Bitcoin worth has famous a powerful restoration this weekend after a pointy decline lately falling beneath the $91K mark. Amid this, veteran dealer Peter Brandt has reiterated his bullish outlook on the flagship crypto, indicating that the crypto might proceed its rally forward. In addition, different on-chain metrics additionally point out a constructive momentum for BTC forward.

Peter Brandt Predicts Bitcoin Price Rally Ahead

The Bitcoin worth, alongside the highest altcoins, has witnessed a powerful rally over the previous few days, sparking market confidence. However, the flagship crypto has lately witnessed a pointy decline amid a broader crypto market crash this week. Despite that, BTC has recovered from its weekly lows on Saturday, indicating buyers are reentering the market.

Amid this, veteran dealer and high market skilled Peter Brandt maintained a bullish outlook for BTC. In a current evaluation, Brandt mentioned that the crypto is prone to hit $108,358 within the coming days, sparking optimism. However, he additionally warned over a possible decline to $76,614 citing the technical charts.

Besides, he additionally mentioned that “this is not a prediction”, indicating the dangers related to the market. He mentioned that these analyses solely replicate the “possibilities, not probabilities, not certainties.” Besides, he has lately set a BTC price target of $125K, which has additionally gained notable market consideration.

However, the market optimism is hovering in direction of the crypto market after Donald Trump’s election win in November. Now, as Trump’s inauguration on January 20 is approaching, the market sentiment is additional bolstered by anticipation over the pro-crypto regulatory setting within the US.

What’s Next For BTC?

The discussions over the US BTC Strategic Reserve have fueled market sentiment lately. On the opposite hand, the current sturdy influx into US Spot Bitcoin ETF has additionally signaled a rising institutional curiosity within the crypto. However, the current outflux this week into BlackRock Spot Bitcoin ETF and others has fueled issues.

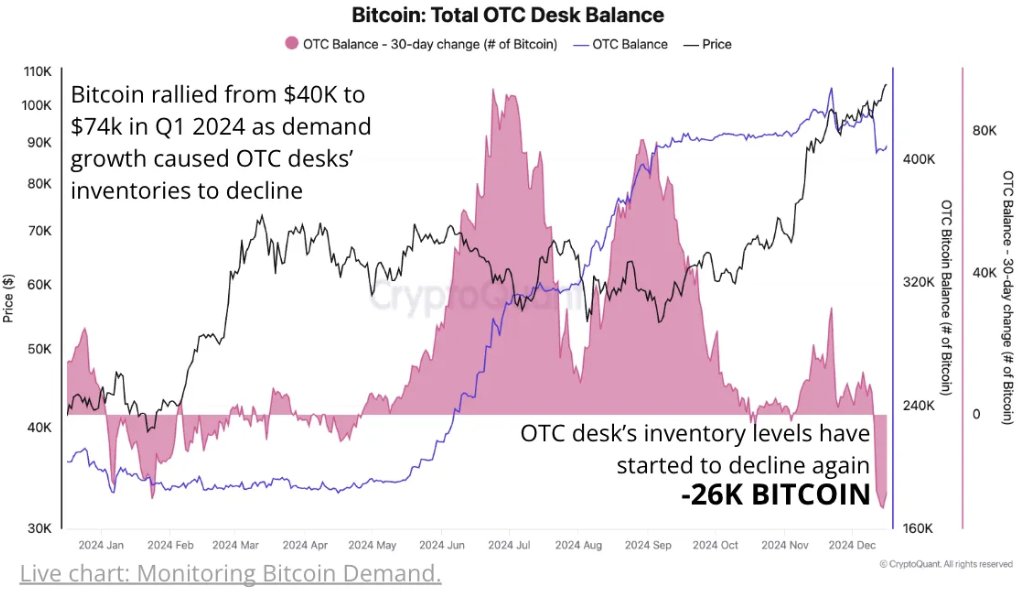

Despite that, the on-chain metrics point out constructive momentum forward. For context, high analytics platform CryptoQuant mentioned that “Bitcoin demand is surging.” CryptoQuant mentioned that “OTC desks” are witnessing their largest month-to-month stock decline this yr, down 26K BTC. Considering that, the tightening market provide additionally signifies a bullish momentum forward.

In addition, different market consultants have additionally remained optimistic in regards to the future trajectory of BTC. For context, Matrixport has cited key reasons lately which have sparked a rally in Bitcoin worth and high altcoins like Solana, XRP, and DOGE. Besides, it additionally set a BTC worth goal of $160K for the crypto, boosting buyers’ confidence.

Disclaimer: The introduced content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.