Ethereum has confronted important volatility over the previous few days, with large promoting stress rising after the cryptocurrency failed to interrupt above its yearly highs set earlier in December. This worth motion has left merchants and traders questioning the subsequent course for ETH because it consolidates underneath crucial resistance.

(*96*)Related Reading

Despite the turbulence, on-chain information suggests a doubtlessly bullish outlook. Analyst Ali Martinez shared insightful metrics displaying that Ethereum whales have been accumulating closely throughout this era of uncertainty. According to the info, whales bought 340,000 ETH—value over $1 billion—within the final 96 hours. This important accumulation signifies that main gamers see long-term worth in Ethereum, whilst short-term market sentiment stays combined.

The ongoing whale activity might sign an upcoming restoration for ETH, with giant holders positioning themselves for future beneficial properties. Historically, such accumulation phases have usually preceded robust rallies, as elevated demand and decreased provide contribute to upward momentum.

Ethereum Whale Demand Keeps Rising

Ethereum demand has proven important instability all year long, with persistent promoting stress pushing costs down from native highs. Each rally try has confronted resistance, highlighting the challenges ETH has encountered in sustaining upward momentum. Despite this, Ethereum continues to exhibit resilience, significantly throughout corrective phases, as giant holders actively accumulate ETH.

Martinez not too long ago shared compelling data on X, indicating a exceptional whale accumulation development. In the previous 96 hours alone, whales have bought 340,000 Ethereum, valued at over $1 billion. This substantial shopping for exercise underscores the boldness that main gamers have in Ethereum’s long-term potential. Such accumulation usually alerts the potential of a market shift, with whales strategically positioning themselves forward of a possible breakout.

Martinez and different analysts imagine this whale-driven demand hints at a major worth surge within the weeks to come back. Furthermore, the broader crypto neighborhood anticipates Ethereum taking part in a pivotal position within the anticipated altseason subsequent 12 months, solidifying its place as a market chief amongst altcoins.

(*96*)Related Reading

As Ethereum enters this crucial section, market members will intently monitor its potential to capitalize on the present accumulation. If whale exercise continues, it might pave the way in which for Ethereum to reclaim native highs and doubtlessly set new milestones, reinforcing its dominance within the crypto house.

ETH Holding Key Support

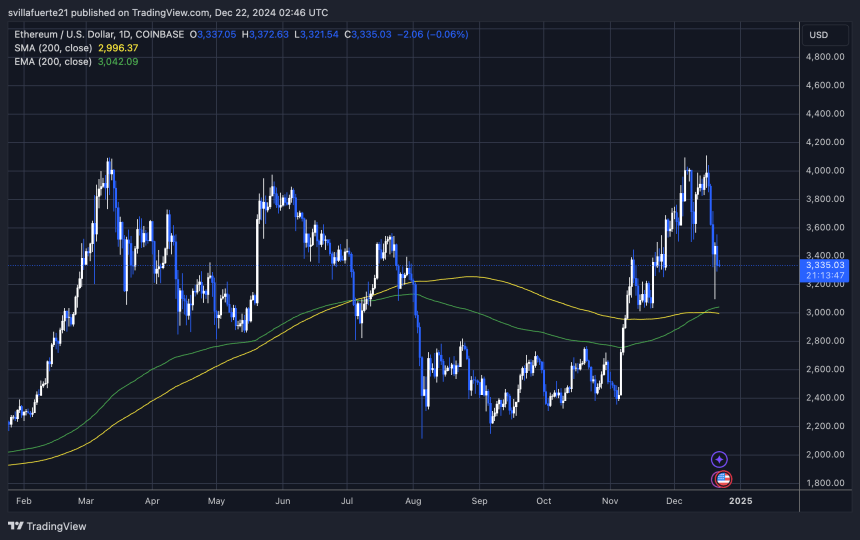

Ethereum is presently buying and selling at $3,320, displaying resilience after holding above the crucial 200-day transferring common (MA) at $3,000. This stage is broadly considered a key indicator of long-term market energy. Holding above it means that Ethereum stays in a bullish construction regardless of current volatility and promoting stress.

For Ethereum to regain momentum, bulls might want to push the value above the $3,550 resistance stage and keep it. Breaking this zone would sign a renewed upward development and improve the probability of Ethereum testing greater ranges. However, this may increasingly not occur instantly, because the market might enter a interval of sideways consolidation.

(*96*)Related Reading

Such consolidation is widespread after intervals of heightened volatility and permits the market to ascertain a extra steady base for the subsequent important transfer. A robust consolidation section above $3,000 would additional verify the 200-day MA as a strong help stage, boosting confidence amongst traders.

Featured picture from Dall-E, chart from TradingView