Ethereum is on the verge of reclaiming the $4,000 stage because it inches nearer to its all-time highs. The second-largest cryptocurrency by market cap has confronted skepticism all through this cycle, with some analysts predicting it could underperform in comparison with its earlier bull runs. However, Ethereum has shocked doubters, steadily climbing in latest weeks regardless of market uncertainty.

Related Reading

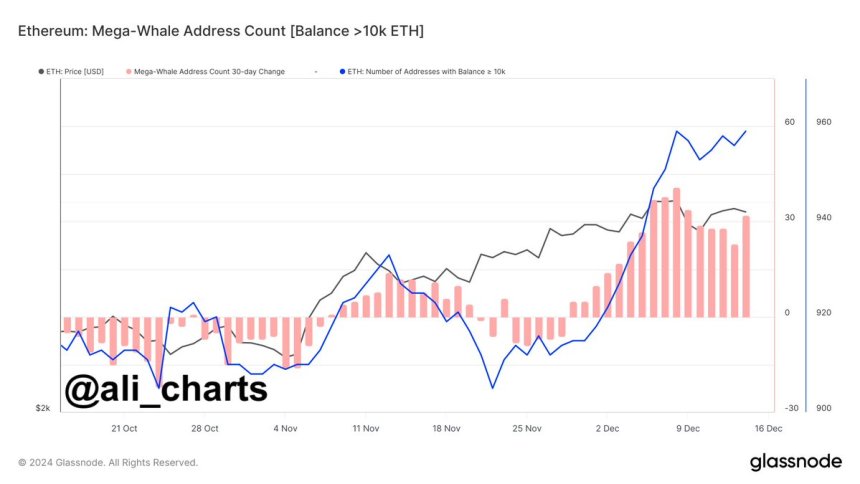

Key on-chain metrics from Glassnode reveal an vital pattern that would gasoline additional worth positive aspects: Ethereum whales have been accumulating aggressively since late November. This alerts rising confidence amongst main holders, who’re positioning themselves for potential upside. Historically, whale accumulation has usually preceded vital worth strikes, hinting at the potential for a breakout within the close to time period.

While the market stays divided on Ethereum’s trajectory, its capability to maintain upward momentum close to the $4,000 mark will seemingly outline its efficiency within the weeks forward. Breaking above this crucial resistance may open the door to new highs and additional solidify ETH’s function as a pacesetter within the ongoing bull cycle.

Ethereum Mega-Whale Balances Grow

Ethereum has skilled a gentle, albeit modest, rally since November 5, however it appears the actual fireworks for ETH are but to ignite. As Bitcoin soars into worth discovery and several other altcoins outperform expectations, Ethereum buyers are trying to find clear alerts of an impending bull run for the second-largest cryptocurrency.

Key on-chain information shared by prime analyst Ali Martinez on X supplies intriguing insights into Ethereum’s present state. Martinez highlights that Ethereum whales—entities holding vital quantities of ETH—have been accumulating aggressively for the reason that worth broke above the $3,330 stage.

This accumulation pattern means that sensible cash is positioning itself for what could possibly be a large upward transfer within the months forward. Historically, whale accumulation has usually been a precursor to sturdy worth rallies, as these massive buyers are inclined to anticipate main market shifts earlier than retail merchants.

However, the narrative isn’t solely bullish. While whale accumulation might sign confidence, it additionally raises considerations a couple of potential bull lure. These massive holders may shortly pivot, offloading their ETH for different belongings if market situations shift or if Bitcoin’s dominance suppresses altcoin progress. Such a transfer may catch smaller buyers off guard, resulting in sharp corrections.

Related Reading

For Ethereum, holding above crucial ranges like $3,800 whereas breaking key resistances could possibly be the catalyst wanted to spark a real bull run. Until then, ETH stays a watchlist favourite, balancing potential and uncertainty.

Price Testing Crucial Resistance

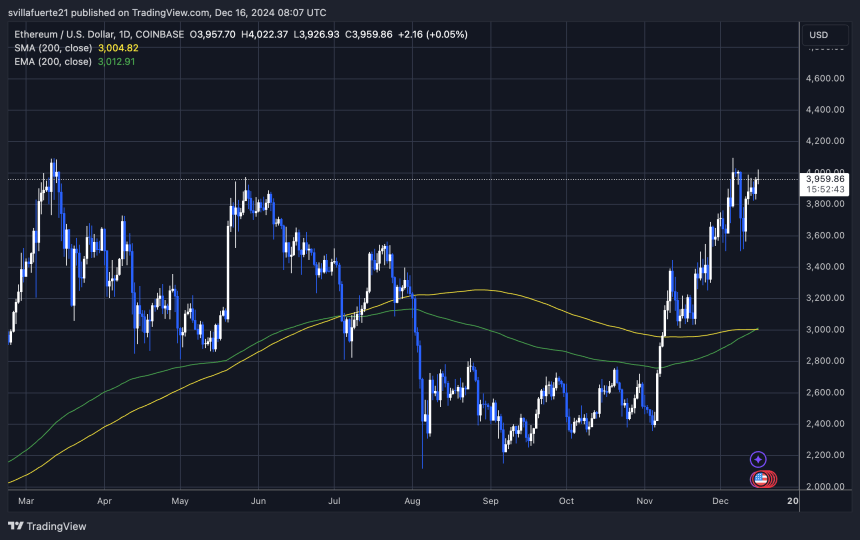

Ethereum (ETH) is buying and selling at $3,950, struggling to interrupt above the essential $4,000 resistance stage for a number of days. Despite this, the worth stays resilient, signaling sturdy market help. Clearing this stage is crucial to verify the continuation of the uptrend, as $4,000 represents a psychological barrier and a key resistance zone for the asset.

If Ethereum fails to breach the $4,000 mark, a retrace towards decrease demand zones round $3,500 could possibly be anticipated. This stage has served as sturdy help in latest weeks, offering a cushion in periods of elevated promoting stress. A pullback to this space may enable for renewed shopping for momentum, setting the stage for one more try to interrupt increased.

Related Reading

However, latest market dynamics counsel Ethereum could also be poised for a big transfer upward. Bitcoin’s surge into worth discovery and rising optimism round altcoins have created a bullish atmosphere. With whales persevering with to build up ETH, as highlighted by on-chain information, market individuals are more and more assured in Ethereum’s capability to retest and surpass its all-time highs.

Featured picture from Dall-E, chart from TradingView