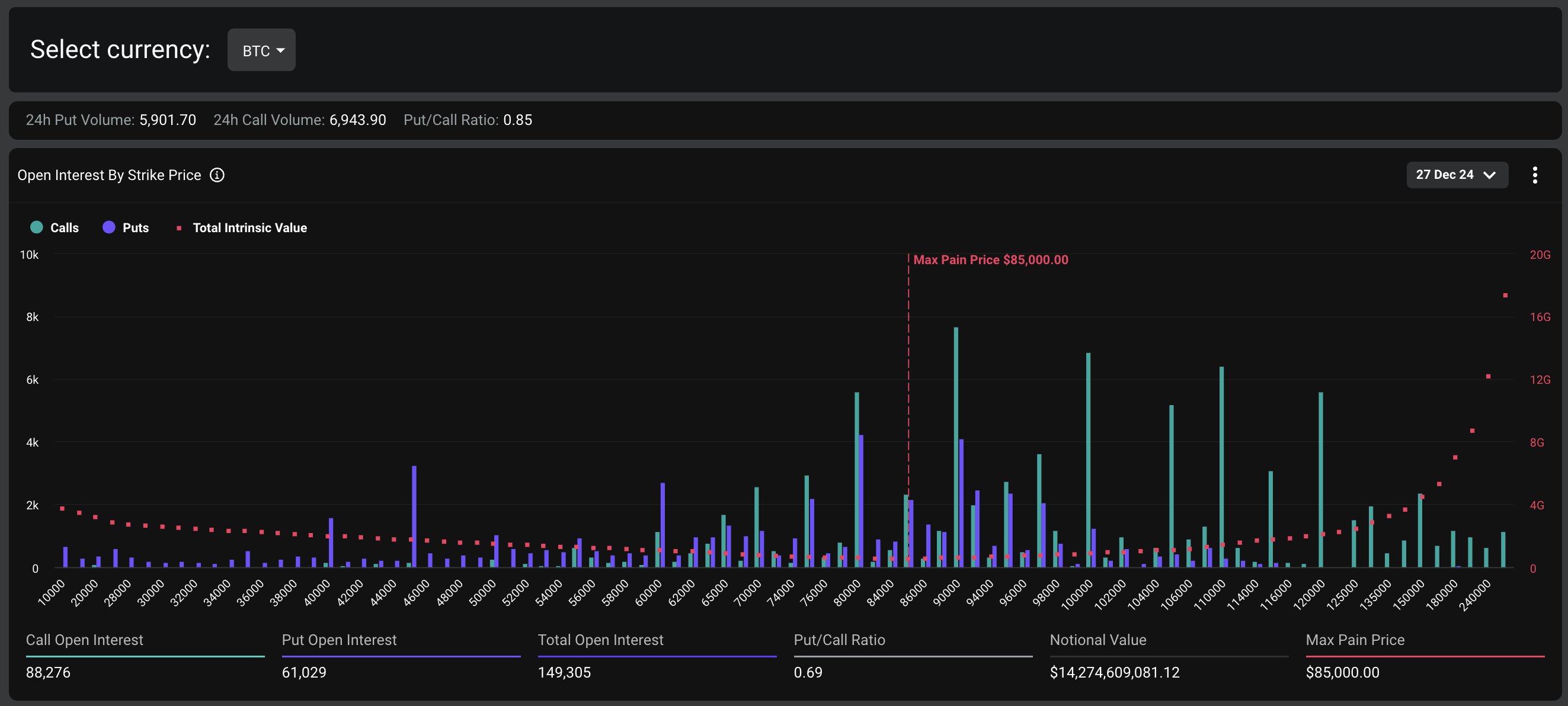

The current downturn in Bitcoin value comes forward of the biggest crypto choices expiry on the Deribit trade, with over $18 billion in choices set to run out tomorrow. The expiry has sparked directional uncertainty, with elevated volatility and “sharp swings in DVOL”, Deribit famous. Besides, market consultants additionally warned that the closely leveraged market to the upside might set off a fast snowball impact with any important draw back transfer, resulting in excessive volatility.

Notably, the Bitcoin options expiry accounts for almost all of the entire notional worth, with $14.27 billion set to run out. The put/name ratio stands at 0.69, indicating a barely bullish sentiment amongst merchants. The max ache level for Bitcoin is $85,000, which might act as a resistance degree within the occasion of a value swing.

On the opposite hand, Ethereum choices expiring tomorrow account for $3.79 billion in notional worth. The put/name ratio is 0.41, suggesting a extra pronounced bullish bias amongst Ethereum merchants. The max ache level for Ethereum is $3,000, which can affect the asset’s value motion.

BTC Dip To $80K Imminent?

The latest BTC price chart confirmed that the crypto plunged about 3.5% to $95,175, with its buying and selling quantity falling 1.5% to $42.45 billion. Notably, the crypto has touched a 24-hour excessive of $99,884, whereas sustaining a month-to-month achieve of two%. Further, BTC Futures Open Interest additionally fell about 3.5%, CoinGlass showed, indicating a bearish momentum hovering out there.

