The market intelligence platform IntoTheBlock has revealed how Ethereum has constructed up robust on-chain demand zones that ought to maintain it afloat above $4,000.

Ethereum Has Two Major Support Centers Just Below Current Price

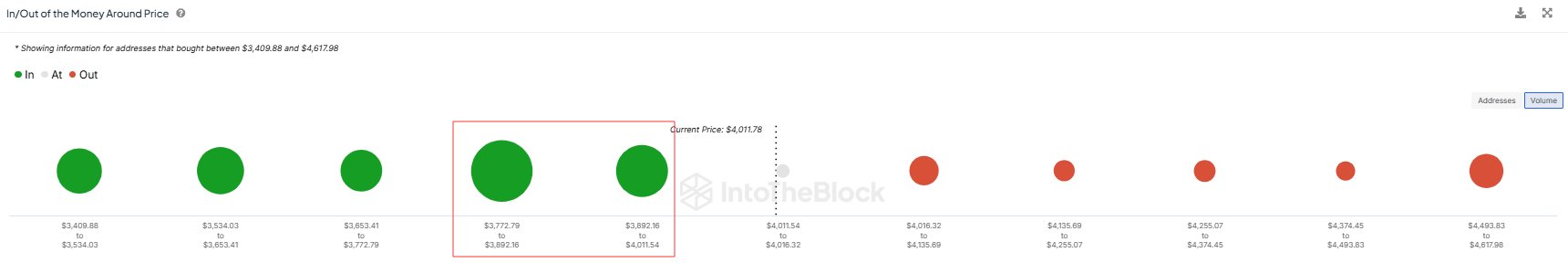

In a brand new post on X, IntoTheBlock has mentioned about how the on-chain demand zones for Ethereum are trying proper now. Below is the chart shared by the analytics agency that exhibits the quantity of provide that the buyers purchased on the value ranges close to the present spot ETH worth.

As is seen within the graph, the Ethereum value ranges up forward have solely small dots related to them, that means not a lot of the provision was final bought at these ranges.

It’s totally different for the value ranges under, nevertheless, with the $3,772 to $3,892 and $3,892 to $4,011 ranges specifically internet hosting the price foundation of a major quantity of addresses. In complete, the buyers bought 7.2 million ETH (price nearly $28.4 billion on the present change fee) at these ranges.

Related Reading

Demand zones are thought-about essential in on-chain analysis on account of how investor psychology tends to work out. For any holder, their cost basis is a vital stage, to allow them to be extra prone to make a transfer when a retest of it happens.

When this retest happens from above (that’s, the investor was in revenue previous to it), the holder would possibly resolve to buy extra, pondering that the extent can be worthwhile once more within the close to future. Similarly, buyers who have been in loss simply earlier than the retest would possibly worry one other decline, so they could promote at their break-even.

Naturally, these results don’t matter for the market when just a few buyers take part within the shopping for and promoting, however seen fluctuations can seem when a considerable amount of holders are concerned.

The aforementioned value ranges fulfill this situation, so it’s doable that Ethereum retesting them would produce a sizeable shopping for response available in the market, which might find yourself offering help to the cryptocurrency.

During the previous day, Ethereum has seen a slight dip into this area, so it now stays to be seen whether or not the excessive demand can push again the coin above $4,000 or not.

Related Reading

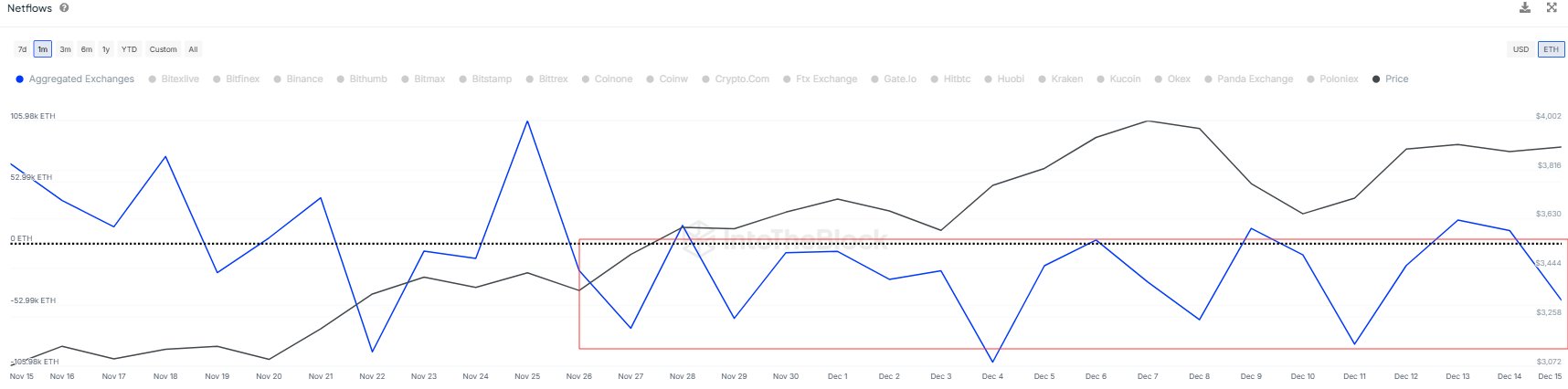

In another information, the Ethereum Exchange Netflow has been adverse because the starting of this month, as IntoTheBlock has identified in one other X post.

The Exchange Netflow is an on-chain indicator that retains monitor of the online quantity of Ethereum that’s flowing into or out of the wallets related to centralized exchanges. “Over 400k ETH have flowed out since December 1st, suggesting a trend of accumulation,” notes the analytics agency.

ETH Price

At the time of writing, Ethereum is buying and selling round $3,950, up 10% over the past week.

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com