Notably, the market image signifies that regardless of hovering institutional curiosity, the current developments have weighed in the marketplace sentiment. For context, MicroStrategy (MSTR) stock recorded volatility lately amid its BTC shopping for technique, which has fueled market speculations. Besides, many companies like KULR have additionally shifted their focus in the direction of BTC accumulation.

Meanwhile, in a current evaluation, well-liked market knowledgeable Justin Bennett mentioned that BTC is more likely to fall to the $81K-$85K vary. This evaluation of Bitcoin value has fueled market issues, with many different consultants echoing an analogous sentiment.

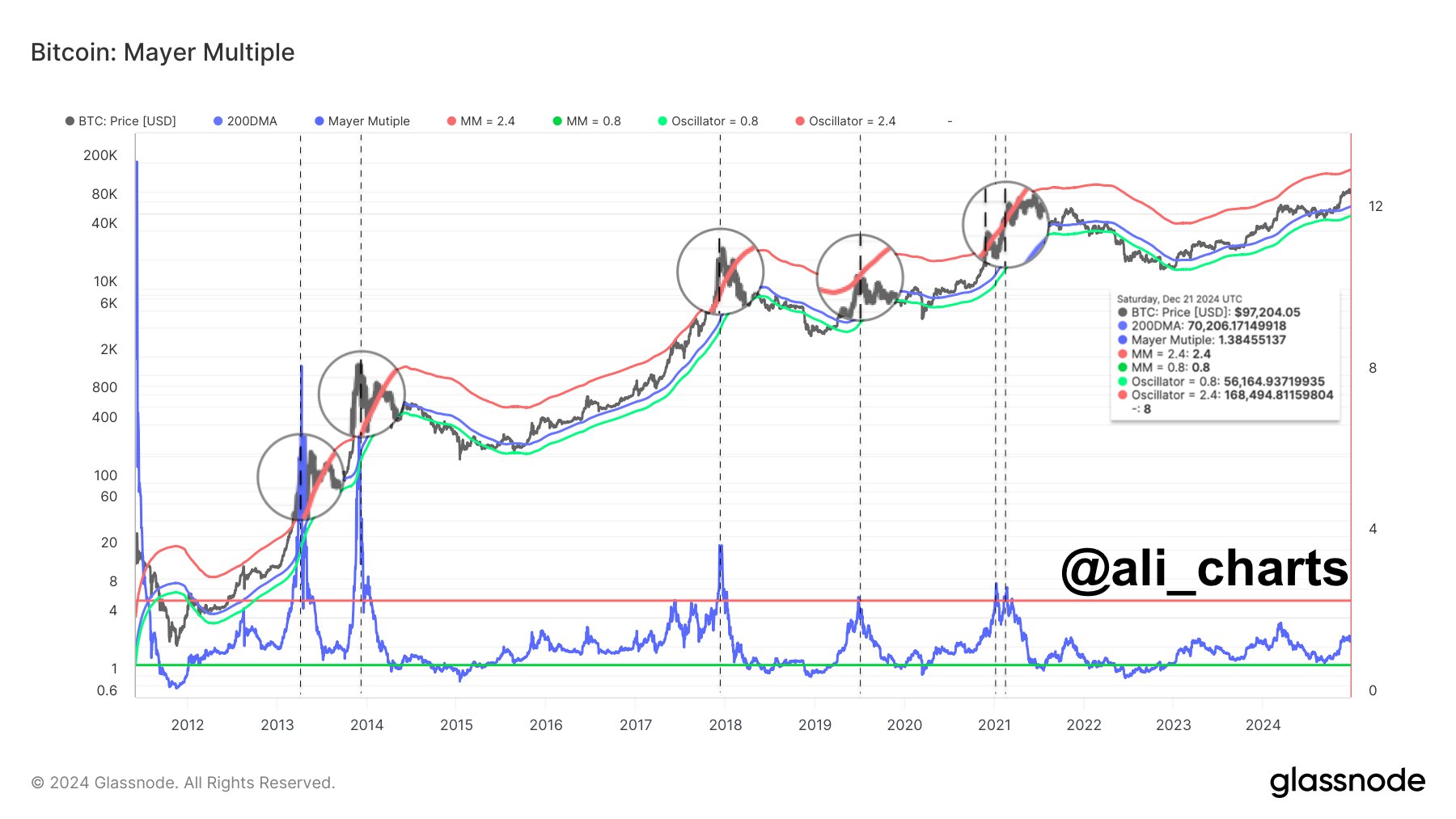

For context, Ali Martinez famous as Bitcoin dipped under the $97,300 mark, it signifies a bearish momentum for the crypto. However, he famous if BTC rebounds to this important help and rally to $100K, it might rally to $168,500 forward.

Simultaneously, Peter Brandt has additionally predicted a possible BTC dip to $80K forward, citing technical traits. On the opposite hand, well-liked market knowledgeable Tone Vays additionally mentioned that if BTC trades under the $95,000 mark, it will increase the chance of a correction to $75K.

Disclaimer: The offered content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.